Goldman Sachs (GS) has raised the likelihood of a U.S. recession in the next 12 months to 45%, up from 35% just days prior and 20% the previous week. Also, the firm revised its Q4 2025 GDP growth forecast downward to 0.5% from 1%. This rapid shift reflects growing concerns over the potential impact of President Trump’s proposed reciprocal tariffs.

GS cited tighter financial conditions, foreign consumer boycotts, and growing policy uncertainty as major concerns. These factors are expected to hurt capital spending.

Impact on Federal Reserve Policy

Goldman Sachs anticipates that the rising recession risk will prompt the Federal Reserve to implement “insurance cuts” to interest rates. GS currently forecasts three consecutive 25 basis point cuts, beginning in June, bringing the federal funds rate down to 3.5% to 3.75%.

However, in a recession scenario, the bank expects the Fed to aggressively cut rates by nearly 2% over the next year to mitigate the economic downturn.

It must be noted that Fed Chair Jerome Powell on Friday noted that the proposed tariffs were larger than anticipated. He warned they could lead to higher inflation and slower economic growth.

Moreover, Powell said that the central bank is taking a cautious approach and will wait for more clarity on the effects of Trump’s policies before making any changes to interest rates.

JPM Sees 60% Chances of Recession

Last week, JPMorgan (JPM) also raised its U.S. recession probability to 60%, up from 40%, citing the economic risks posed by new tariffs. These tariffs, along with potential retaliatory measures from other nations, are expected to slow business activity, increase costs, and weaken consumer spending.

Overall, JPM warns this could lead to a contraction in economic growth, raising global recession fears.

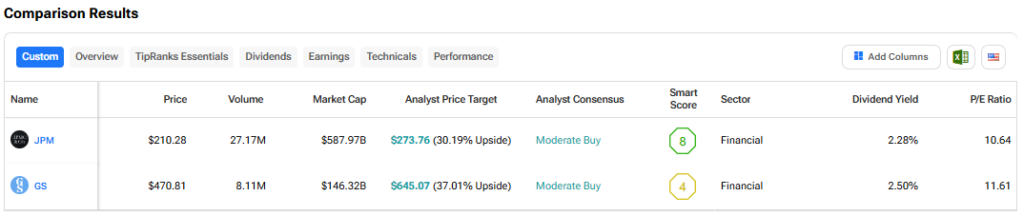

Which is better, JPM or Goldman Sachs?

According to the TipRanks Stock Comparison tool, both JPM and GS stocks have a Moderate Buy consensus rating. Also, the analysts see an upside potential of over 30% in both stocks.