UnitedHealth (UNH) is under renewed scrutiny after a Senate investigation concluded that the company used aggressive strategies to secure higher federal payments for its Medicare Advantage members, the Wall Street Journal reported.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Medicare Advantage plans receive a fixed payment per patient, with additional funds provided for members who have certain costly health conditions. This system, known as risk adjustment, aims to ensure that insurers caring for sicker patients receive adequate compensation.

But according to the committee’s review of 50,000 pages of internal UnitedHealth documents, the company “turned risk adjustment into a business.”

The report comes as UnitedHealth is already under several investigations, including civil and criminal probes by the Justice Department, over its Medicare Advantage practices. The company has rejected the Senate report’s claims, saying it follows Medicare rules and has done well in federal audits.

Payment-Boosting Tactics Deployed by UNH

Importantly, the Senate report highlights several tactics the company used to identify payment‑boosting diagnoses, such as:

- Sending nurses to patients’ homes to collect new diagnoses, offering bonuses to doctors who considered additional conditions, and using AI and data‑mining tools to scan medical records to add diagnoses.

- Internal training materials showed that employees were sometimes encouraged to diagnose conditions without the recommended medical testing.

- The report also noted that staff were encouraged to label patients as having opioid dependence even when they were just taking prescribed pain medication. Even after patients stopped taking the medications, employees were advised to continue labeling them as having opioid dependence in remission.

- Another area of concern was UnitedHealth’s use of the QuantaFlo device to test for peripheral artery disease during home visits. Nurses and doctors told the WSJ that the device often gave false positives, yet the company collected $1.4 billion in payments tied to the diagnosis between 2019 and 2021.

The company has since stopped using the device following changes to Medicare rules that eliminated extra payments for the condition.

While the Senate report does not call for penalties or policy changes, it shows how the country’s largest health insurer used the risk adjustment system to boost revenue. This raises concerns about oversight, accuracy, and the balance between business goals and patient care.

Is UNH a Good Stock to Buy?

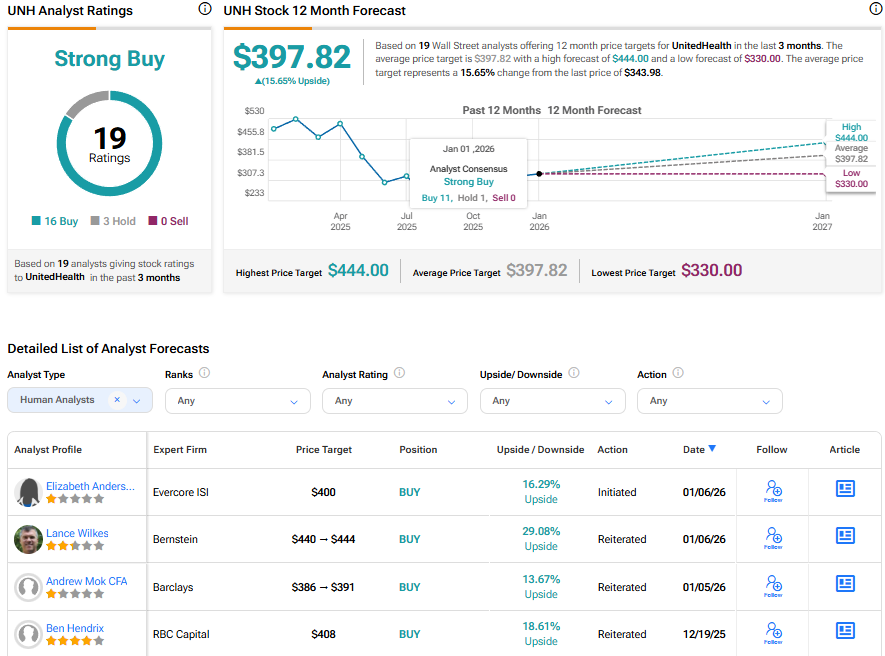

Overall, Wall Street has a Strong Buy consensus rating on UnitedHealth stock based on 16 Buy and three Hold recommendations. The average UNH stock price target of $397.82 indicates 15.65% upside potential.