Chinese tech giant Baidu (BIDU) has registered a sharp rally recently, rising 38% from last month’s lows. This rally has been mainly powered by China’s unprecedented stimulus efforts to stabilize the economy. While the stimulus has undoubtedly boosted Baidu stock, the company’s underlying strength, driven by solid profitability and promising AI and cloud initiatives, further supports a bullish outlook. Additionally, despite the recent rally, Baidu continues to look undervalued, offering an attractive opportunity for long-term investors. For this reason, I am bullish on BIDU stock.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Unpacking Baidu’s Recent Rally

Baidu stock’s impressive rally during the past few weeks is closely tied to China’s huge stimulus package, which includes injecting 800 billion yuan ($114 billion) of liquidity into the stock market. These measures, including lowering the reserve requirements for banks and promoting stock buybacks, have undoubtedly boosted market sentiment. They have particularly benefited large tech players that have been trading at fairly humble valuations for ages, like Alibaba (BABA), JD.com (JD), PDD (PDD), and, of course, Baidu.

For Baidu, this liquidity injection not only benefits its stock price due to market sentiment, but should also help strengthen the company’s underlying financial position. As the Chinese economy stabilizes and consumer confidence improves, businesses will likely increase their advertising budgets, boosting Baidu’s digital marketing revenue. Furthermore, Baidu’s AI Cloud services, a growing revenue stream, will benefit as businesses across industries expand their digital infrastructure during this period of economic recovery.

Baidu’s Robust Investment Case Beyond the Stimulus

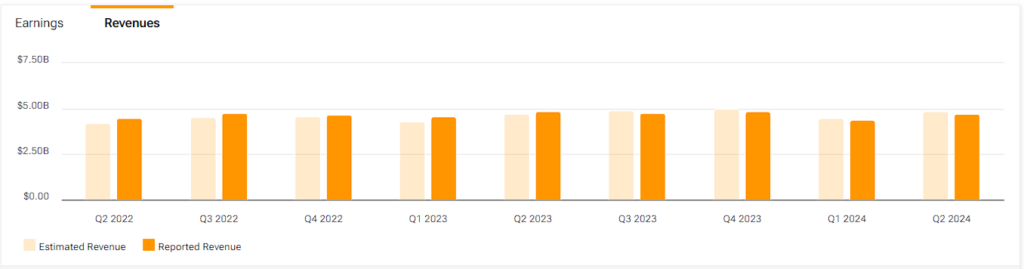

Beyond the recent stimulus-powered rally, Baidu’s investment case remains robust, with its most recent Q2 results showing solid earnings. While overall revenue growth has stalled, with revenues (core) growing by just 1% year-over-year, the company has maintained strong profitability metrics. Its core adjusted operating income rose 8%, with the adjusted operating income margin expanding to 26% from about 25% last year.

In the meantime, Baidu’s recent advancements seem encouraging, positioning the company to capitalize on some of the most pivotal trends emerging today. A standout achievement is the progress of Apollo Go, Baidu’s autonomous ride-hailing service, which has reached a significant milestone by offering fully driverless operations in Wuhan.

Also, Baidu’s AI-powered transformation of its search platform through ERNIE is poised to boost user engagement and increase product loyalty. In fact, Baidu’s AI Cloud business demonstrated strong potential overall, with 14% year-over-year revenue growth in Q2, showing Baidu’s promising trajectory in the AI sector.

Another exciting factor I see in Baidu’s investment case is its growing involvement in the semiconductor sector. The company has been developing its own AI chips, like the Kunlun chips, to power its cloud computing and autonomous driving technologies. These chips are created to optimize performance for AI workloads, reducing dependence on external suppliers, and improving cost efficiency. Considering Chinese regulators have asked domestic companies to avoid Nvidia (NVDA) chips, Baidu’s growing presence in this space could end up giving it a strong competitive edge.

Still Cheap Despite Recent Rally

Even after a significant rally, I believe that Baidu stock remains attractively priced at just 9.7 times this year’s expected earnings per ADR of $11.27. This low, single-digit multiple is not completely unjustified, as there are valid investor concerns over past capital allocation missteps. Such examples include Baidu’s costly investments in ventures like iQIYI (IQ), which have hampered the company’s balance sheet.

Nevertheless, Baidu’s leadership in AI and cloud computing in the country, along with China’s continued economic growth potential, makes today’s valuation compelling. With the Chinese government providing strong financial support and Baidu focusing on higher-margin, fast-growing sectors, I think the company seems well-positioned to overcome past challenges and deliver long-term value to shareholders from its current levels.

Is BIDU Stock a Buy, According to Analysts?

Looking at Wall Street’s view on the stock, Baidu currently commands a Strong Buy consensus rating based on 11 Buys and three Holds assigned in the past three months. At $128.75, the average BIDU stock price target implies 16.56% upside potential.

If you’re unsure which analyst you can trust when buying and selling BIDU stock, James Lee from Mizuho Securities is the most profitable analyst covering the stock (on a one-year timeframe). He boasts an average return of 3.61% per rating and a 47% success rate.

Takeaway

In conclusion, Baidu’s recent rally highlights the impact of China’s aggressive stimulus measures, but its underlying fundamentals tell an equally compelling story. The company’s domestic leadership in AI, cloud computing, autonomous driving, and robust profitability metrics set the stage for long-term growth.

Simultaneously, even as the stock has climbed, Baidu’s valuation remains attractive, trading at a modest multiple that continues to reflect concerns over past capital missteps. Still, with promising developments in AI chips and other forward-looking technologies, Baidu stands well-positioned to capitalize on China’s tech-driven future, in my view. Therefore, for long-term investors seeking exposure to China’s economic recovery and tech innovation, I think Baidu offers an attractive opportunity at its current price levels, with notable upside potential remaining.