Lifestyle retailer Urban Outfitters (NASDAQ:URBN) sank in pre-market trading even as the company reported third-quarter earnings of $0.88 per diluted share, more than double its diluted earnings of $0.40 per share in the same period last year. Analysts were expecting earnings of $0.82 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company’s Q3 net sales increased by 9% year-over-year to a record $1.28 billion, beating analysts’ estimates by $20 billion.

Richard A. Hayne, Urban Outfitters’ CEO commented, “We are proud to report record third quarter sales that helped drive a 120% increase in EPS. As we enter the holiday season the consumer continues to react positively to our assortments and marketing campaigns at four out of five of our brands which leaves us confident we can continue to drive revenue and earnings growth in the fourth quarter.”

What is the Target Price for URBN Stock?

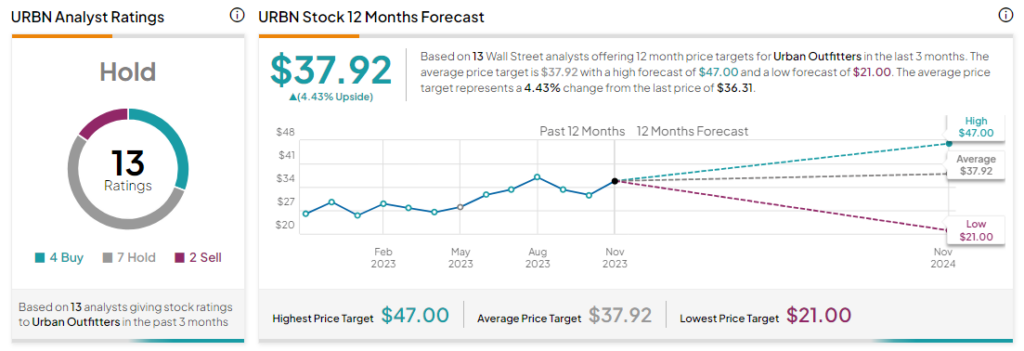

Analysts remain sidelined about URBN stock with a Hold consensus rating based on four Buys, seven Holds, and two Sells. While URBN stock has rallied by more than 48% year-to-date, the average URBN price target of $37.92 implies an upside potential of 4.4% at current levels.