UnitedHealth (UNH) is facing a proposed class-action lawsuit from investors who claim the company misled them by hiding the financial risks tied to its shift in strategy after the sudden death of former top executive Brian Thompson on December 4.

The lawsuit claims that investors suffered “significant losses and damages” due to the defendants’ alleged “wrongful acts and omissions” and the subsequent sharp decline in the company’s stock value.

The shareholders seek unspecified damages for those who held shares between December 3, 2024, and April 16, 2025.

In addition to UnitedHealth, the lawsuit also names CEO Andrew Witty and CFO John Rex as co-defendants, alleging they failed to disclose key financial challenges.

Investors Accuse UNH of Unfair Stock Inflation

Shareholders claim UnitedHealth changed its strategy after facing public backlash over the executive’s death and a U.S. Senate report on October 17, 2024, that pointed out UNH’s high claim denial rates. But the lawsuit claims the company did not fully explain how these changes affected its profits.

Also, the proposed lawsuit alleges that the company raised stock prices unfairly. In December, UNH predicted earnings per share (EPS) between $29.50 and $30. Then in January, it confirmed the same forecast, even though public concerns were growing.

Further, the lawsuit points out that the company cut its 2025 earnings forecast to $26-$26.50 per share. After this change, UNH stock price crashed, dropping about $130 in a single day, the biggest drop in over 25 years. This fall also pulled down the Dow Jones (DJIA) by 1.3%, reflecting the market’s strong reaction.

Is UNH a Good Buy Right Now?

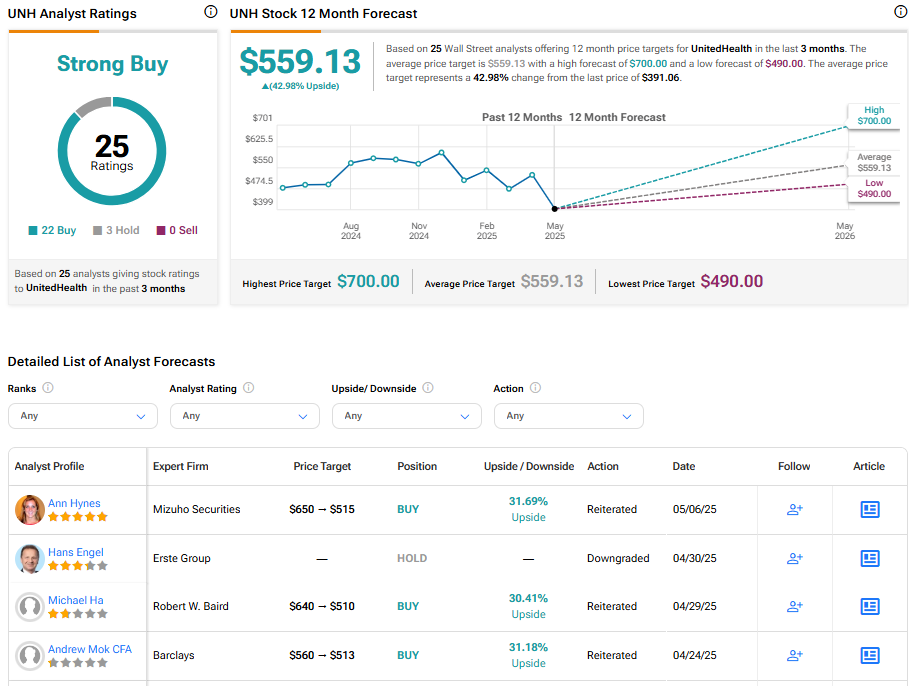

Turning to Wall Street, UNH stock has a Strong Buy consensus rating based on 22 Buys and three Holds assigned in the last three months. At $559.13, the average UnitedHealth stock price target implies a 42.98% upside potential.