According to an analysis by The Wall Street Journal, early prescription refills by U.S. pharmacies added about $3 billion in extra costs for Medicare and patients between 2021 and 2023. Indeed, the review examined prescription data from more than 50 million Medicare beneficiaries. While mail-order pharmacies filled only around 9% of Medicare prescriptions, they accounted for 37% of excess medication dispensing. As a result, a relatively small portion of prescriptions drove a disproportionate share of the added costs.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

When digging deeper, the report found that mail-order pharmacies operated by UnitedHealth (UNH) and Humana (HUM) were responsible for much of the extra costs. It’s worth noting that in many cases, insurers require patients to use at least 75% of a prior supply before refilling a 90-day prescription. However, UnitedHealth’s mail-order pharmacies sent refills before that threshold 11% of the time, which was nearly nine times more often than other Medicare pharmacies. Therefore, UnitedHealth delivered an average of $142 worth of excess medication per patient, while Humana followed with $93.

However, it’s important to remember that Medicare relaxed its early-refill limits during the COVID-19 pandemic, which contributed to higher refill volumes during that time. Since those emergency rules ended in 2023, both UnitedHealth and Humana say they have tightened controls. UnitedHealth said it rejected up to five times more early refills in 2024 than in 2021 and 2022, while Humana said its current approach allows timely access to medication without encouraging unnecessary stockpiling.

Which Stock Is the Better Buy?

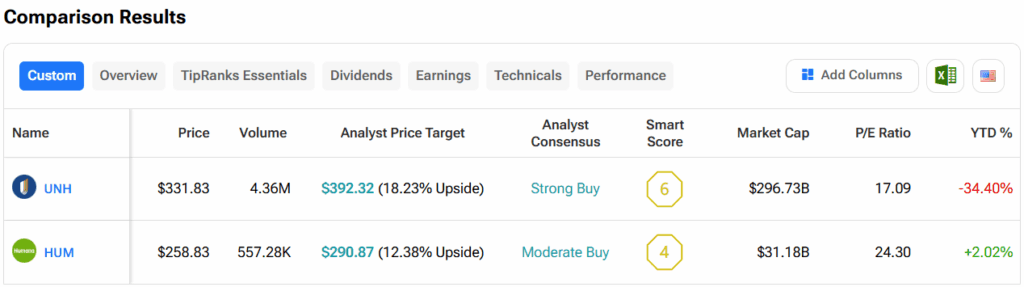

Turning to Wall Street, out of the two stocks mentioned above, analysts think that UNH stock has more room to run than HUM. In fact, UNH’s price target of $392.32 per share implies 18.2% upside versus HUM’s 12.4%.