With $41 million in the bank, Uniswap (UNI-USD) heads into a crucial vote on a new fee mechanism that could shape its future. At the same time, the Uniswap Foundation has thrown down some unaudited financials, giving crypto’s biggest DEX some much needed support.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Financial Flex and Fee Vote

The Uniswap Foundation recently revealed that they’re sitting on a hefty $41 million war chest, just as the community gears up to vote on a new fee mechanism. It’s a move to build trust and show they have the funds to back whatever direction the hodlers take.

The vote on the new fee mechanism is a big deal. If it passes, it could significantly impact how Uniswap operates and makes money. The proposed fee mechanism’s purpose is to ensure the protocol’s financial sustainability, keeping Uniswap a major player in the DeFi space.

This isn’t just a routine vote—it’s a critical moment that could shape Uniswap’s future. With a $41 million bankroll at their disposal, the foundation is ready to support and implement the necessary changes.

Community Reaction and Market Moves

The community’s reaction to Uniswap’s financial reveal and the upcoming vote has been a mix of excitement and cautious optimism. Transparency is always a good look, and that $41 million bankroll gives everyone confidence that Uniswap can handle whatever comes next.

Analysts are watching this vote like hawks. The outcome could set the tone for other DeFi platforms considering similar moves. Uniswap’s ability to maintain and grow its financial resources while navigating regulatory and operational hurdles will be key to indicating its long-term success.

Is Uniswap a Buy?

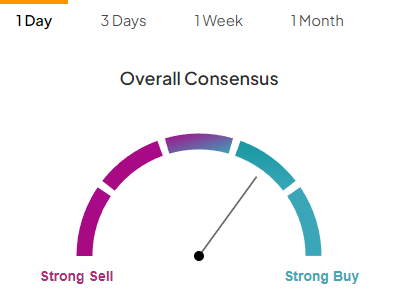

According to TipRanks’ Summary of Technical Indicators, Uniswap is a Buy.

Don’t let crypto give you a run for your money. Track coin prices here.