Vaalco Energy (EGY) enjoyed a positive turnaround in share price momentum, as the announcement of top and bottom-line beats for Q4 sparked a 14% one-day rally in the stock late last week. The independent energy company has strategically positioned itself across significant regions with its diverse energy portfolio. Operating within the oil and gas sector, the company is involved in offshore and onshore drilling and production activities in Gabon, Egypt, Côte d’Ivoire, Equatorial Guinea, Nigeria, and Canada. The company’s recent financial performance has been robust, with better-than-expected earnings and revenues in the fourth quarter of 2024. Additionally, Vaalco has increased its year-end reserves significantly and closed an acquisition of Svenska Petroleum while continuing to focus on strategic investments that promise future growth.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Strategic Acquisitions Driving Growth

Vaalco Energy is an independent energy firm with a broad array of production, development, and exploration assets spread across several countries, including Gabon, Egypt, Côte d’Ivoire, Equatorial Guinea, Nigeria, and Canada. With a primary focus on the oil and gas industry, Vaalco is engaged in both offshore and onshore drilling and production activities.

Key recent developments for the company include acquiring a 70% working interest in the CI-705 block situated offshore Côte d’Ivoire, where Vaalco will also take on operational duties. Their projected 2025 capital budget ranges from $270 to $330 million, encompassing significant efforts such as a drilling initiative at Etame, refurbishment of the Côte d’Ivoire Floating Production Storage and Offloading vessel (FPSO), and ongoing drilling operations in Egypt and Canada. Further, the acquisition of Svenska Petroleum Exploration expanded its asset base in West Africa, especially in Cote d’Ivoire. This acquisition outperformed initial expectations, and the company has already recovered 1.8 times its investment in just eight months.

VAALCO exceeded expectations with its top-line and bottom-line performance in the fourth quarter of 2024. The company achieved revenue of $121.72 million, $13.92 million more than anticipated, despite a year-over-year decline of 18.4%. The net income for the quarter was $11.7 million, and the company generated an Adjusted EBITDAX of $76.2 million. Production stood at 20,775 net revenue interest barrels of oil equivalent per day (BOEPD) and 25,300 working interest BOEPD, aligning with guidance predictions. The reported GAAP EPS of $0.11 surpassed consensus projections by $0.06.

For the full year 2024, VAALCO Energy recorded a significant net income of $58.5 million and net operational cash flows totaling $113.7 million. The company boasted a record Adjusted EBITDAX of $303 million and enhanced its annual production by 7% from the previous year to 19,936 NRI BOEPD. Additionally, VAALCO saw a 57% rise in SEC proved reserves by the year-end, concluding at 45 million barrels of oil equivalent. The company declared a dividend of $0.0625 per share for Q1 2025, contributing to an annualized payout of $0.25.

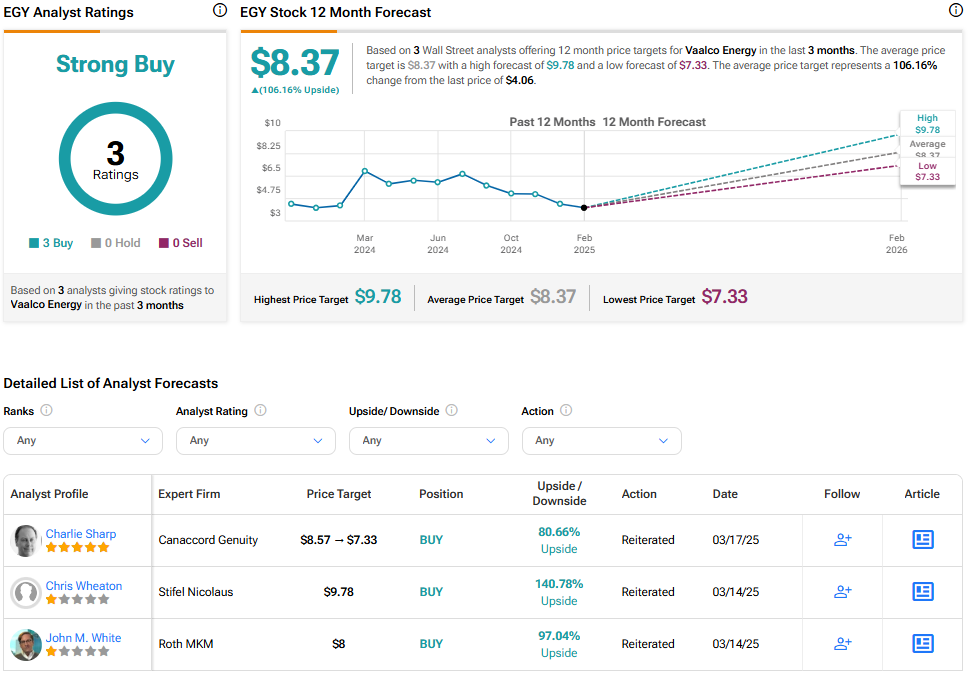

Analysts are Bullish

Analysts following the company have been bullish about its prospects. For example, following the earnings report, Stifel Nicolaus’ Chris Wheaton reaffirmed a Buy rating on the shares while maintaining a price target of $9.78, noting Vaalco’s strong production performance and strategic investments. While the company has planned increased capital expenditure to fund projects in Equatorial Guinea and Cote d’Ivoire, its commitment to maintaining dividends and the potential for substantial stock price appreciation bolster confidence in its sustained growth and profitability.

Vaalco Energy is rated a Strong Buy overall, based on the recent recommendations of three analysts. The average price target for EGY stock is $8.37, which represents a potential upside of 106.16% from current levels.