UK-based Hargreaves Lansdown PLC (GB:HL) today accepted its $6.9 billion (£5.4 billion) takeover by a private equity consortium, marking its exit from the London Stock Exchange. The consortium includes CVC Capital Partners, Nordic Capital, and Abu Dhabi’s sovereign wealth fund. Hargreaves shares gained 2.27% as of writing.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Hargreaves Lansdown is a renowned financial services firm known for its industry-leading investment platform.

More About HL’s Takeover

The consortium has offered £11.40 per share in cash to Hargreaves shareholders, representing a 54.1% premium over the company’s closing price on April 11, the last day before it was initially approached. The offer price includes a dividend of 30p per share for FY24.

The takeover agreement also provides an option for shareholders who wish to remain invested in Hargreaves Lansdown to transfer their shares to the private company.

HL rejected a buyout offer from the consortium of 985p per share in May, stating that it undervalued the company. Nonetheless, the company’s board views the latest offer as a compelling opportunity for shareholders and plans to unanimously recommend that they vote in its favour.

Analysts at Jefferies acknowledged the offer’s significant premium but also think that the company could achieve a higher value over the medium term.

Hargreaves Lansdown’s 2024 Results

The takeover news came along with Hargreaves Lansdown’s full-year results for FY24. Hargreaves Lansdown’s AUA (assets under administration) hit a record £155.3 billion, marking a 16% year-over-year growth. Annual revenue for FY24 increased 4% to £764.9 million, exceeding expectations of £755.4 million.

The results were driven by increased clients, higher share dealing volumes, and favourable market movement. In the fourth quarter, the company’s net new clients grew by 85% year-over-year to 24,000.

The company also announced a final dividend of 43.2p per share, up from last year’s payment of 41.5p.

Is Hargreaves Lansdown a Good Buy?

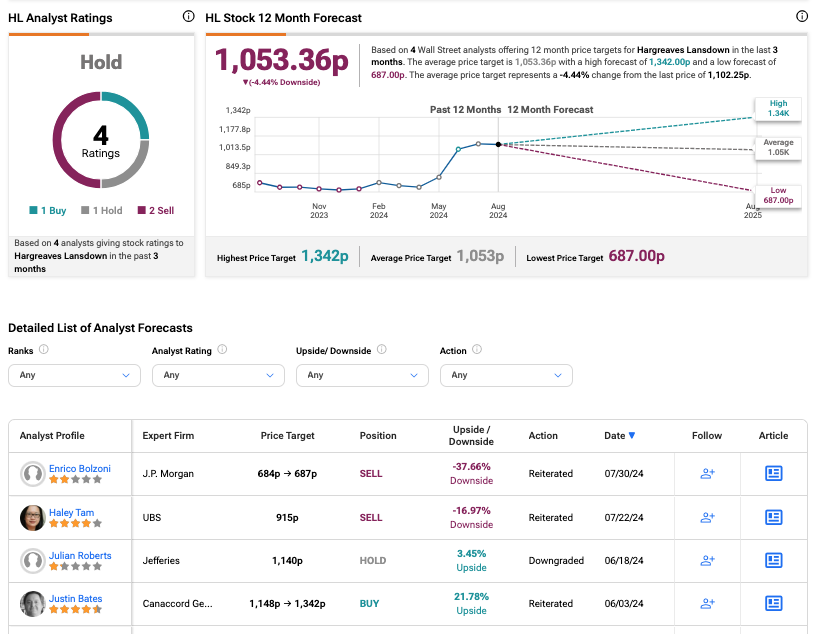

HL stock has been rated a Hold based on two Sell, one Buy, and one Hold recommendation. The Hargreaves Lansdown share price forecast is 1,053.36p, which is 4.4% lower than the current price level.