These are the upcoming stock splits for the week of October 6 to October 10, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action that makes a stock appear more affordable without changing the company’s actual value. It works by issuing additional shares to existing shareholders and lowering the price per share proportionally. The overall market cap remains the same, but the lower price often makes the stock more accessible, and sometimes more appealing, to retail investors.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Some companies, however, go in the opposite direction. A reverse stock split combines shares instead of dividing them, reducing the number of outstanding shares while lifting the price per share. The company’s value doesn’t change, but the move is often designed to meet exchange listing requirements, such as Nasdaq’s minimum price rule, and avoid delisting.

Whether the goal is to attract new investors or maintain compliance, these share adjustments often carry meaning beyond the math. Experienced traders watch them closely, knowing that such moves can offer clues about a company’s strategy, confidence, or challenges.

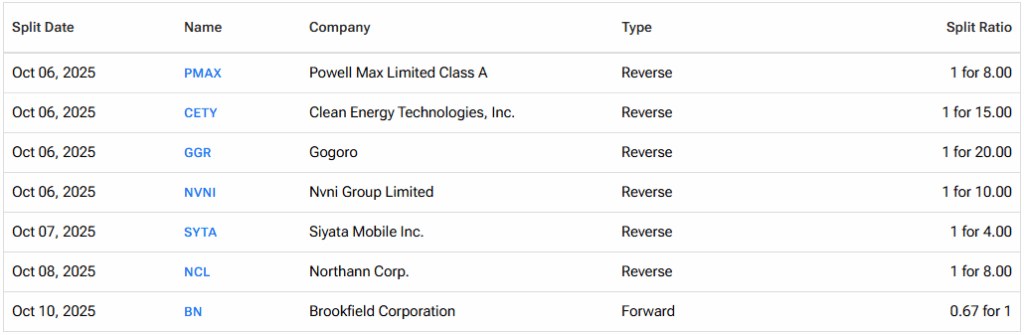

Let’s take a look at the upcoming stock splits for the week.

Powell Max Limited (PMAX) – Powell Max is a Hong Kong-based financial communications services company that supports corporate clients with financial printing, reporting, translation, design, and full disclosures. As of now it faces a Nasdaq deficiency notice for failing to maintain the $1.00 minimum bid price and will execute a 1-for-8 reverse stock split, effective October 6, in order to consolidate its share base, elevate its trading price, and aim to regain compliance with Nasdaq listing standards.

Clean Energy Technologies (CETY) – Clean Energy Technologies develops and markets technologies for clean power generation, waste heat recovery, biomass, and sustainability solutions through multiple business segments (engineering, manufacturing, EPC, and gas trading). It offers a proprietary Clean Cycle generator that captures wasted heat in industrial processes and converts it into electricity, as well as waste-to-energy and energy efficiency systems across North America, Europe, and Asia. The company has scheduled a 1-for-15 reverse stock split effective October 6, in a bid to consolidate its share base, elevate its trading price, and restore compliance with Nasdaq’s minimum bid price rule.

Gogoro (GGR) – Gogoro is a Taiwan-based innovator in battery-swapping ecosystems and electric mobility solutions, integrating smart batteries, swap stations, EV design, and cloud/AI battery management systems. On October 6, the company will implement a 1-for-20 reverse stock split to raise its per-share trading price and regain compliance with Nasdaq’s minimum bid price requirement.

Nvni Group (NVNI) – Nuvini Group is a Latin America–focused tech acquisition vehicle combining SaaS and fintech assets across emerging markets. It will implement a 1-for-10 reverse split effective October 6 to consolidate its share structure and elevate its trading price, aiming to regain Nasdaq compliance and improve market perception.

Siyata Mobile (SYTA) – Canada-based Siyata Mobile develops Push-to-Talk over Cellular (PoC) devices, rugged smartphones, and in-vehicle communication systems used by first responders and enterprise customers. On October 7, the company will execute a 1-for-4 reverse stock split as part of its restructuring tied to its recently completed merger with Core Gaming. The split is designed to consolidate shares, increase the trading price, and help meet Nasdaq’s minimum bid requirements, while positioning the combined company (renamed Core AI Holdings, ticker CHAI) for future growth in AI, gaming, and communications.

Northann Corp. (NCL) – Northann Corp is a U.S.-based company specializing in sustainable interior finishes and advanced materials, best known for its Benchwick brand of eco-friendly, 3D-printed flooring made from recycled and natural components. The firm has approved a 1-for-8 reverse stock split, effective October 7. The move is designed to elevate the stock’s trading price, streamline its capital structure, and help maintain compliance with NYSE American listing standards.

Brookfield Corporation (BN) – Brookfield Corporation, a global alternative-asset manager with major holdings in real estate, infrastructure, renewable power, and private equity, will carry out a 3-for-2 stock split in the form of a stock dividend. The split will be payable on October 9 to shareholders of record as of October 3, with post-split trading set to begin on October 10. The move, covering Brookfield’s Class A limited voting and Class B shares, is designed to make the stock more accessible to a broader range of investors and to enhance trading liquidity. Fractional shares will be settled in cash.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.