UnitedHealth (UNH) has divested home health and hospice operations in 54 locations across Tennessee, Georgia, and Alabama to The Pennant Group (PNTG) for $146.5 million. The asset sale was required by the U.S. Justice Department to help clear the way for UnitedHealth’s acquisition of Amedisys and maintain competition in key local markets.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Background on the Divestiture

UnitedHealth first announced its plan to acquire home health and hospice provider Amedisys for $3.3 billion in June 2023. Earlier that year, UNH had already acquired LHC Group, another major player in the same space.

In November 2024, the Justice Department sued to block the Amedisys deal, arguing that combining two of the largest providers would reduce competition across 19 states.

To resolve the lawsuit, UnitedHealth and Amedisys agreed to divest a total of 164 home health and hospice locations, which accounted for about $528 million in annual revenue.

The merger officially closed in August 2025, and the asset sales began shortly after. Pennant and BrightSpring Health Services (BTSG) were selected to acquire the divested facilities, helping ensure continued patient access and market competition.

TipRanks AI Analyst Bullish on UNH

According to TipRanks’ A.I. Stock Analysis, UNH stock earns an Outperform rating with a score of 72 out of 100. Meanwhile, it sets a price target of $386, which implies an upside of 10.49% from current levels.

Overall, UnitedHealth shows solid financial strength and a reasonable valuation, but technical indicators suggest potential volatility. While the company’s recent governance changes are a positive factor, rising medical costs continue to weigh on the company.

Is UNH a Good Buy Right Now?

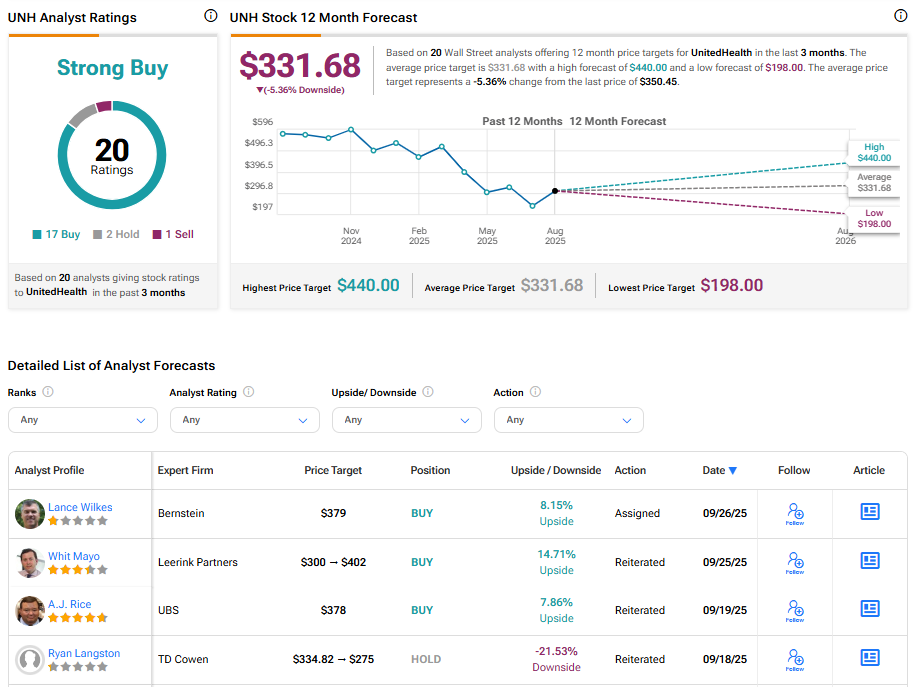

Turning to Wall Street, UNH stock has a Strong Buy consensus rating based on 17 Buys, two Holds, and one Sell assigned in the last three months. At $331.68, the average UnitedHealth stock price target implies a 5.36% downside potential.