Shares of UnitedHealth (UNH) declined in pre-market trading after the healthcare company reported mixed Q4 results. UnitedHealth’s latest results come after the tragic death of Brian Thompson, CEO of the company’s insurance unit, last month.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A key concern for investors when it comes to UNH’s results was the company’s annual medical cost ratio, which climbed to 85.5% in 2024, up from 83.2% in 2023. This figure exceeded analysts’ expectations of 84.96% and sits well above the industry’s ideal target of around 80%. This persistent increase highlights the ongoing challenges insurers face amid surging medical costs. Annual medical cost ratio is the percentage of premiums spent on medical care and is calculated by dividing total medical expenses paid by an insurer by the total insurance premiums collected by the insurer.

Why Are Medical Expenses Rising for Health Insurers?

The healthcare industry has struggled with elevated costs for nearly two years, largely driven by high demand for services under government-backed Medicare plans catering to older adults. As the industry bellwether, UnitedHealth has felt the brunt of these pressures, navigating multiple headwinds throughout 2024. These challenges included a significant cyberattack on its technology division, which disrupted operations, and the unrelenting rise in medical expenses.

UNH Announces Mixed Q4 Results

The company’s adjusted earnings increased by 10.5% year-over-year to $6.81 per share, above consensus estimates of $6.73 per share. Furthermore, the company’s revenues increased by 6.75% to $100.8 billion in the fourth quarter. This was below Street estimates of $101.6 billion.

UNH Reiterates FY25 Guidance

Looking ahead, the company expects adjusted earnings in the range of $29.50 to $30.00 per share in FY25 while revenues are likely to be between $450 and $455 billion. For reference, analysts were expecting the company to report earnings of $29.86 per share on revenues of $455.6 billion.

Is UNH a Good Buy Right Now?

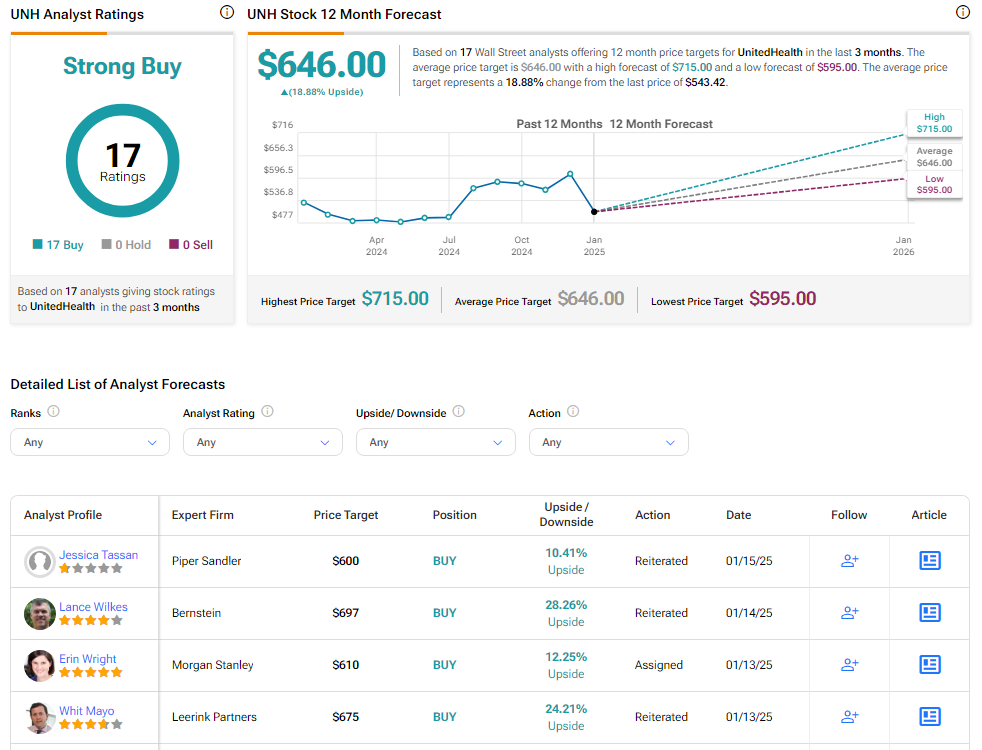

Analysts remain bullish about UNH stock, with a Strong Buy consensus rating based on a unanimous 17 Buys. Over the past year, UNH has increased by more than 6%, and the average UNH price target of $646 implies an upside potential of 18.8% from current levels. These analyst ratings are likely to change following UNH’s results today.