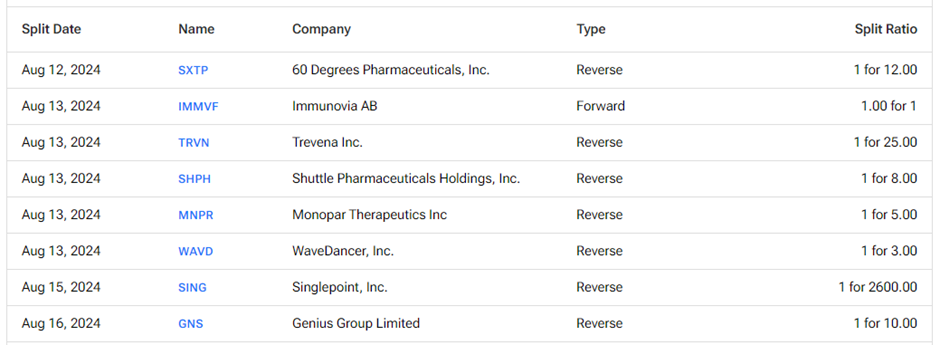

These are the upcoming stock splits for the week of August 12 to August 16, based on TipRanks’ Stock Splits Calendar. A stock split is a corporate action in which the company issues additional common shares to increase the number of outstanding shares. Accordingly, the stock price of the company’s shares decreases, which maintains the market capitalization before and after the split. In contrast, there are also reverse stock splits that reduce the number of outstanding shares (consolidate). In this case, too, the market cap is maintained as the share price increases following the reverse stock split.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Companies often undertake stock splits to improve the liquidity of the common shares and make them more affordable for retail investors. Let’s look quickly at the upcoming stock splits for the week.

60 Degrees Pharmaceuticals, Inc. (SXTP) – 60 Degrees Pharmaceuticals is engaged in the research and development of small-molecule therapies for treating infectious diseases. Its lead product candidate, ARAKODA (tafenoquine), is a malaria-preventative treatment marketed in the U.S. Its pipeline also includes treatments for COVID-19, fungal, tick-borne, and viral diseases. On August 6, SXTP announced a one-for-12 reverse stock split to comply with Nasdaq’s minimum bid price requirement. Shares will start trading on a split-adjusted basis on August 12.

Immunovia AB (IMMVF) – Immunovia is a diagnostic company engaged in developing simple blood-based testing to detect proteins and antibodies that indicate a high-risk individual has developed pancreatic cancer. On June 19, IMMVF’s board approved a rights issue of its shares. According to the rights issue, each registered shareholder will receive three-unit rights for each share held. The record date for the rights issue is set for August 14.

Immunovia intends to issue a maximum of 67,931,247 units, equivalent to 135,862,494 shares through the issue. The net proceeds will be used to repay the bridge loan and toward research and development and clinical studies.

Trevena (TRVN) – Trevena is a clinical-stage biopharmaceutical company focused on developing treatments for patients suffering from central nervous system (CNS) disorders. On August 8, Trevena announced a one-for-25 reverse stock split, effective August 13. The stock split will help Trevena regain compliance with the minimum bid price requirement of listing on the Nasdaq Capital Market.

Shuttle Pharmaceuticals Holdings Inc. (SHPH) – Shuttle Pharmaceuticals is a clinical-stage pharmaceutical company that develops treatments for cancer. Its focus areas include surgery, radiation therapy, chemotherapy, and immunotherapy. On August 7, SHPH announced a one-for-eight reverse stock split of its common shares, effective August 13.

Monopar Therapeutics, Inc. (MNPR) – Monopar Therapeutics is a clinical-stage radiopharmaceutical company engaged in developing cancer treatments. On August 5, MNPR shareholders approved a one-for-five reverse stock split to regain compliance with Nasdaq’s listing rules. The split is effective on August 12 after the market closes. Shares will start trading on a split-adjusted basis on August 13.

WaveDancer, Inc. (WAVD) – WaveDancer provides enterprise IT solutions, including system modernization, cloud-based solutions, and cybersecurity protection. On August 9, WaveDancer announced a one-for-three reverse stock split, that will take effect on August 13. WaveDancer is poised to merge with privately held, commercial-stage, medical technology company Firefly Neuroscience in an all-stock transaction. Post the split, shares will start trading under the ticker symbol “AIFF” and the company’s name will change to Firefly Neuroscience, Inc.

Genius Group Ltd (GNS) – Genius Group operates a digital, artificial intelligence (AI)-backed education platform, offering K-12 education programs, accredited university courses, and skills-based courses for entrepreneurs. The company caters to millions of students, including individuals, enterprises, and governments. On August 5, Genius Group announced a one-for-ten reverse stock split to meet the minimum bid price requirement for listing on the NYSE. The shares will start trading on a split-adjusted basis on August 16.

To find more information about historical and upcoming stock splits, visit the TipRanks Stock Splits Calendar.