These are the upcoming stock splits for the week of February 17 to February 21, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action in which the company issues additional common shares to increase the number of outstanding shares. Accordingly, the stock price of the company’s shares decreases, which maintains the market capitalization before and after the split.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In contrast, there are also reverse stock splits that reduce the number of outstanding shares (consolidate). In this case, too, the market cap is maintained as the share price increases following the reverse stock split.

Companies often undertake stock splits to improve the liquidity of the common shares and make them more affordable for retail investors. Let’s look quickly at the upcoming stock splits for the week.

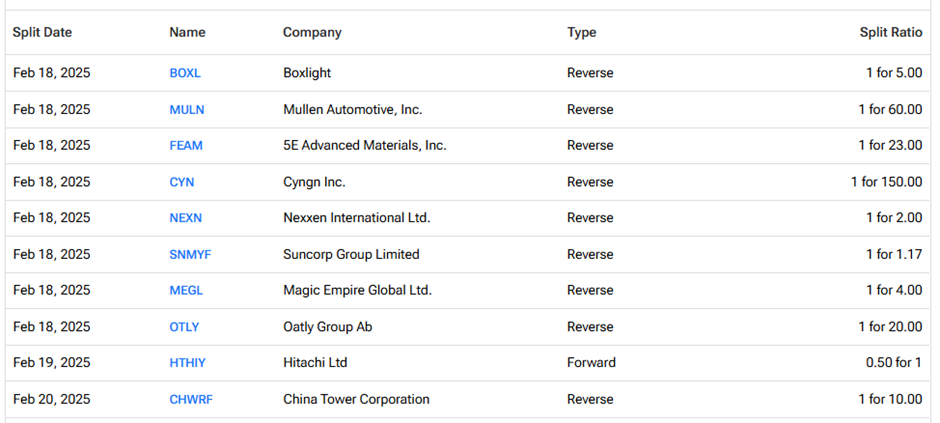

Boxlight Corp. (BOXL) – Boxlight is a technology company that offers interactive tech solutions, including interactive displays, collaboration software, audio solutions, supporting accessories, and professional services, to enhance user engagement and communication. On February 13, BOXL announced a one-for-five reserve stock split of its common stock, to be effective on February 18. The split is being undertaken to regain compliance with Nasdaq’s minimum bid price requirement of $1.00 per share.

Mullen Automotive (MULN) – Mullen Automotive is a commercial electric vehicle (EV) manufacturer in the U.S. On February 13, MULN announced a one-for-60 reverse stock split of its common stock to regain compliance with Nasdaq’s minimum bid price requirement. MULN shares are expected to start trading on a split-adjusted basis on February 18.

5E Advanced Materials (FEAM) – 5E Advanced Materials is a vertically integrated boron (boric acid) producer. Its products are used in various applications, including electric transportation, clean energy, food, and military capabilities. FEAM announced a one-for-23 reverse stock split of its common stock to be effective on February 18.

Cyngn Inc. (CYN) – Cyngn is a technology company that offers autonomous vehicle technology for industrial applications, such as self-driving industrial AMRs (Autonomous Mobile Robots). Some of its large customers include John Deere (DE) and Rivian (RIVN). CYN announced a massive one-for-150 reverse stock split of its common stock to boost its per share trading price and regain listing compliance with Nasdaq. The CYN stock is expected to start trading on a split-adjusted basis on February 18.

Nexxen International (NEXN) – Nexxen International is a flexible ad tech platform that helps advertisers, agencies, publishers, and broadcasters globally boost their visibility and brand awareness through data-driven insights. On February 14, Nexxen announced the termination of its ADR program, leading to the conversion of its American Depositary Shares (ADS) to ordinary stock. Following this, the common stock will undergo a reverse stock split of one-for-two. The stock is expected to start trading on a split-adjusted basis on February 18.

Suncorp Group Ltd. (SNMYF) – Australia-based Suncorp Group Ltd. is a Trans-Tasman insurance company, implying it offers travel insurance between Australia and New Zealand. On February 12, SNMYF announced that its shares would undergo stock consolidation in the ratio of 100:85.11, effective February 18. The consolidation was announced alongside a special stock dividend of $0.22 per share.

Magic Empire Global Ltd. (MEGL) – Hong Kong-based Magic Empire Global Ltd. is a financial services provider that offers services such as advisory and underwriting services. On February 6, MEGL announced a one-for-four reverse stock split of its common stock to be effective on February 18.

Oatly Group AB (OTLY) – Sweden-based Oatly Group operates in the food and drinks industry related to oats. On January 31, Oatly announced a change in the ratio of its ADR (American Depositary Receipts) to ordinary shares from one-to-one to one-to-20. The change in the ADR ratio will have the same effect as a one-for-20 reverse ADR split. Effective February 18, OTLY stock will start trading on a split-adjusted basis.

Hitachi Ltd. (HTHIY) – Japan-based Hitachi is a consumer electronics conglomerate. Hitachi announced a two-for-one stock split of its common shares, to be effective on February 19.

China Tower Corporation (CHWRF) – China Tower Corporation offers telecommunications tower infrastructure, maintenance, and other services in China. On December 23, 2024, CHWRF shareholders approved a one-for-ten reverse stock split of its common stock. CHWRF stock is expected to start trading on a split-adjusted basis on February 20.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.