While artificial intelligence is a boon for global conglomerates and big spenders, fintech specialist Upstart Holdings (UPST) has been a laggard. At first glance, the company appears to be a shoo-in for blistering growth and seems like a company ready to join the AI revolution, including its bullish stock performance.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to its public profile, Upstart utilizes AI to provide consumer loans by using non-traditional variables to predict creditworthiness. However, UPST stock is down more than 20% year-to-date. To give some perspective, investors who bought UPST stock at its October 2021 peak are now down approximately 87%.

Put simply, when Upstart releases its third-quarter earnings report next week, it has an opportunity for redemption. Through Black-Scholes-Merton (BSM)-derived calculations that integrate the latest implied volatility estimates, market makers are anticipating a big move for UPST stock. Nominally, we’re talking about $9.80 or 20.10% in either direction.

While the market intelligence is insightful — meaning that UPST stock could rise to $61.40 or drop to $40 post-disclosure — we don’t know which one of these outcomes is likelier to materialize. That’s one of the criticisms that I have about the BSM model: it can provide a stochastic range of possible outcomes but no clear estimate of a single number that’s most probable.

Unfortunately, under traditional methodologies, we’re left with this groundbreaking assessment: UPST stock could be between a really big number and a really small number. I have good news, though. There is a better way, with inspiration coming from actual real-world search-and-rescue (S&R) teams.

Finding Out by Getting Lost

If you can avoid it, you should do your absolute best to not get lost in the woods. However, given the vastness of U.S. national parks and nature reserves, and the propensity for Americans to roam the land, it’s going to happen eventually. It’s just statistical inevitability. To combat this eventuality, S&R teams are deployed to find missing individuals.

Although advanced technologies have contributed greatly to rescue and recovery efforts, nothing beats getting people out to traverse the terrain. However, S&R teams are obviously limited in participants, and they can’t possibly search every square inch of a major national park. As such, they have to rely on data science to best allocate their resources.

Using probabilistic search theory and likely path modeling, S&R specialists first gather a profile on the missing individual, including age, health status, experience level, and other attributes relevant to the search. From there, rescue workers map out a search radius and likely pathways. This way, S&R teams can make sure they’re making efficient use of resources.

In many ways, markets respond in a way similar to missing persons. For example, looking for a small child may only require a search radius of a mile or so, whereas a missing hiker who is young, healthy and experienced may require a vast radius.

In fact, under GARCH (Generalized AutoRegressive Conditional Heteroskedasticity) studies, we know that volatility diffuses predominantly as a dependent variable tied to prior volatility. It stands to reason, then, that different market stimuli yield different market outcomes. As it turns out, we can identify such stimuli or signals to better predict where a security may end up at some point in time.

Putting Theory into Practice for UPST Stock

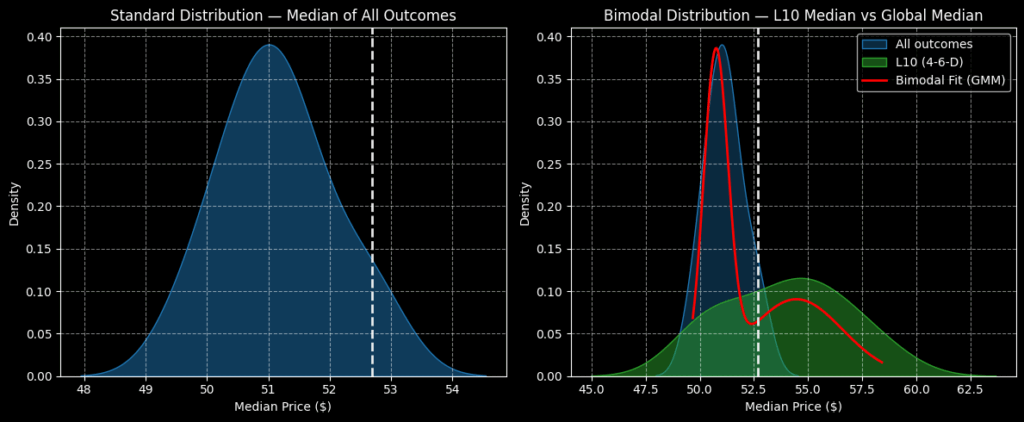

Using relatively simple arithmetic on data extending back to Upstart’s initial public offering, the projected 10-week median returns of UPST stock would be expected to form a standard distribution, with prices mostly ranging between $48 and $55 (assuming last week’s close of $52.69 as an anchor). Further, in terms of price density, clustering would be predominant at $51.

Put another way, under homeostatic or baseline conditions, UPST stock suffers from a negative bias. However, the argument is that Upstart is not in a homeostatic state but is rather in a distributive state. From past analogs, it can be determined that traders tend to buy the dips, making UPST particularly intriguing at this juncture.

Specifically, the security as of last Friday was structured in a 4-6-D sequence: four up weeks, six down weeks, with an overall downward slope. Under this condition, the projected 10-week forecast ranges from $45 to $62.50 (which coincidentally is similar to the BSM model’s estimation of Upstart’s post-earnings volatility).

Notably, price clustering would be most prominent around $55. To be fair, this is an estimation over the next 10 weeks. It’s difficult to isolate a specific terminal number for an individual week. That said, if the earnings results turn out to be surprisingly positive, a $55 target would seem to be both statistically and fundamentally rational.

For those that find this data to be credible, an attractive trading idea may be the 52.50/55.00 bull call spread expiring November 21. This transaction involves buying the $52.50 call and simultaneously selling the $55 call, for a net debit paid of $110 (the maximum possible loss on the trade).

Should UPST stock rise through the second-leg strike of $55 at expiration, the maximum profit stands at $140, a payout of over 127%. Breakeven comes in at $53.60, which will require a 5.72% move from the current price. However, for the reasons specified above, I believe this is a rational target.

What is the Future of UPST Stock?

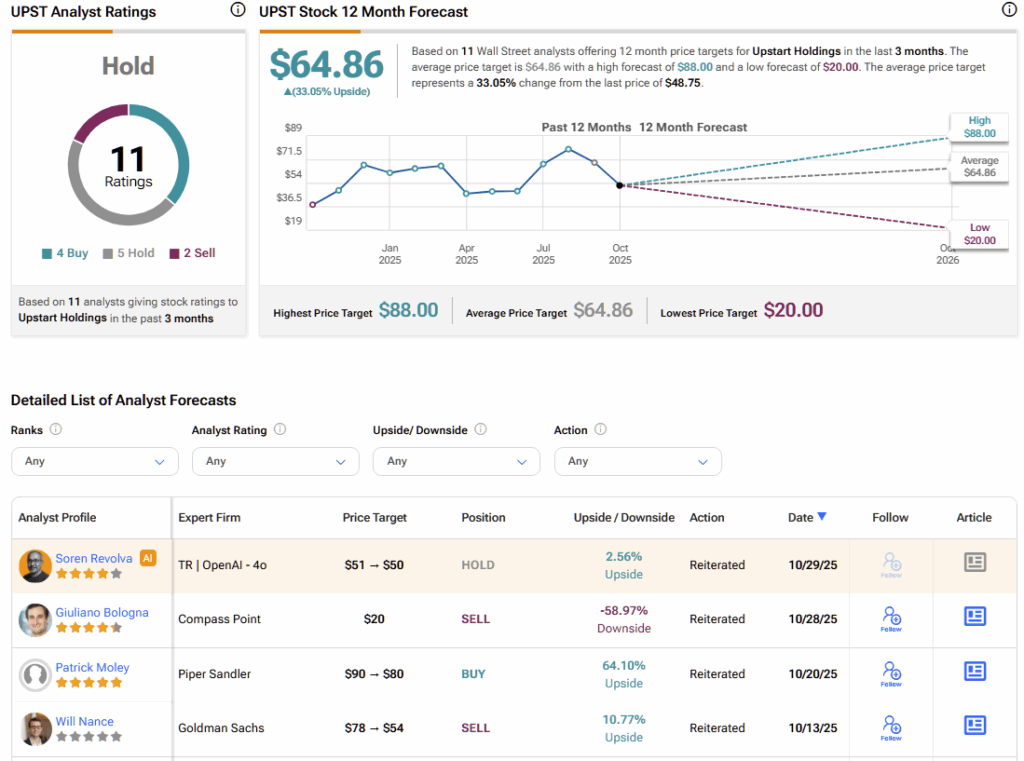

Turning to Wall Street, UPST stock has a Hold consensus rating based on four Buys, five Holds, and two Sell ratings, obtained over the past three months. The average UPST stock price target is $64.86, implying more than 33% upside potential over the coming 12 months.

Let the Numbers Speak for Themselves

Whether you’re tracking missing hikers or hunting for market opportunities, success depends on knowing your numbers. In both pursuits, you’re constrained by limited resources — time, capital, or manpower — so every decision must be guided by probability and efficiency. In the case of UPST stock, its distribution-heavy profile suggests that the odds favor a contrarian move to the upside. That statistical setup makes a bull call spread not only a rational choice, but a strategically compelling one for risk-managed participation in potential gains.