Shares of United Natural Foods (NYSE: UNFI) were down 4.3% on March 10, after the natural and organic food company reported mixed fiscal Q2 results. Revenues topped estimates, but did not lead to a bottom-line beat due to higher operating expenses.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Mixed Q2 Results

During the Q4 quarter, United Natural Foods’ revenues totaled $7.4 billion, up 7.5% year-over-year. It easily outperformed the $7.15 billion average predictions.

Despite strong revenue numbers, the company posted adjusted earnings of $1.13 per share, which declined 9.6% year-over-year and fell a cent short of analysts’ expectations of $1.14 per share. The company reported earnings of $1.25 per share for the prior-year period.

FY2022 Outlook

Based on continued growth in net sales from both existing and new customers, the company raised its revenue guidance for fiscal 2022, while the earnings outlook remained unchanged. The revenue guidance was driven by inflation and unit volume growth.

Fiscal 2022 revenues are now forecast to be in the range of $28.2 billion to $28.7 billion, higher than the prior outlook of $27.8 billion to $28.3 billion. The consensus estimate is pegged at $28.23 billion.

However, based on the potential ongoing operating environment volatility, the company continues to forecast adjusted earnings in the range of $3.90 to $4.20 per share, while the consensus estimate is pegged at $4.21 per share.

CEO Comments

Looking ahead, UNFI CEO, Sandy Douglas, commented, “We are optimistic toward the second half of the fiscal year as our Fuel the Future strategy continues to deliver real value and best positions our customers for success in today’s unpredictable environment.”

Wall Street’s Take

Following the Q2 results, BMO Capital analyst Kelly Bania decreased the price target on United Natural Foods to $45 (25.59% upside potential) from $50 and reiterated a Hold rating.

Highlighting the clearly higher inflation, Bania stated, “Continuing the top-line momentum, UNFI raised net sales guidance by $400MM, but did not flow through to adjusted EPS & EBITDA, suggesting the potential for increased operating expenses in the future.”

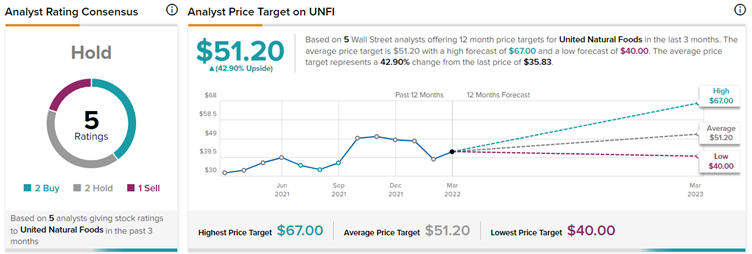

Consensus among analysts is a Hold based on 2 Buys, 2 Holds, and 1 Sell. The average United Natural Foods price target of $51.20 implies 42.9% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Diversey Holdings Shares Gain 15.3% on Q4 Earnings Beat & Outlook

ZIM Integrated Shipping Surges 6.3% on Stellar Q4 Beat & Dividends

Children’s Place Tanks 4.1% on Mixed Q4 Results & Uncertain Outlook