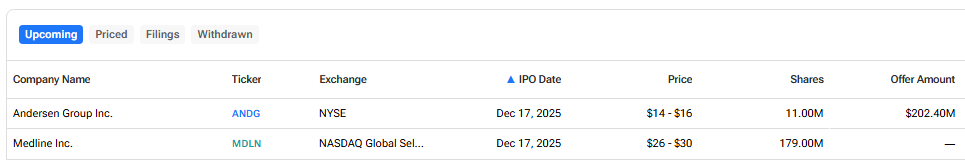

These are the upcoming IPOs (initial public offerings) for the week of December 15-December 19, based on the TipRanks IPO Calendar. An IPO refers to the public market debut of a private company. Following the IPO, the company’s shares become available for trade (sale/buy) on the stock exchange.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Going public can bring clear benefits, including access to fresh capital, an exit option for early investors, and higher visibility with customers and partners. A public listing can also support future growth by making it easier to raise funds through additional share sales. However, public listings also bring strict reporting requirements, higher compliance costs, and constant scrutiny from investors and regulators.

After a slow start earlier in the year, the IPO market is showing fresh momentum as investor interest picks up. Recent weeks have seen a steady flow of new listings and better demand in select sectors and regions. With sentiment improving, here’s a look at the upcoming IPOs for this week.

Andersen Group, Inc.

Andersen Group, Inc. is a U.S.-based company that provides business and professional services to commercial and institutional clients. The company focuses on long-term contracts and recurring revenue, which help support steady cash flows.

Andersen Group is expected to list on the New York Stock Exchange (NYSE) under the ticker symbol ANDG on December 17, 2025. The company plans to offer 11 million shares at a price range of $14 to $16 per share.

According to its IPO filing, the company will use the proceeds primarily for internal restructuring related to its corporate structure.

Medline, Inc.

Medline Inc. is a healthcare company that manufactures and distributes medical supplies and solutions to hospitals, surgery centers, and other healthcare providers. The company serves customers across the U.S. and internationally, with a broad product portfolio used in everyday patient care.

Medline is expected to go public on the Nasdaq Global Select Market under the ticker symbol MDLN on December 17, 2025. The company is offering 179 million shares at an indicated price range of $26 to $30 per share. The final offer size has not yet been disclosed.

As outlined in its filings, Medline plans to use most of the IPO money to buy ownership interests in its main operating business. That money will then be used mainly to pay down debt, cover IPO-related costs, and support general business needs.

To find more information about upcoming and recent IPOs, visit the TipRanks IPO Calendar.