Shares of game-engine maker Unity Software (NYSE:U) declined 12% in Thursday’s extended trading session as the company reported lower-than-anticipated third-quarter revenue and did not issue guidance for the December quarter. Unity, which offers a content creation platform mainly used by video game developers, faced severe backlash recently when it introduced a new fee based on how frequently a developer’s game is downloaded.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Given the outrage, the company apologized for the pricing change and modified its update. Following the controversy, the then-CEO John Riccitiello announced his retirement from the company in early October.

Unity’s Disappointing Results

Unity’s Q3 2023 revenue grew 68.5% year-over-year to $544 million, reflecting the favorable impact of the $2.9 billion acquisition of mobile ad company ironSource. However, Q3 revenue lagged analysts’ estimate of $554 million. Continued restrictions on gaming by the Chinese government impacted the performance of the company’s Create Solution segment to a certain extent.

Nonetheless, the company’s Q3 2023 GAAP loss narrowed to $0.32 per share compared to $0.84 per share in the prior-year quarter on higher revenue and was better than analysts’ expectation of a loss per share of $0.49.

Speaking about the recent backlash, the company said, “While we did not expect the introduction of the fees to be easy, the execution created friction with our customers and near-term headwinds.”

The company did not issue any guidance for Q4 2023, as it commenced a comprehensive assessment of its product portfolio several weeks back to focus on profitable products. The company is also evaluating its cost structure and expects to make final decisions over the next few weeks. The company is contemplating exiting certain product offerings, job cuts, and reducing its office footprint.

The company said that it will begin the implementation of its streamlining plan this quarter and expects to “complete all interventions” before the end of Q1 2024.

Is Unity Software a Buy, Sell, or Hold?

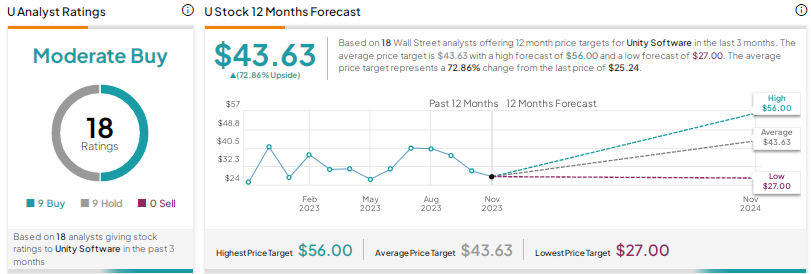

Wall Street is cautiously optimistic on Unity Software, with a Moderate Buy consensus rating based on nine Buys and nine Holds. The average price target of $43.63 implies about 73% upside potential. Note that these ratings and the average price target could be revised today or in the days ahead in reaction to the company’s Q3 results.