Shares of Abercrombie & Fitch (NYSE:ANF) have been on an absolute tear since the start of 2023, rising over 700% in the last 18 months. Valued at $9.5 billion, the retail stock has staged a remarkable comeback in recent months, outpacing its peers by a wide margin. Nonetheless, I still believe it’s a good buy right now despite its outsized gains. I am bullish on the company due to its reasonable valuation and stellar turnaround strategy.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

An Overview of Abercrombie & Fitch

Founded in 1892, Abercrombie & Fitch is one of the oldest companies in the world. It initially operated an outdoor specialty retailer and sold camping, fishing, and hunting gear. Today, it operates as an omnichannel retailer in the U.S., Canada, Europe, the Middle East, and Asia Pacific.

The company offers an assortment of apparel, personal care products, and accessories for men, women, and children. These products are sold through its retail stores, licensing agreements, and e-commerce platforms.

A Remarkable Turnaround

Over the last few years, Abercrombie & Fitch has successfully transformed itself from a legacy mall brand to a Wall Street winner. It has focused on revamping its product assortment and rebranded itself as an inclusive company, allowing the retailer to consistently top Wall Street revenue and earnings estimates in the last five quarters.

CEO Fran Horowitz first changed Abercrombie’s product mix in 2017, moving away from its loud branding. The maverick leader also overhauled its store footprint and closed several retail locations while changing the look of these outlets to target the modern customer.

Abercrombie’s transformation that began in 2017 is finally bearing fruit. For example, despite lower consumer spending amid inflation and other headwinds, Abercrombie increased its sales by 16% in Fiscal 2023. In 2023, the stock rose by 285% and has surged another 100% year-to-date.

A Stellar Performance in Q1 2024

In Fiscal Q1 of 2024 (ended in April), Abercrombie & Fitch reported revenue of $1.02 billion and adjusted earnings of $2.14 per share. Comparatively, analysts expected sales of $963.3 million and earnings of $1.74 per share in the April quarter. While sales grew by 22% year-over-year, earnings surged by almost 500% in the last 12 months, driving the stock higher by over 20% in a single trading session last month. In the year-ago period, ANF reported revenue of $836 million and net income of $16.6 million or $0.39 per share.

Abercrombie & Fitch attributed its Q1 results to relevant product assortments, marketing, inventory discipline, and operational efficiencies. Its growth in Q1 was broad-based, with the Abercrombie brand growing sales by 31% while the Hollister brand grew by 12%.

The company’s comparable sales rose by 21%, and it has raised its revenue guidance for the year. In Fiscal 2024, it expects sales to grow by 10%, much higher than its previous outlook of growth between 4% and 6%. It’s evident that Abercrombie & Fitch is building on the double-digit revenue growth it achieved in 2023.

What Next for Abercrombie & Fitch?

During its earnings call, Horowitz disclosed plans to expand its Hollister brand, which currently accounts for 50% of total sales. The Hollister team is focused on seeking opportunities to reduce discounts and promotions and tightly manage inventory levels, all of which should drive its gross margin higher.

In March, Abercrombie & Fitch debuted its wedding collection, which includes outfits for rehearsals and other festivities. In fact, the company has a mid-tier price point for its “A&F Wedding Shop” allowing it to gain traction in a multi-billion-dollar market. Horowitz emphasized that this business segment exceeded expectations in Q1.

Another key driver of top-line growth was international sales, which soared 19% in regions such as Europe, the Middle East, and Africa.

Unlike other legacy retailers, Abercrombie has partnered with affiliated and influencers to acquire new customers. This user-generated content has resonated with customers and is a key part of its marketing strategy.

Is ANF Stock Still Undervalued?

Analysts tracking Abercrombie & Fitch stock expect adjusted earnings to grow by 51.5% to $9.52 per share in Fiscal 2024. So, priced at 19.5x forward earnings, ANF stock is not too expensive, given its growth forecasts, even though the sector median multiple is lower at 15.8x.

Is ANF Stock a Buy, According to Analysts?

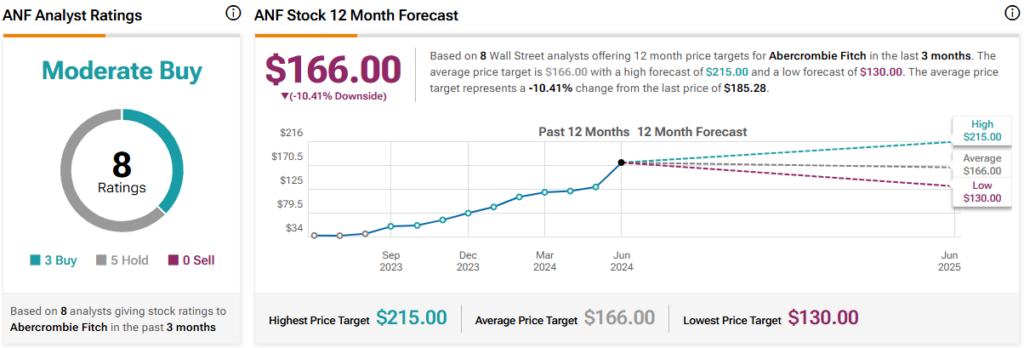

Out of the eight analyst ratings given to ANF stock, three are Buys, five are Holds, and none are Sells, indicating a Moderate Buy consensus rating. The average ANF stock price target is $166, implying downside potential of 10.4% from current levels.

The Key Takeaway

Abercrombie & Fitch has had a strong start to the year, allowing it to raise guidance for the rest of Fiscal 2024. Management now expects sales to grow by 10%, about twice the previous estimates. Moreover, it is also forecast to end the year with an operating margin of 14%, among the highest in the retail sector.

Therefore, I believe that Abercrombie’s reasonable valuation, improving brand value, and market-beating growth make it a good investment option in June 2024.