Shares of the transportation and business services provider FedEx (NYSE:FDX) are up over 18% year-to-date. The stock got a significant boost after the company announced solid Q4 financials and a strategic review of its Freight segment. While FDX stock has outperformed the S&P 500’s (SPX) nearly 15% gain, analysts expect the upward trend to continue in the days ahead.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Analysts predict that FedEx may spin off its Freight unit into a separate company, which could benefit shareholders. Per a Wall Street Journal report, sector experts and analysts see a spinoff as more likely than a sale, citing Freight’s leading position in the less-than-truckload (LTL) sector.

Analysts Weigh In

Following this announcement, JPMorgan analyst Brian Ossenbeck upgraded FedEx stock to Buy from Hold. The analyst raised the price target to $359 from $296. The analyst expects the spinoff to be positive, boost FDX’s valuation, and support the stock in the coming months.

Echoing similar sentiments, Stifel analyst J. Bruce Chan raised FDX’s price target to $327 from $303 and kept a Buy rating. The analyst said that management’s review will likely result in a spinoff. The analyst expects the spinoff to unlock value for shareholders as peers operating in this segment are trading at a significant premium.

Is FedEx a Buy, Sell, or Hold?

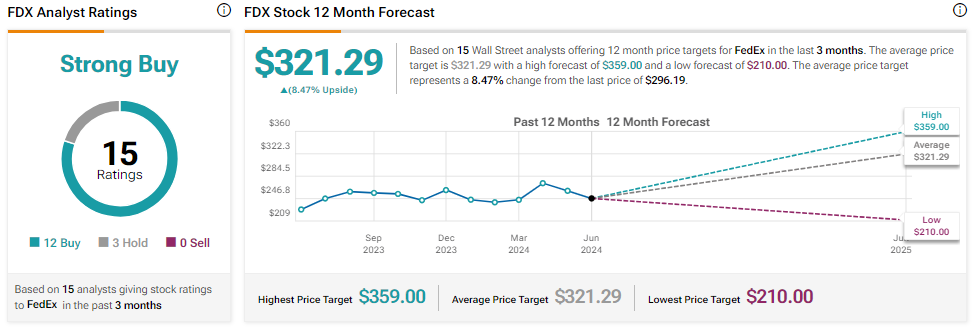

Wall Street analysts are bullish about FedEx’s prospects. With 12 Buys and three Hold recommendations, FDX stock has a Strong Buy consensus rating. The analysts’ average FDX stock price target is $321.29, implying 8.47% upside potential from current levels.

The Bottom Line

Analysts are confident that FedEx will spin off its Freight segment. Also, analysts expect the FDX stock’s uptrend to continue. Overall, Wall Street is bullish about FedEx, and the average price target suggests further upside potential.