UnitedHealth Group (NYSE:UNH) shares are ticking lower in the early trading session today after the healthcare major posted better-than-anticipated second-quarter results, but its performance pointed to the continued overhang of the recent cyberattack on its subsidiary, Change Healthcare.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

UNH’s Q2 Numbers

During the quarter, UNH’s revenue increased by 6.5% year-over-year to $98.9 billion, outpacing expectations by $170 million. Similarly, EPS of $6.80 fared better than estimates by $0.14. The gains in the company’s top line were led by performance at its Optum business.

Change Cyberattack Overhang

Still, this performance included an impact of $0.92 per share on UNH’s bottom line from the Change Healthcare cyberattack. So far, UNH has provided advance funding and interest-free loans to the tune of over $9 billion to support care providers impacted by the cyber incident. Additionally, it has managed to restore the majority of affected services at Change.

For the full year, UNH expects an impact of $1.90 to $2.05 per share on its bottom line from the cyberattack. Furthermore, the company plans to sell its remaining operations in South America. It has already completed the divestment of its Brazilian operations.

On the operations front, UNH’s second-quarter performance was marked by growth at its UnitedHealthcare and Optum units. Its medical care ratio during this period increased to 85.1% from 83.2% a year ago primarily due to reductions in Medicare funding and the cyberattack impact. Still, a focus on cost efficiency helped UNH improve its operating cost ratio to 13.3% from 14.9% a year ago.

UNH’s Full Year Outlook

Despite this performance, an unimpressive outlook by UNH is weighing on investor sentiment in the stock today. To be fair, UNH kept its outlook for the year unchanged with an estimated EPS of $27.50 to $28. Investors, though, were looking for a hike in the metric.

What Is the Price Target for UNH Stock?

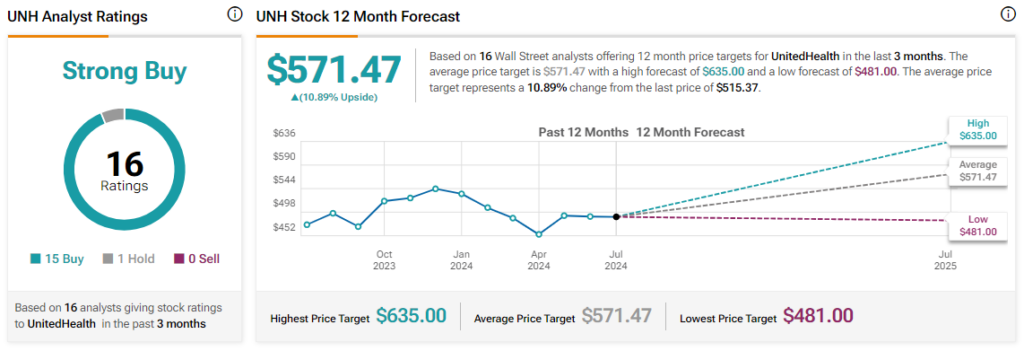

Overall, the Street has a Strong Buy consensus rating on the stock, alongside an average UNH price target of $571.47. However, analysts’ views on the company could see a revision following today’s earnings report.

Read full Disclosure