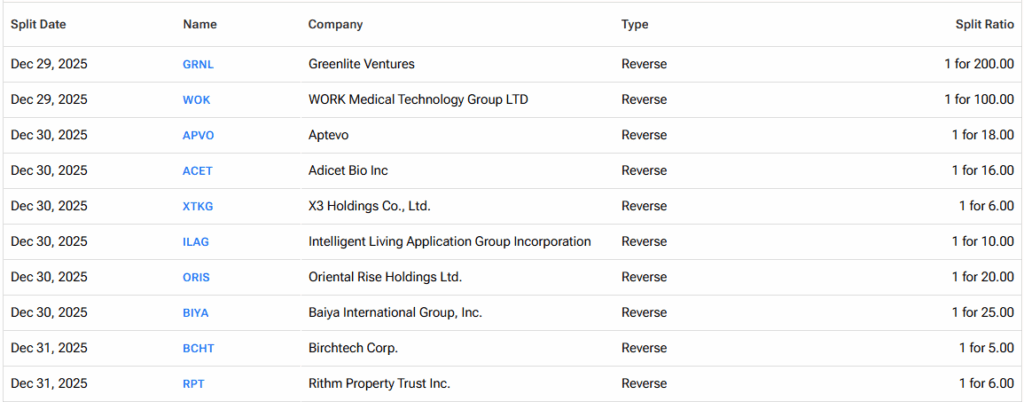

These are the upcoming stock splits for the week of December 29 to January 2, based on TipRanks’ Stock Splits Calendar. A stock split is generally viewed as a shareholder-friendly step, intended to make a company’s shares more accessible by lowering the price per share. The underlying value of the business doesn’t change – it is simply divided into a larger number of shares.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Some companies, however, move in the opposite direction. In a reverse stock split, multiple shares are consolidated into one, reducing the share count and increasing the price per share. While the overall valuation remains the same, the rationale often differs. Reverse splits are frequently used to meet exchange listing requirements, particularly minimum bid price rules, and to avoid potential delisting.

Whether aimed at expanding accessibility or maintaining compliance, these actions can provide insight into management’s priorities and how the company views its position and next steps.

Let’s take a look at the upcoming stock splits for the week.

Greenlite Ventures (GRNL) – Greenlite Ventures is a Florida-headquartered company that has evolved from traditional metal mining services into a more diversified technology and environmental enterprise, with initiatives spanning carbon offsets marketing, AI-driven gaming and sports platforms, blockchain applications, and consumer engagement solutions. On December 23, the company announced a 1-for-200 reverse stock split designed to increase the per-share price of its common stock. Shares are expected to begin trading on a split-adjusted basis when markets open on December 29.

WORK Medical Technology Group (WOK) – WORK Medical Technology Group is a China-based supplier of medical devices and healthcare solutions, focused on the design, manufacturing, and distribution of therapeutic and diagnostic equipment through its subsidiary Work (Hangzhou) Medical Treatment Equipment Co., Ltd. On December 24, the company announced a 1-for-100 reverse stock split, which will take effect when markets open on December 29. The move is aimed at maintaining compliance with Nasdaq’s minimum bid price requirement.

Aptevo Therapeutics (APVO) – Aptevo Therapeutics is a biopharmaceutical company developing targeted immuno-oncology and antibody-based therapies, with a pipeline focused on engineered protein platforms for cancer and rare diseases. On December 26, the company disclosed a 1-for-18 reverse stock split as part of its effort to remain compliant with Nasdaq’s minimum bid price rule. The split will take effect on December 30.

Adicet Bio (ACET) – Adicet Bio is a clinical-stage biotechnology company developing allogeneic gamma delta T-cell therapies and other engineered immune cell treatments for cancer and serious diseases, aiming to harness the body’s immune system with off-the-shelf cellular platforms. On December 26, the company announced a 1-for-16 reverse stock split to support Nasdaq listing criteria and bolster its share price. The split is scheduled to become effective on December 30.

X3 Holdings (XTKG) – X3 Holdings, formerly known as Powerbridge Technologies, is a Singapore-based global provider of digital solutions and technology services that operates across diversified segments including digital trade technologies, smart agritech platforms with AI-driven monitoring tools, renewable energy projects, and bitcoin cryptomining operations. On December 26, the company announced a 1-for-6 share consolidation as part of its efforts to maintain compliance with Nasdaq’s minimum bid price requirement. The consolidation will become effective on December 30, alongside a capital reduction.

Intelligent Living Application Group (ILAG) – Intelligent Living Application Group, headquartered in Hong Kong, develops and produces premium mechanical locksets and smart security hardware, supplying access-control solutions to residential, commercial, and industrial customers across Asia and beyond. The company’s offerings blend traditional security engineering with modern connectivity features to address evolving market needs. On December 26, it announced a 1-for-10 reverse stock split to meet Nasdaq’s minimum bid price requirements, with the split taking effect on December 30.

Oriental Rise Holdings (ORIS) – Oriental Rise Holdings is a China-based agricultural and consumer goods company primarily engaged in the sourcing, processing, and distribution of tea products and other agricultural commodities, serving both domestic and international markets. On December 11, the company’s board approved a 1-for-20 reverse stock split following prior shareholder authorization. The reverse split is expected to become effective on December 30, as part of the company’s efforts to address Nasdaq compliance requirements.

Baiya International Group (BIYA) – Baiya International Group is a China-based cloud-technology and human capital solutions provider that operates a comprehensive HR services platform, offering job matching, recruitment, outsourcing, and labor-dispatching services to enterprises and workers. On December 23, the board approved a 1-for-25 reverse stock split to meet Nasdaq’s minimum bid price requirement. The split will take effect on December 29, with split-adjusted trading beginning December 30.

Birchtech Corp (BCHT) – Birchtech is an environmental technology company developing specialty activated carbon solutions and advanced materials designed to reduce emissions and clean air and water across industrial and consumer applications. On December 23, the company announced that its board has approved a 1-for-5 reverse stock split, with split-adjusted trading beginning December 31, to support future strategic uplisting plans and improve marketability.

Rithm Property Trust (RPT) – Rithm Property Trust is a real estate investment trust focused on owning and managing a diversified portfolio of flexible commercial real estate and mortgage assets, with an emphasis on industrial, office, and multi-tenant properties. On December 19, the company announced a 1-for-6 reverse stock split, which will take effect on December 30, with split-adjusted trading beginning December 31, as part of its capital structure optimization efforts.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.