Wells Fargo (WFC) is set to report its quarterly earnings number next week on October 14, and I believe the bank is well-positioned to meet—or possibly beat—analyst expectations. Continued share buybacks, a prudent approach to loan loss provisioning, and solid performance in the Wealth and Investment Management segment are expected to provide tailwinds. The uptrend is still on.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I remain Bullish on WFC heading into the earnings figures, although broader headwinds from a soft U.S. economy could temper the upside in the near term.

WFC’s Q3 2025 Earnings Preview

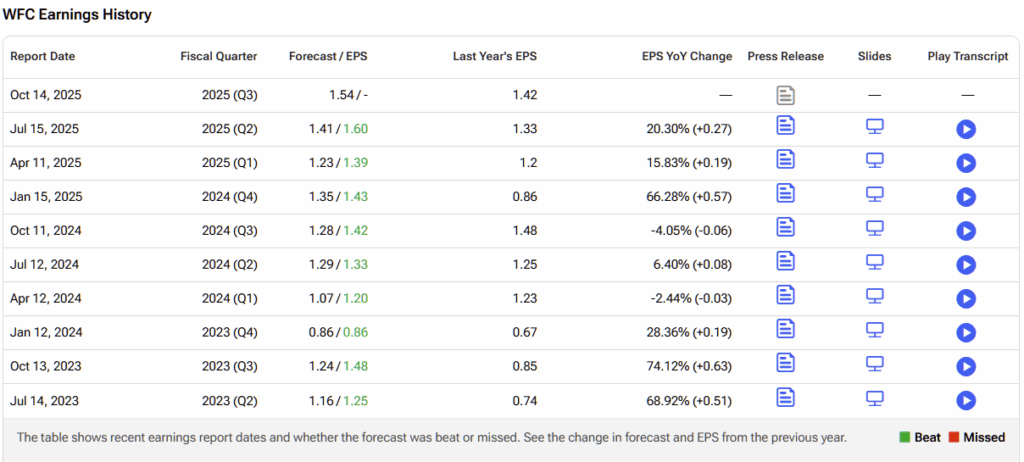

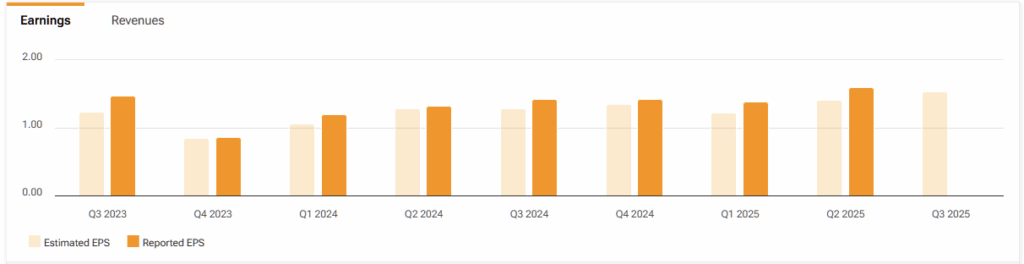

Wells Fargo analysts expect EPS of $1.54/share, up 8.5% year-over-year. I think this is quite conservative when you consider that EPS will get a boost of 5-6% from a lower share count (Q2 2025 shares outstanding were down 6.3% year-over-year).

Investors will pay close attention to changes in the bank’s macroeconomic outlook, which impact provisioning in the allowance for credit losses (ACL). As of June 30, 2025, Wells Fargo maintains conservative buffers with its unemployment rate outlook standing at 4.6% for 2025 and 5.8% for 2026.

For comparison, the Federal Reserve only expects an unemployment rate of 4.5% in 2025, declining to 4.4% in 2026. As such, it is likely that Wells Fargo will not have to increase its ACL, indicating that provisioning expenses will remain in check.

The Wealth and Investment Management segment, which accounted for 8.7% of Wells Fargo’s Q2 2025 net income, is expected to perform well in Q3 2025, given the rapid recovery in equity prices following the volatility in April 2025.

To conclude, I believe that Wells Fargo is well-positioned to meet (and potentially marginally exceed) the $1.54/share analyst consensus, driven by share repurchases, already conservative provisioning, and strength in the Wealth and Investment Management segment.

Federal Reserve Casts Long Shadow Over Wells Fargo

Looking ahead to Q4 2025 and into 2026, Fed funds futures suggest Wells Fargo will need to navigate the impact of roughly 1.25% in cumulative rate cuts — with the first 0.25% already delivered in late September 2025. Encouragingly, the 1% easing cycle in late 2024 had only a modest impact on the bank’s net interest margin, which decreased from 2.75% to 2.68% year-over-year.

This resilience was supported by a 0.32% decline in the average deposit cost to 1.52% in Q2 2025, while total deposits fell just 1% year over year to $1.34 trillion. With a conservative loan-to-deposit ratio of 69%, Wells Fargo retains the flexibility to further lower funding costs.

However, investors should keep an eye on the deposit mix: noninterest-bearing deposits rose 6.4% year-over-year, while interest-bearing deposits fell 4.6%. Since noninterest-bearing balances can’t be repriced below zero, Wells Fargo will have limited room to offset pressure on net interest income through deposit cost reductions alone.

In summary, Wells Fargo is well-positioned to mitigate the impact on net interest income from upcoming Fed rate cuts, thanks to its strong balance sheet and low loan-to-deposit ratio — although shifting deposit dynamics may make the next phase of rate easing more challenging than the previous one.

Wells Fargo Valuation Insights Suggest Bullish Bias

Analysts project Wells Fargo to earn approximately $5.93 per share in 2025, implying a forward P/E of about 13.6x. This places its valuation roughly in line with regional bank peers, which trade near 13.7x trailing earnings. Notably, Wells Fargo still trades at a meaningful discount to larger competitors such as J.P. Morgan Chase (JPM), which carries a 2025 earnings multiple of around 15.7x.

As such, I view Wells Fargo’s current valuation as undemanding, justifying a Buy rating on the shares. Indeed, we observe that with conservative provisioning, ample loan growth potential (the asset cap imposed by the Federal Reserve is no longer in effect), and an earnings multiple in line with regional banks, risks are clearly tilted to the upside regarding Wells Fargo stock.

Still, I would caution that, like all banks, Wells Fargo remains exposed to downside risks in U.S. economic growth, as evidenced by a weak labor market (private sector jobs slumped by 32,000 in September 2025), which may be further exacerbated by the government shutdown this month. As such, while Wells Fargo appears attractively valued relative to the banking industry, sector-wide headwinds may prevent the shares from appreciating in value.

Is Wells Fargo & Co. a Good Stock to Buy?

Turning to Wall Street, Wells Fargo earns a Moderate Buy consensus rating based on 17 analyst ratings. Currently, 10 analysts are bullish, while seven are neutral with a Hold rating. Most notably, Wells Fargo has no analyst sell ratings. Additionally, the average WFC stock price target of $88.14 implies 9.5% upside potential over the next twelve months.

Wells Fargo Poised for a Solid Q3

I believe Wells Fargo is on track to meet — and possibly exceed — analysts’ Q3 2025 EPS estimate of $1.54 when it reports next week. The bank’s performance should be supported by continued share buybacks, conservative loan-loss provisioning, and solid results in its Wealth and Investment Management segment.

Looking ahead, Wells Fargo will need to manage the impact of ongoing Fed rate cuts. Its low loan-to-deposit ratio provides a cushion for maintaining a healthy net interest margin, though the recent rise in noninterest-bearing deposits could make the task more challenging than during the 1% rate cuts in late 2024.

Overall, I view Wells Fargo’s valuation as appealing and assign a Buy rating to the stock, despite sector-wide headwinds from a slowing U.S. economy.