United Airlines (UAL) is set to release its first quarter 2025 financials on April 15. UAL stock has lost over 32% year-to-date, weighed down by tariff concerns and softening travel demand due to macro uncertainties. Wall Street analysts expect the company to report earnings of $0.74 per share, versus a loss of $0.15 in the year-ago quarter.

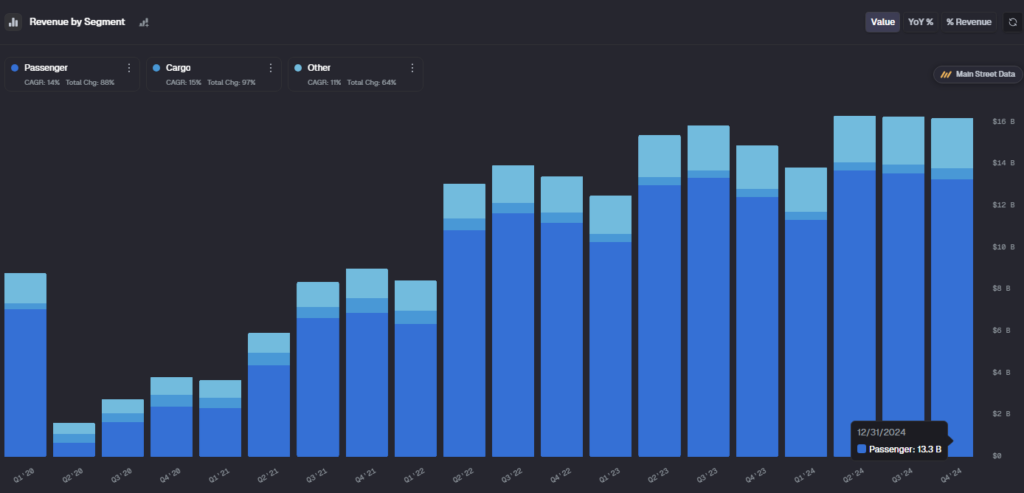

Meanwhile, revenues are expected to increase by about 6% from the year-ago quarter to $13.23 billion, according to data from the TipRanks Forecast page.

Also, UAL has a strong quarterly performance history. It has beaten earnings estimates for nine consecutive quarters. In the fourth quarter, passenger services drove nearly 90% of the company’s revenue, while cargo brought in about 4% and other sources contributed the remaining 6%, according to Main Street Data.

Analysts’ Views Ahead of UAL’s Q1 Earnings

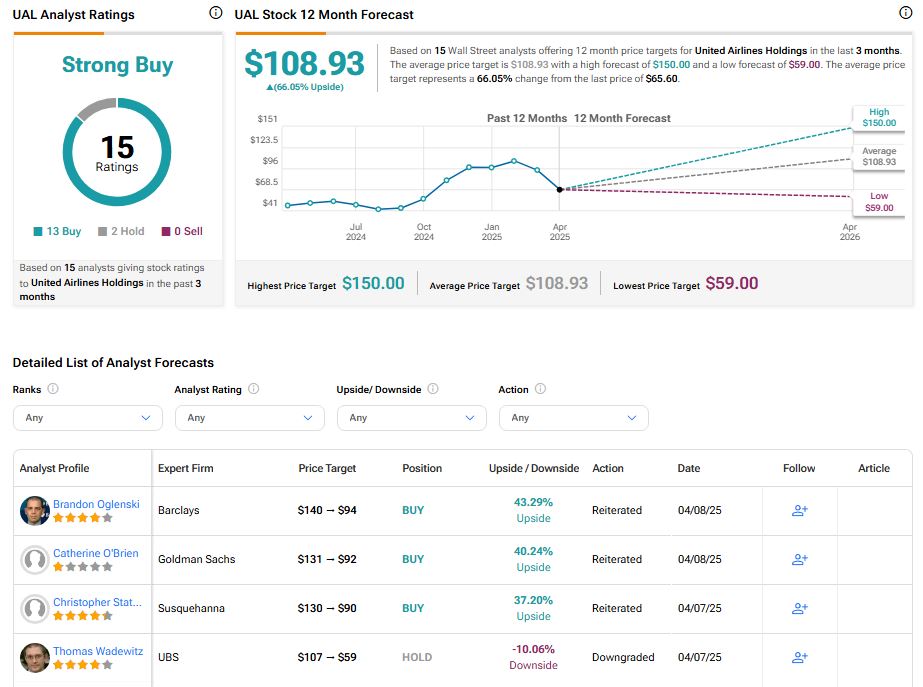

Ahead of United Airlines’ Q1 earnings, Goldman Sachs analyst Catherine O’Brien reduced the price target to $92 from $131 but still recommends buying the stock. She cites weaker demand due to increasing economic and global uncertainty and believes this trend could persist throughout 2025. Nevertheless, she sees the airlines’ quick capacity cuts as a positive move to better align with the reduced demand.

Also, Susquehanna analyst Christopher Stathoulopoulos lowered his price target for United Airlines to $90 from $130 but maintained a Buy rating on the stock. Given the uncertainty about demand, the firm reduced its financial forecasts for the airline sector in 2025 and 2026.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 13.4% move in either direction.

Is UAL Stock a Good Buy Right Now?

Turning to Wall Street, United Airlines Holdings stock has a Strong Buy consensus rating based on 13 Buys and two Holds assigned in the last three months. At $108.93, the average UAL price target implies 66.05% upside potential.