Union Pacific (UNP) stock soared today after the railroad company posted strong results in its Q4 2024 earnings report. The report started with diluted earnings per share of $2.91, beating Wall Street’s estimate of $2.79 for the quarter. That represents a 7.38% improvement year-over-year from $2.71 per share.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Union Pacific also reported Q4 revenue of $6.12 billion, which just missed analysts’ estimate of $6.15 billion. This represents a 1% decrease from the $6.16 billion reported in the same period of the year prior. The company attributed the drop to “lower fuel surcharge revenue, unfavorable business mix, and lower other revenue.”

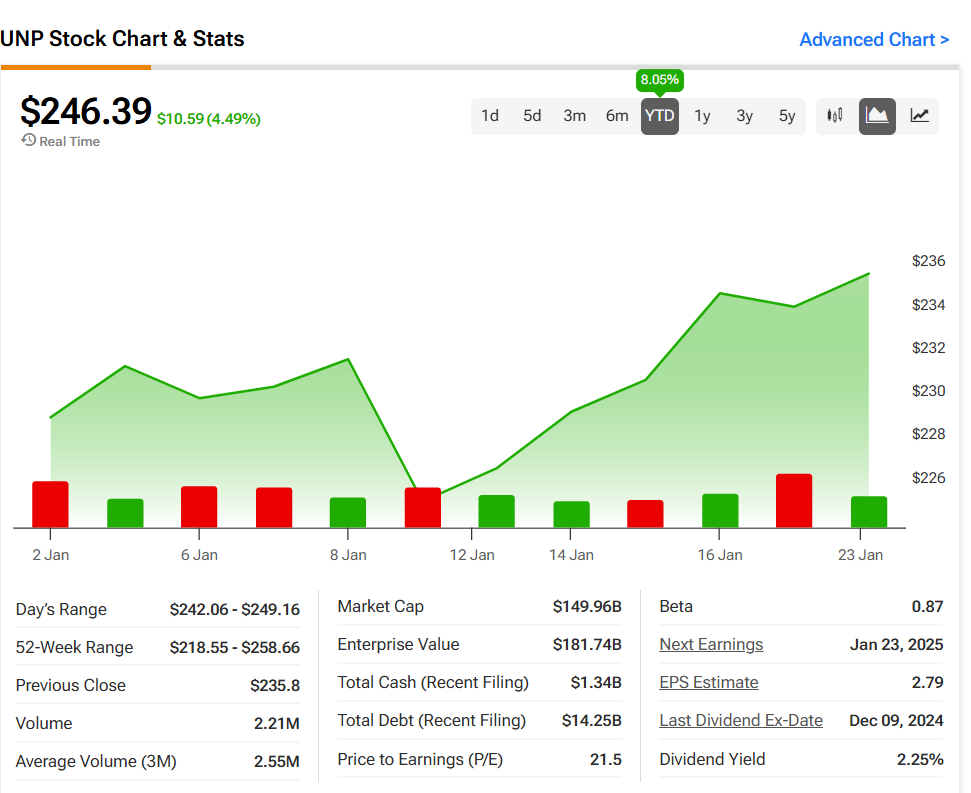

Even with these mixed Q4 earnings results, Union Pacific investors are pleased with the report. UNP stock is up 4.43% today, building on its 7.98% increase year-to-date. With that comes 2.21 million shares traded, which is closing in on its three-month daily average trading volume of 2.55 million shares.

Union Pacific Maintains Its 2025 Guidance

Union Pacific said today’s earnings results reaffirm its Investor Day outlook for 2025. That includes earnings per share growth meeting its three-year CAGR target of high single-digit to low double-digit improvement. It also expects pricing dollars will be accretive to its operating ratio while a mixed economic backdrop, coal demand, and challenging year-over-year international intermodal comparisons will impact volume.

Union Pacific doesn’t expect any change to its long-term capital allocation strategy. It still estimates a $3.4 billion capital plan and stock repurchases between $4 and $4.5 billion.

Is UNP Stock a Buy, Sell, or Hold?

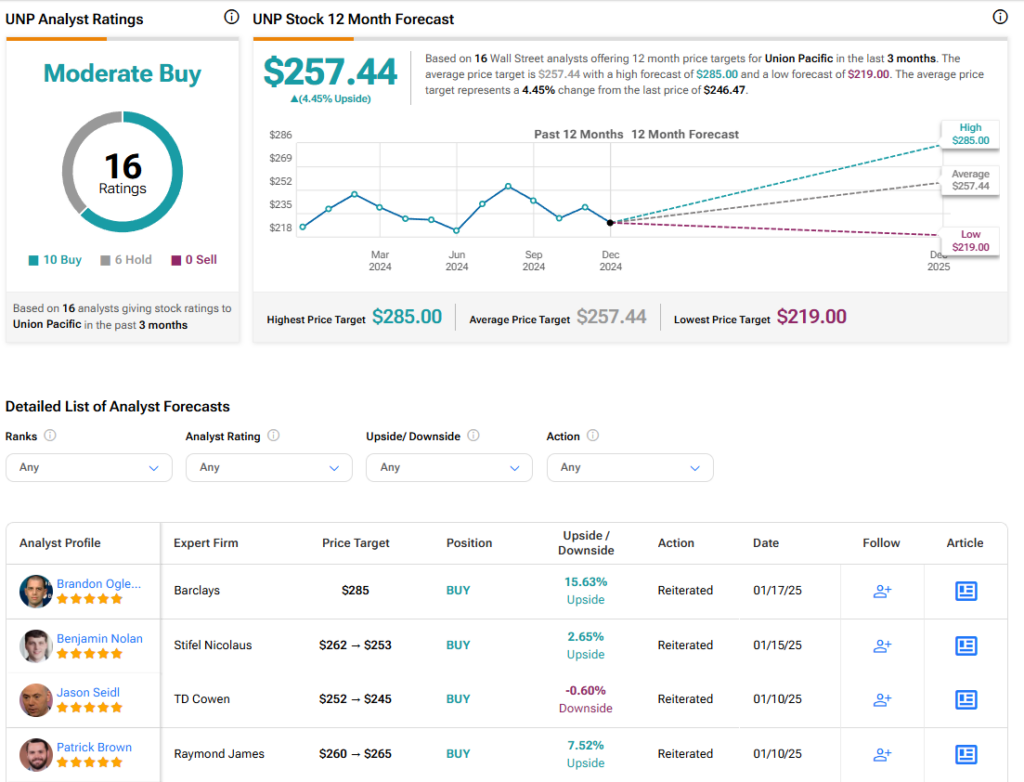

Turning to Wall Street, the analysts’ consensus rating for Union Pacific is Moderate Buy based on 10 Buy and six Sell ratings over the last three months. With that comes an average price target of $257.44, a high of $285, and a low forecast of $219. This represents a potential 4.45% upside for UNP shares. These ratings and price targets will likely change as analysts update their coverage.