UnitedHealth (UNH) stock was up over 7% during Tuesday’s trading session. The upside came after several analysts praised the healthcare giant for a positive forecast for its highly-rated Medicare Advantage plans.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a recent filing, the company revealed that preliminary data show nearly 78% of its Medicare Advantage members will be enrolled in plans with four stars or higher for 2026.

The Centers for Medicare & Medicaid Services (CMS) uses this star rating system to evaluate plans based on their quality and customer experience. Achieving a high rating is crucial for insurers because it drives enrollment and boosts bonus payments from the government, directly boosting the insurer’s bottom line.

Importantly, this projection is also in line with the company’s internal expectations and historical performance.

Shares of other health insurers, including Elevance (ELV) and Alignment Healthcare (ALHC), also saw gains following UnitedHealth’s update.

Analysts Respond with Price Upgrades and Optimism

Truist Securities analyst David S. Macdonald raised his price target on UnitedHealth stock to $365 from $310, maintaining a Buy rating. He believes the 2026 Star Ratings outlook is encouraging, especially in a sector that has witnessed volatility in recent years. Also, the analyst is impressed that the company reaffirmed its Fiscal 2025 adjusted EPS guidance, even after factoring in the recent Amedisys acquisition.

JPMorgan’s Lisa Gill echoed the sentiment, keeping a Buy rating on UNH. She highlighted that the 78% figure is likely better than some investors feared. While she cautioned that some metrics could still change, the update was seen as “at least a modest positive.”

At the same time, Barclays analyst Andrew Mok, CFA, maintained a Buy rating and raised his price target to $352, citing the consistency between UnitedHealth’s 2025 and 2026 bonus-eligible membership levels. The analyst said the news helps reinforce the company’s multi-year margin improvement thesis.

Challenges in Medicare Advantage Market

The Medicare Advantage market has been a major growth engine for health insurers, but it has faced several challenges recently. Rising medical costs and stricter government payment policies have put pressure on profit margins.

Further, a sluggish Medicare strategy led to a 37% decline in UnitedHealth’s share price earlier this year and led the company to cut its financial outlook.

It is worth noting that the CMS is expected to release its official 2026-star ratings data in October. This data will be crucial as it not only influences where members choose to enroll but also sets the reimbursement levels that will affect the insurers’ revenues in 2027.

Is UNH a Good Buy Right Now?

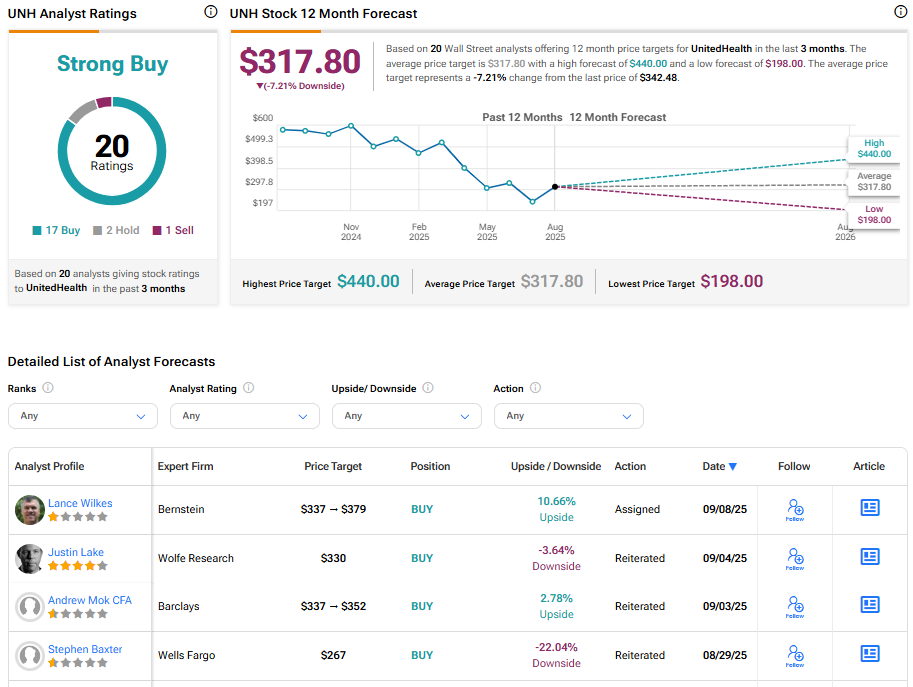

Turning to Wall Street, UNH stock has a Strong Buy consensus rating based on 17 Buys, two Holds, and one Sell assigned in the last three months. At $317.80, the average UnitedHealth stock price target implies a 7.21% downside potential.