UnitedHealth Group (UNH), the largest U.S. health insurer, has had a difficult 2025, with its stock down more than 27% so far this year. Yet, despite this decline, TipRanks’ A.I. Analyst remains bullish, giving the stock an “Outperform” rating and pointing to long-term growth potential. For context, TipRanks’ A.I. Stock Analysis provides automated, data-backed evaluations of stocks across key metrics, offering users a clear and concise view of a stock’s potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The decline has been driven by higher Medicare Advantage costs, a leadership shake-up, and increased federal scrutiny of the company’s billing practices. Recently, UNH also faced pressure from a shareholder advocacy group urging it to separate the roles of CEO and Chairman, both currently held by Stephen Hemsley.

After a turbulent stretch, the company is now working to stabilize performance and restore investor confidence. It plans to make operational changes, adjust pricing and benefits for its 2026 Medicare plans, and exit unprofitable markets to protect margins and improve efficiency.

UNH Earns Outperform Rating

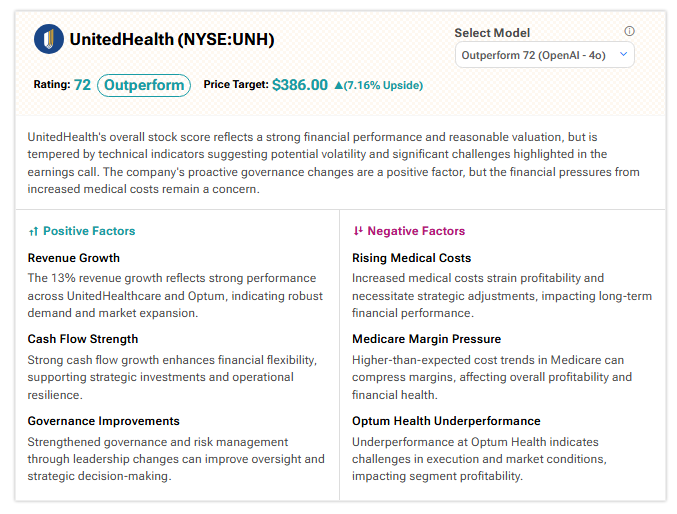

According to TipRanks A.I. Stock Analysis, UNH earns a solid score of 72 out of 100 with an Outperform rating. Meanwhile, the A.I. analyst assigns UnitedHealth a price target of $386, implying a 7.2% upside potential.

Overall, UnitedHealth’s stock score reflects strong financial performance and reasonable valuation as key drivers.

AI Analyst Weighs UNH’s Strengths and Weaknesses

The analysis points out both positive and negative factors weighing on the company’s stock performance.

On the bright side, the company’s 13% revenue growth in Q2 shows strong results across UnitedHealthcare and Optum, the company’s health services arm. Its steady cash flow gives it room to invest and handle costs better. Specifically, Optum generated $67.2 billion in Q2 revenue, up 6.8% from a year ago. The company has also made governance changes that could help improve decision-making. According to the tool, these factors support the stock’s strong financial base and long-term outlook.

On the negative side, rising medical costs are still a big problem and could hurt profit margins. The tool also points to Medicare margin pressure and weak results at Optum Health, which have added more strain to earnings. Notably, revenue at Optum Health declined 7% to $25.2 billion, driven by changes to legacy client contracts and reduced Medicare Advantage funding.

Overall, while UnitedHealth remains solid, higher medical costs and margin pressure could limit near-term growth.

Is UNH a Good Buy Right Now?

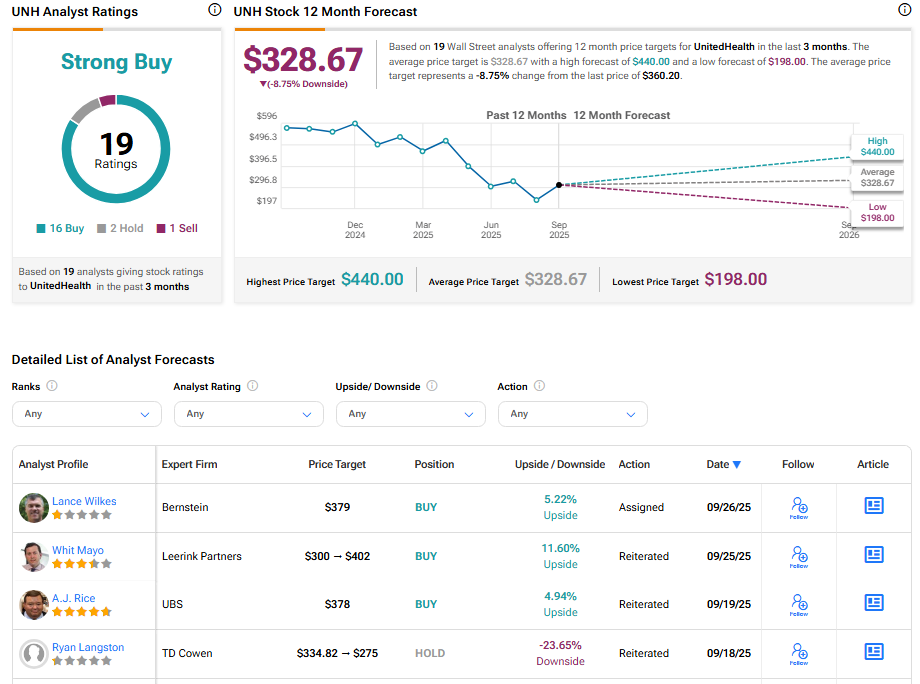

Overall, Wall Street analysts also remain bullish on UNH stock. According to TipRanks’ consensus, UNH stock has a Strong Buy consensus rating based on 16 Buys, two Holds, and one Sell assigned in the last three months. At $328.67, the average UnitedHealth stock price target implies a 9% downside potential.