Under Armour (UAA) continues its turnaround journey, recently reporting Fiscal Q3 results that exceeded estimates, as the quarterly gross margins increased significantly and revenue surpassed analysts’ expectations. The company has embraced a strategy to bolster its brand, enhance marketplace discipline, and shift towards a category-led operating model to strengthen its position further. The updated Fiscal 2025 outlook predicts a revenue decline, in part due to softer trends in the APAC region, which have caused Wall Street analysts’ price targets on the shares to be lowered.

The stock has dropped 13.85% in the past week, further pushing it into value territory. Investors looking to play the turnaround might want to wait for a turn in the stock’s negative price momentum before entertaining a position.

Turnaround Strategy Making Progress

Under Armour is a global provider of athletic apparel, footwear, and accessories. Its customer base is wide-ranging, including professional athletes, amateur sports enthusiasts, sponsored college and professional teams, and individuals who lead active lifestyles.

Since founder Kevin Plank returned to the company as CEO in April, the company has been transitioning from a primarily product-focused model to a consumer-focused, category-managed model which allows greater understanding and servicing of athletes’ needs. This has been accompanied by a concerted effort to improve gross margins, driven partly by successful promotional measures and discounts in the eCommerce business. The company is implementing initiatives to reduce SKU counts by around 25% across all assortments, improving operational efficiency and focus.

Central to the company’s turnaround strategy is crafting intentional, disciplined marketplace management across regions. The focus on North America —the company’s most sizable and influential market— continues to be a priority. With a structured approach towards marketplace management and a more premium brand presentation, Under Armour aims to solidify its brand strength for the long term.

Despite the immediate impact on the topline due to fewer promotional days and shallower discounts, there have been positive signs of progress reflected in the growth of average unit retail and average order value. The changes in promotional strategies, alongside SKU reduction initiatives, have been making progress, as seen in the recent financial results.

Soft Forward Guidance

Under Armour surpassed top-line and bottom-line estimates for the third quarter of Fiscal 2025. Despite a 6.7% decrease year-over-year, revenue of $1.4 billion beat analysts’ forecasts by $60 million. North American and international revenue declined, while accessories revenue increased by 6%. Gross margin rose by 240 basis points to 47.5%, driven by decreased direct-to-consumer discounting, lower product and freight costs, and favorable foreign currency impacts. On the other hand, selling, general, and administrative costs increased by 6% to $638 million.

Operating income was $14 million after excluding impairment, restructuring, and transformation expenses. Adjusted operating income stood at $60 million, with net income at $1 million and adjusted net income at $35 million. Non-GAAP earnings per share (EPS) was $0.08, beating consensus estimates by $0.05.

As of the quarter’s end, there was no change in inventory, valued at $1.1 billion, and cash and cash equivalents were $727 million, with no borrowings under the company’s $1.1 billion revolving credit facility.

Management has given guidance for Fiscal 2025, projecting a revenue decline of approximately 10%. This includes a 12 to 13% decrease in North American sales and a mid-single-digit decline in international markets. However, the company projects the gross margin to continue improving by about 160 basis points, attributed to reduced direct-to-consumer discounting and lower product and freight expenses. The diluted loss per share is anticipated to be between $0.48 and $0.50, with adjusted diluted earnings per share expected in the range of $0.28 to $0.30. Lastly, capital expenditures are projected to be between $170 and $180 million.

Caution Warranted

The stock has continued its ongoing slide, shedding roughly 12.5% over the past year. It trades near the bottom of its 52-week price range of $6.17 – $11.89 and shows ongoing negative price momentum as it trades below major moving averages. The price decline has the stock trading at a relative value with a P/S ratio of 0.60x compared to the Consumer Discretionary sector average of 0.97x.

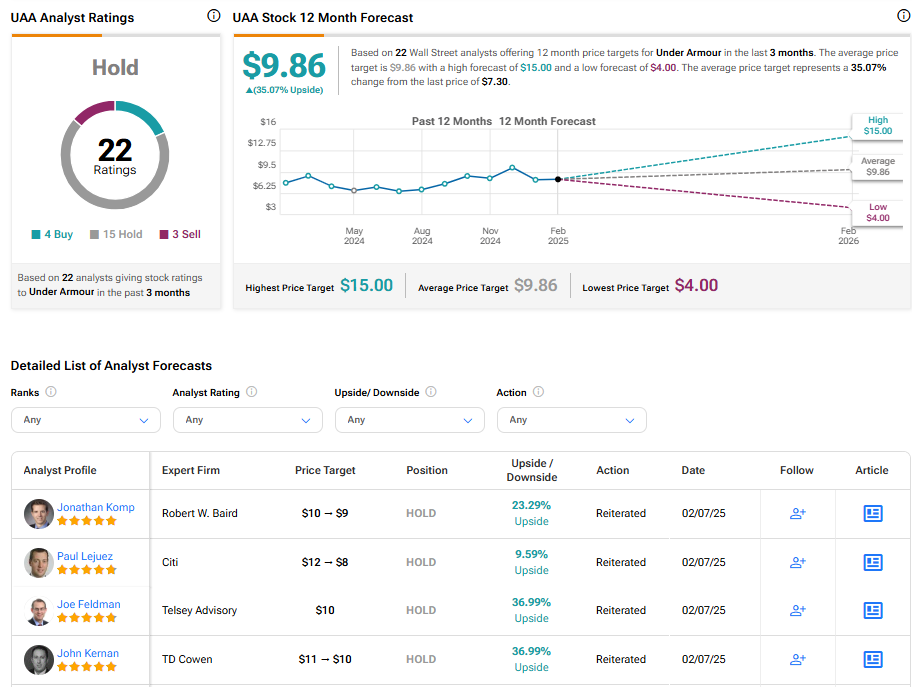

Analysts following the company have been cautious about UAA stock. For instance, Citi’s Paul Lejuez, a five-star analyst according to Tipranks’ ratings, recently lowered the price target on the shares to $8 (from $12) while keeping a Neutral rating, noting the turnaround for Under Armour is still unclear, with lower earnings upside potential on the immediate horizon.

Under Armour is rated a Hold overall, based on the recent recommendations of 22 analysts. The average price target for UAA stock is $9.86, which represents a potential upside of 35.07% from current levels.

UAA Stock in Summary

Under Armour’s pursuit of a successful turnaround is well underway, as recent financial results confirm. With a focus on improving gross margins and shifting to a consumer-centric model, the company is fostering a more efficient and aligned brand. However, despite signs of progress, the company anticipates a near-term revenue decline, partly due to challenging trends in key markets. While potential value exists for those investors patiently awaiting a turnaround, caution is warranted because of the stock’s negative price momentum and lowered price targets.