Under Armour (UAA) has seen a surge in shares following better-than-expected earnings for Q2 and a revised outlook for its 2025 financial year. Despite this, overall revenue and profit continue to decline year-over-year as it faces challenges across product categories. Yet, with cost-cutting measures boosting margins and operating income, the company strives to engineer a turnaround. Recent changes have been initiated under the guidance of returning Founder/CEO Kevin Plank, including inventory reductions and fewer store and online discounts.

Early results look promising, but the company’s financial fortunes still need to be turned around. The shares trade at a relative discount, making them intriguing prospects for contrarian value-oriented investors.

Under Armour Progresses with Restructuring

Under Armour specializes in performance apparel, footwear, and accessories and caters to a wide demographic of men, women, and youth. The company’s product range spans various types of apparel, footwear designed for different sports and outdoor activities, and accessories like gloves, bags, headwear, and socks.

Under Armour has been focused on improving results since the return of its founder, Kevin Plank, as chief executive. In May 2024, the company announced a restructuring plan aimed at enhancing the company’s financial and operational efficiencies. In September, it announced additional restructuring actions, primarily involving its decision to exit a distribution facility in Rialto, California. These actions have enlarged the restructuring plan’s scope to between $140 million and $160 million, with up to $75 million expected to be cash-related charges and up to $85 million predicted non-cash charges.

As of the second fiscal quarter of 2025, the company has recognized $28 million in restructuring and impairment charges and $11 million in related transformational expenses under the plan. The total amount incurred so far stands at $40 million, with $36 million being cash-related and $4 million non-cash-related. The remaining charges under the revised restructuring plan will occur during Fiscal 2025 and 2026.

Under Armour’s Recent Financial Results

The company recently announced results for Q2 2025. Revenue of $1.4 billion exceeded analysts’ expectations by $20 million. However, it marked a year-over-year decline in both domestic and international revenues. Domestic revenue fell 13% to $863 million, and worldwide revenue dropped 6% to $538 million. Further, the company’s wholesale revenue decreased by 12%, down to $826 million, and direct-to-consumer revenue fell by 8% to $550 million. Revenue from owned and operated stores remained constant, while e-commerce revenue, which composed 30% of the total direct-to-consumer business, dropped by 21%. Revenue from apparel and footwear decreased by 12% and 11%, respectively, while accessories revenue rose by 2%.

Regarding expenses, the cost margin increased by 200 basis points to 49.8% due to lower product and freight costs, less discounting in direct-to-consumer business, and a favorable channel mix. Selling and general and administrative expenses fell by 15% to $520 million. Non-GAAP earnings per share (EPS) of $0.30 surpassed consensus expectations by $0.11.

Management has issued guidance for Fiscal 2025, projecting a low double-digit percentage decline in revenue, with a 14% to 16% decrease expected in North America due to the business reset and a minor drop in its international business. However, the gross margin is anticipated to surge by 125 to 150 basis points due to lower promotional activities in its direct-to-consumer business. The expected operating loss is $176 to $196 million, an improvement from the previously expected $220 to $240 million, while the adjusted operating income is predicted to be $165 to $185 million. A diluted loss per share between $0.48 and $0.51 is anticipated.

What Is the Price Target for UAA Stock?

After several years of decline, the stock has rebounded over 40% in the past 90 days. It trades at the high end of its 52-week price range of $6.17 – $9.50 and shows ongoing positive price momentum as it trades above the 20-day (8.94) and 50-day (8.53) moving averages. Its P/S ratio of 0.86x suggests the stock trades at a relative value to the Apparel Manufacturing industry with its average P/S ratio of 1.05x.

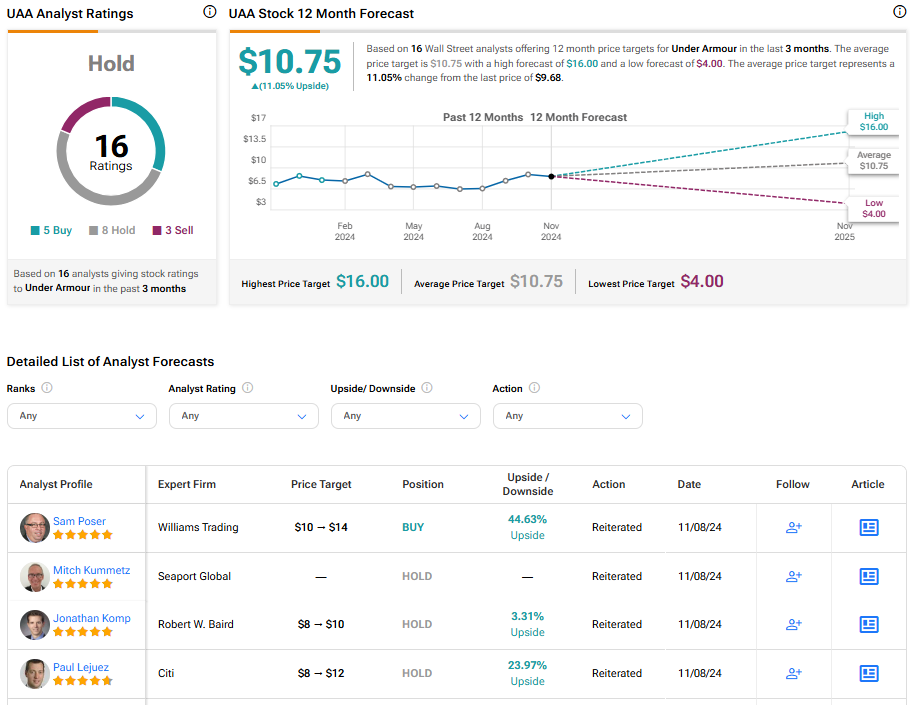

Analysts following the company have taken a cautious approach to UAA stock, though recent exceptional Q2 earnings have caused many to revisit their price targets. Based on 16 analysts’ most recent recommendations, Under Armour is rated a Hold overall. The average price target for UAA stock is $10.75, representing a potential upside of 11.05% from current levels.

Final Analysis of UAA

Under Armour has been navigating a challenging financial landscape, but recent measures have begun to turn the tide toward improvement. Q2 2025 saw better-than-expected earnings and a revised outlook for the fiscal year, yet revenue and profit continue to experience a downward trend. Recently, company shares experienced a surge, and analysts predict further potential growth on the horizon. With the stock trading at a discount, it may be an appealing target for value-oriented investors interested in turnaround opportunities.