Shares of UPS (UPS) gained in pre-market trading after the company reported strong third-quarter results. The shipping and logistics company’s adjusted earnings increased by 12.1% year-over-year to $1.76 per share, above analysts’ expectations of $1.63 per share.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

UPS Sees Growth in Both Business Segments in Q3

Furthermore, the company’s revenues grew by 5.6% year-over-year to $22.2 billion, compared to consensus estimates of $22.1 billion. As the holiday season approaches, the company is experiencing rising demand, leading to a rebound in shipping volumes.

In fact, UPS’s domestic segment generated revenues of $14.5 billion, up by 5.8% year-over-year, and comprised more than 65% of the company’s revenues in the third quarter. On the other hand, the company’s international business segment clocked revenues of $4.4 billion, up by 3.4% year-over-year.

UPS Updates Its FY24 Guidance

Looking ahead, the company expects its revenues to be around $91.1 billion and has lifted its adjusted operating margin forecast to approximately 9.6%. Moreover, UPS anticipates its dividend payments to be around $5.4 billion, subject to the approval of its Board of Directors. For reference, analysts have estimated UPS’s revenues to be $91.87 billion.

Is UPS a Good Stock to Buy Right Now?

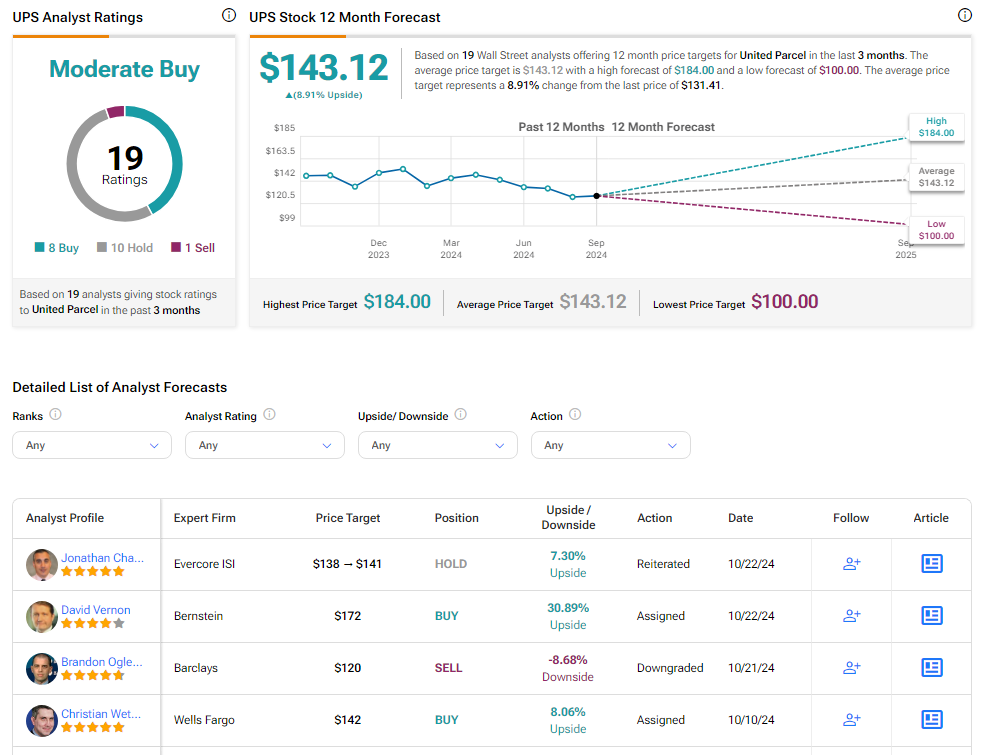

Analysts remain cautiously optimistic about UPS stock, with a Moderate Buy consensus rating based on eight Buys, 10 Holds, and one Sell. Year-to-date, UPS has declined by more than 10%, and the average UPS price target of $143.12 implies an upside potential of 8.9% from current levels. These analyst ratings are likely to change following UPS’s results today.