Credit card issuer Visa (V) has reported mixed financial results as the economic outlook in the U.S. remains uncertain.

San Francisco-based Visa announced earnings per share (EPS) of $2.32, which fell short of consensus expectations that called for a profit of $2.68. However, revenue of $9.59 billion managed to beat Wall Street forecasts of $9.55 billion. Sales were up 9% from a year earlier.

“Consumer spending remained resilient, even with macroeconomic uncertainty,” said Visa CEO Ryan McInerney in the company’s earnings statement. Visa’s payments volume increased by 8% during the quarter and its processed transactions rose by 9% from a year ago.

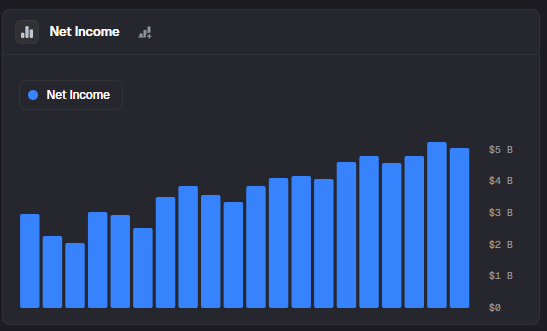

Visa’s net income. Source: Main Street Data

Stock Buybacks

Along with its results, Visa said that its board of directors has authorized a new $30 billion stock buyback program. The financial results and stock buybacks were announced as Visa plans to formally announce its strategy for 2025 at a separate event later this week.

Visa’s management team said they plan to announce “new products, solutions and technology partners” that are tied to artificial intelligence (AI) and consumer spending at an event scheduled for April 30. V stock has gained 8% so far in 2025.

Is V Stock a Buy?

The stock of Visa has a consensus Strong Buy rating among 29 Wall Street analysts. That rating is based on 24 Buy and five Hold ratings issued in the last three months. The average V price target of $381.88 implies 11.92% upside from current levels. These ratings are likely to change after the company’s financial results.