Alphabet (NASDAQ:GOOGL) stock has struggled to gain momentum over the past year, even as the company continues to deliver earnings beats and showcase strong fundamentals – a reminder that the weight of expectations can be a burden, especially when you’re one of the biggest.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

A mix of macro and internal headwinds has kept investors cautious. Concerns over a potential U.S.-China trade war have cast a shadow over tech as a whole, while Alphabet’s heavy AI investment has drawn scrutiny. Some worry that its multibillion-dollar spending spree signals more ambition than efficiency.

Momentum has started to shift in recent weeks, but GOOGL shares are still down by double digits year-to-date. Could this be an opportunity to buy the technology giant at a bargain?

As the name suggests, one investor, known by the pseudonym the Wise Bull, is quite bullish about Alphabet’s potential. He believes the company “is a strong long-term investment for growth portfolios, especially during market corrections, due to its track record and technological prowess.”

Wise Bull also highlights Alphabet’s multi-pronged growth engine – Search, YouTube, and Cloud – as pillars of its dominance. With one of the largest global user bases and an unmatched grip on digital attention, he argues Alphabet is raking in revenue at a pace few can rival.

“I view GOOGL as one of the very rare cases where we see three major growth sectors covered by one company,” adds Wise Bull.

The investor is also bullish on Alphabet’s AI prospects. With Google AI gaining traction as a front-runner in the space, and its AI Overviews in Search reportedly serving over 1.5 billion users each month, Wise Bull sees Alphabet carving out an enormous competitive moat in the race for AI supremacy.

When it comes to its valuation, Wise Bull asserts that GOOGL appears to be a “cheap ‘value’ stock” that should deliver sustainable growth for years to come. Looking at its Forward PEG ratio, the investor calculates that GOOGL’s share price is trading at nice discount to its sector median.

“I rate it as a BUY due to its unique position in the AI growth megacycle and its strong track record of consistent growth in revenue and profits,” the investor summed up. (To watch the Wise Bull’s track record, click here)

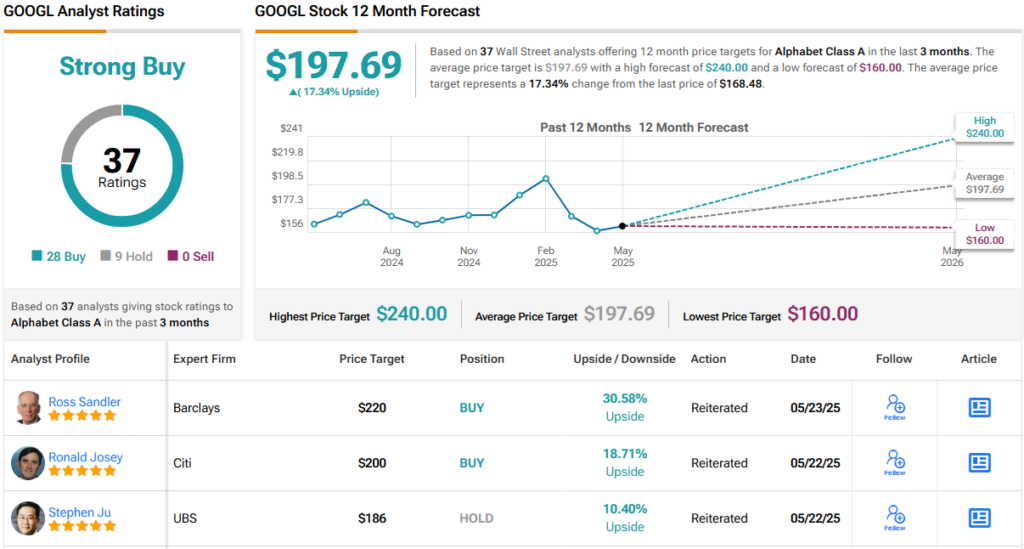

Wall Street is also clambering to get ahold of this one. With 28 Buy and 9 Hold ratings, GOOGL enjoys a Strong Buy consensus rating. Its 12-month average price target of $197.69 implies ~17% upside from current levels. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue