ETFs (exchange-traded funds) are a cost-effective solution for investors looking to diversify their portfolios. They offer lower expense ratios and broker commissions in comparison to individual stocks. Additionally, the lower minimum investment requirements for ETFs make them an attractive option for budget-conscious investors. Today, we focus on two ETFs with more than 25% upside potential in the next 12 months: URNM and FDNI. Furthermore, these ETFs carry an Outperform Smart Score, which points to their potential to beat the expectations.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s explore what Wall Street thinks about these two ETFs.

NorthShore Global Uranium Mining ETF (URNM)

The URNM ETF seeks to invest at least 80% of its total assets in securities of the North Shore Global Uranium Mining Index. The index tracks the performance of companies in the uranium mining industry. URNM has $1.61 billion in AUM, with its top 10 holdings contributing 77.16% of the portfolio. Notably, its expense ratio stands at 0.83%.

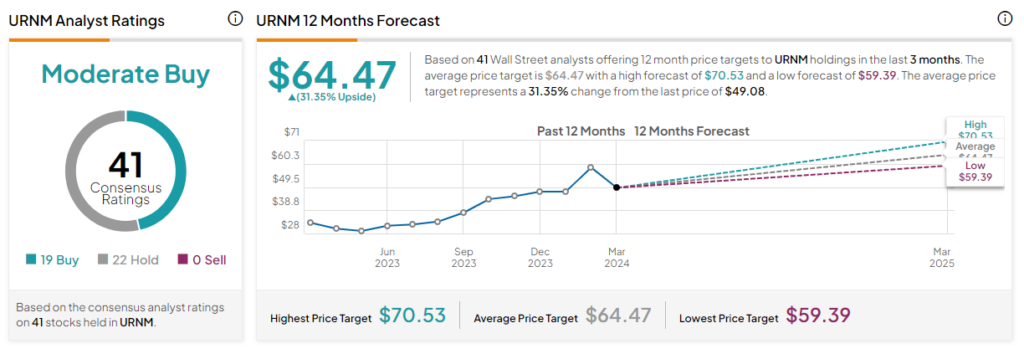

On TipRanks, URNM has a Moderate Buy consensus rating. Of the 41 stocks held, 19 have Buys and 22 have a Hold rating. The average price target of $64.47 implies a 31.35% upside potential from the current levels. The ETF has gained 4.7% in the past six months. Also, it carries a Smart Score of eight.

First Trust Dow Jones International Internet ETF (FDNI)

The FDNI ETF provides exposure to securities of non-U.S. issuers who primarily offer internet-related products and services. It seeks to track the price and yield of the Dow Jones International Internet Index. The ETF has $27.32 million in assets under management (AUM), with the top 10 holdings contributing 65.26% of the portfolio. Meanwhile, the expense ratio of 0.65% is encouraging.

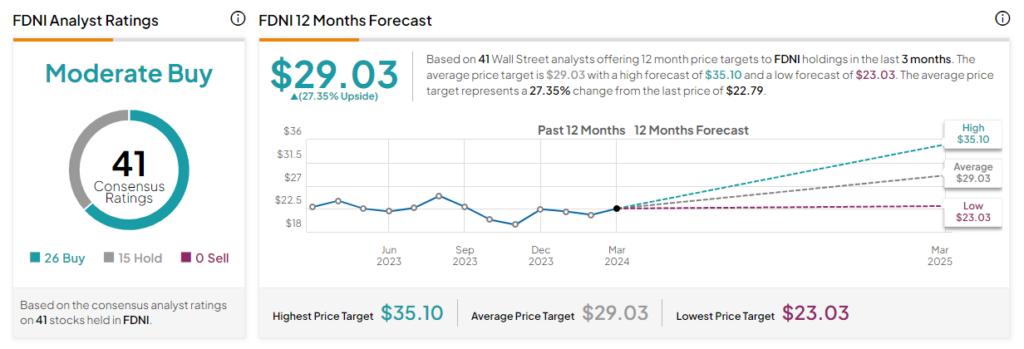

On TipRanks, FDNI has a Moderate Buy consensus rating. This is based on the consensus rating of each stock held in the portfolio. Of the 41 stocks held, 26 have Buys and 15 have Hold ratings. The analysts’ average price target on the FDNI ETF of $29.03 implies a 27.35% upside potential from the current levels. The FDNI ETF has gained nearly 13% in the past six months. Further, FDNI has a Smart Score of eight.

Concluding Thoughts

ETFs offer several benefits to investors including higher liquidity, low costs, and portfolio diversification. Investors looking for potential ETF recommendations could consider FDNI and URNM due to the solid upside potential expected by analysts.