Streaming giant Netflix’s (NFLX) stock came under pressure on Thursday after Paramount Skydance (PSKY) renewed its attack on Netflix’s $72 billion bid for Warner Bros. (WBD) (WBD). The entertainment conglomerate branded Netflix’s offer as “unmistakably inferior,” arguing that the deal’s value has eroded and is likely to leave WBD investors with a legacy TV asset spin-off that may struggle to command much in the market.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The entertainment giant’s latest attack comes as Warner Bros.’ board of directors on Wednesday rejected, for a second time, Paramount’s $108.4 billion acquisition offer, noting that the bid relies on “an extraordinary amount of debt financing.” This is even as Paramount’s $40 billion equity guarantee from Oracle’s (ORCL) billionaire founder, Larry Ellison, failed to change the minds of the WBD board.

Paramount Berates Value of Netflix’s Offer

In a statement, Paramount reiterated that its offer is “superior,” adding that Netflix’s $27.75 per WBD share — which is split into $23.35 in cash and $4.50 in Netflix stock — has fallen in value. Paramount pointed out that NFLX shares are trading well below the low end of the collar protection offered by Netflix.

Netflix’s arrangement with Warner Bros. comes with a collar mechanism that locks the value of the stock portion of the deal at about $4.50 per WBD share. This mechanism works if Netflix’s shares trade between $97.91 (the lower collar) and $119.67 (the upper collar).

Paramount claimed that Netflix’s cash-and-stock offer is now worth $27.42 per WBD share and is “unmistakably inferior” to its $30-per-share cash offer.

Paramount Slams Discovery Global Spin-off

Based on their offers, Netflix is seeking to acquire Warner Bros.’s TV and movie studios, alongside the streaming platform HBO, while Paramount wants the entirety of the more-than-a-century-old Hollywood darling.

Under Netflix’s terms, WBD shareholders expect to get shares from a new entity to be called Discovery Global that will house WBD’s traditional cable networks, such as CNN and TNT. These traditional linear television networks are excluded from Netflix’s offer.

However, Paramount criticized this plan for Discovery Global as offering no significant advantage over its deal, pointing to the disappointing performance of Comcast’s (CMCSA) Versant Media (VSNT) since the latter started trading on Monday. Versant Media houses channels such as CNBC and USA Network that were previously under Comcast’s NBCUniversal cable network portfolio.

“Our offer clearly provides WBD investors greater value and a more certain, expedited path to completion,” noted David Ellison, Paramount’s chair and chief executive.

What Are the Best Entertainment Stocks to Buy?

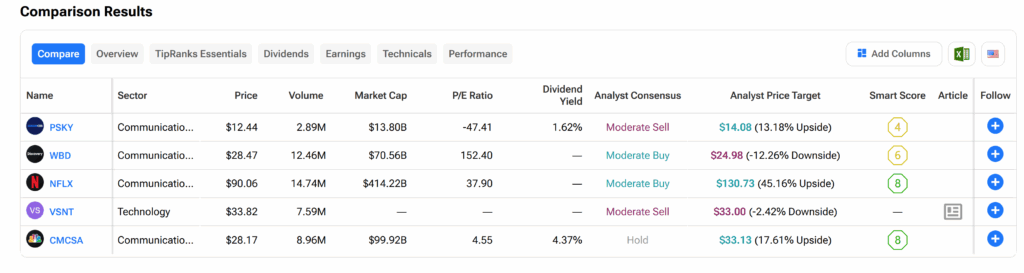

TipRanks’ Stock Comparison tool provides details on how Wall Street currently rates the performance of the entertainment stocks mentioned in this article. Kindly refer to the image below.