Macro uncertainties and tariff wars have increased fears of a potential recession. Given the challenging backdrop, consumer spending could be weak and adversely impact fintech companies. Despite a difficult macro environment, Wall Street is optimistic about several fintech names due to the preference for digital payments and the continued rise in e-commerce. Using TipRanks’ Stock Comparison Tool, we placed Visa Inc. (V), SoFi Technologies (SOFI), and Block (XYZ) against each other to find the fintech stock that could offer the highest upside potential, according to Wall Street analysts.

Visa Inc. (NYSE:V)

Visa is a dominant player in the payments space and has an extensive reach worldwide. V stock has risen about 9% so far this year, reflecting resilience amid macro uncertainties. In the first quarter of Fiscal 2025 (December quarter), Visa processed 63.8 billion transactions (up 11% year-over-year), underscoring the company’s vast network.

The company beat the Street’s revenue and earnings expectations for Q1 FY25 and attributed its performance to healthy spending during the holiday season, improving trends in payments volume, increased cross-border volume, and a rise in processed transactions.

Meanwhile, Visa continues to strengthen its offerings through continued innovation and strategic deals. In December 2024, the company completed its acquisition of Featurespace, a developer of real-time artificial intelligence (AI)-backed payment protection technology that prevents and mitigates payments fraud and financial crime risks.

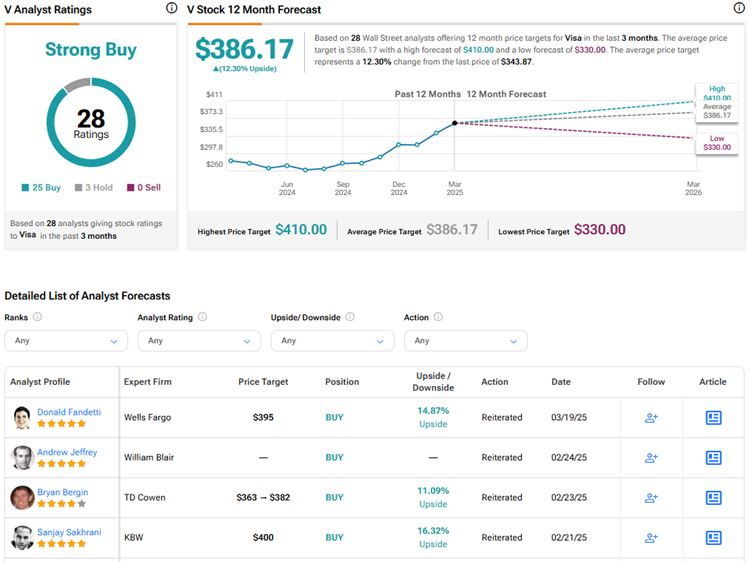

Is Visa Stock a Buy, Sell, or Hold?

In a research note on best fintechs in a recession, William Blair analyst Andrew Jeffrey reiterated a Buy rating on Visa stock. The 5-star analyst sees few fintechs as safe havens in the ongoing challenging situation. In particular, he called Visa, Mastercard (MA), and Fiserv (FI) “the best shelters from the storm,” as he expects these stocks to generate positive relative returns due to multiple secular revenue growth drivers, little direct tariff exposure, varying degrees of protection from soft consumer spending, lower credit risk, and their tendency to generally benefit from inflation.

Jeffrey thinks that Visa is likely more immune to recession than Mastercard, thanks to its higher domestic and debit mix. He expects Visa’s strong internal execution and technology investments to help achieve its financial framework of 9%-12% revenue growth.

With 25 Buys and three Holds, Wall Street has a Strong Buy consensus rating on Visa stock. The average V stock price target of $386.17 implies about 12.3% upside potential from current levels.

SoFi Technologies (NASDAQ:SOFI)

SoFi Technologies stock has rallied 88% over the past year but is down 11% year to date in 2025. The fintech company and digital bank ended 2024 with solid Q4 results and robust expansion in its membership base. Notably, SoFi Technologies reported its first full year of GAAP profitability. However, the company’s earnings outlook failed to impress investors.

Moreover, investors are now concerned that a potential recession would impact the company’s loans business, as the possibility of bad debts and defaults increases during adverse economic conditions.

Nevertheless, management is confident about SoFi’s growth ahead, especially due to its shift toward capital-light, fee-based revenue streams. The company expects to add at least 2.8 million new members in 2025 and generate revenue growth in the range of about 23% to 26%. However, SoFi’s growth investments could impact its bottom line.

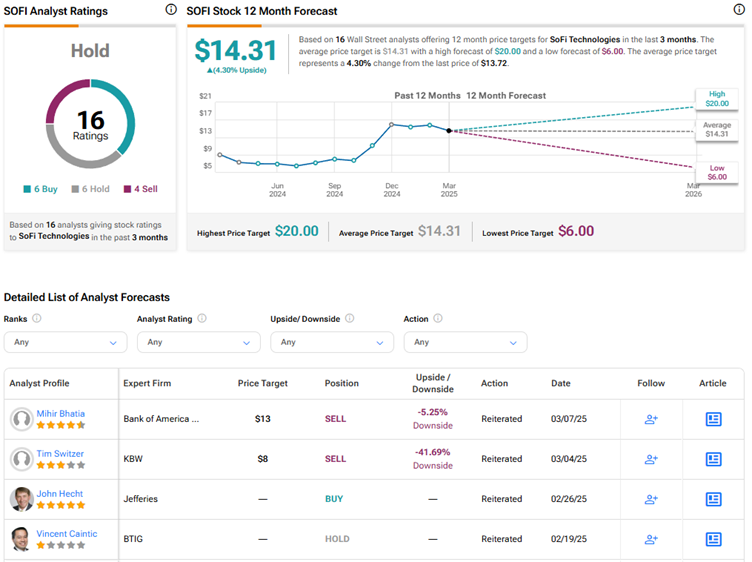

Is SOFI Stock a Good Buy?

Earlier this month, Bank of America Securities analyst Mihir Bhatia reaffirmed a Sell rating on SOFI stock with a price target of $13. The 4-star analyst noted that investors are worried about the lowered guidance for the tech segment (includes the Galileo and Technisys platforms) from mid-20% over the 2023-2026 period to mid-teens due to longer lead times and implementation cycles as the average client size becomes bigger. Still, the company sees the tech segment as a key part of its growth strategy.

Overall, Wall Street has a Hold consensus rating on SoFi Technologies stock based on six Buys, six Holds, and four Sell recommendations. The average SOFI stock price target of $14.31 implies 4.3% upside potential.

Block (NYSE:XYZ)

Block, a fintech company that operates through its CashApp and Square ecosystems, took a hit when it announced lower-than-expected revenue and profit for the fourth quarter of 2024. Macro uncertainties and heightened competition from players like Toast (TOST) and Fiserv’s Clover business weighed on the company’s performance.

Nonetheless, Cash App, Block’s peer-to-peer payments platform, continues to drive the company’s growth. Cash App’s gross profit increased 16% year-over-year, surpassing the Street’s expectations. The company is optimistic about continued growth in this platform, backed by offerings like Cash App Borrow and Afterpay.

The company is also bolstering its Square ecosystem, which is a platform that facilitates transactions for sellers, through several initiatives like international expansion and innovation to enhance offerings.

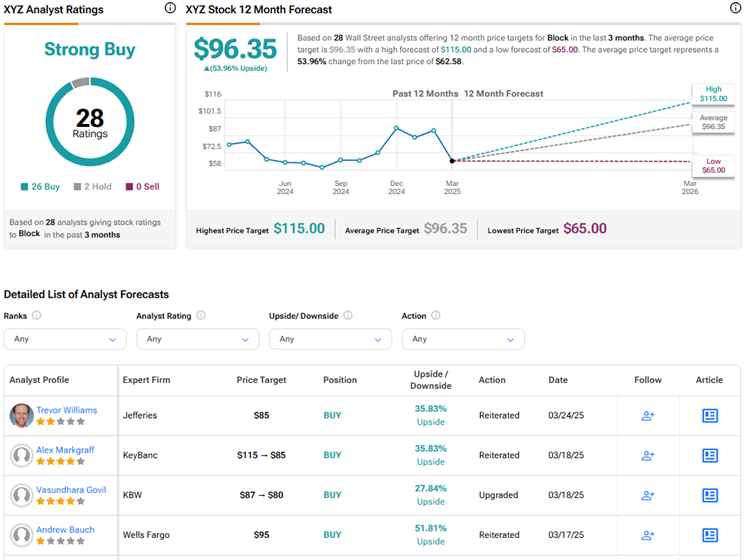

Is Block Stock a Buy, Sell, or Hold?

Last week, Keefe Bruyette analyst Vasundhara Govil upgraded Block stock to Buy from Hold but lowered the price target to $80 from $87. The 4-star analyst sees an attractive risk/reward skew following the recent pullback in the stock.

Although the market seems skeptical about XYZ stock, Govil expects the company to deliver on its guidance of a “steep acceleration” in gross profit growth in the second half of 2025. He sees the potential for a rebound in Block stock’s valuation if the company meets the Street’s expectations.

With 26 Buys versus only two Holds, Wall Street has a Strong Buy consensus rating on Block stock. The average XYZ stock price target of $96.35 implies about 54% upside potential. XYZ stock has declined more than 26% so far this year.

Conclusion

Wall Street is highly bullish on Visa and Block stocks but cautiously optimistic on SoFi Technologies stock. Analysts see higher upside potential in XYZ stock compared to the other two fintech stocks. They view the pullback in Block stock as an attractive buying opportunity to gain from the fintech company’s long-term growth potential.