UiPath (PATH) is set to release its second quarter Fiscal 2025 financials on September 5. Wall Street analysts expect the company to report earnings of $0.03 per share for Q2, down 66% year-over-year. However, analysts expect revenues to increase 9% from the year-ago figure to $303.69 million, according to TipRanks’ data.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

UiPath is a technology company that offers robotic process automation (RPA) solutions and AI-powered enterprise automation technology.

It’s important to highlight that the company has surpassed the consensus EPS estimates in each of the past nine quarters.

Key Takeaways from TipRanks’ Bulls & Bears Tool

Analysts predict earnings will decline even as revenues are expected to increase, contributing to a mixed outlook on the company’s performance.

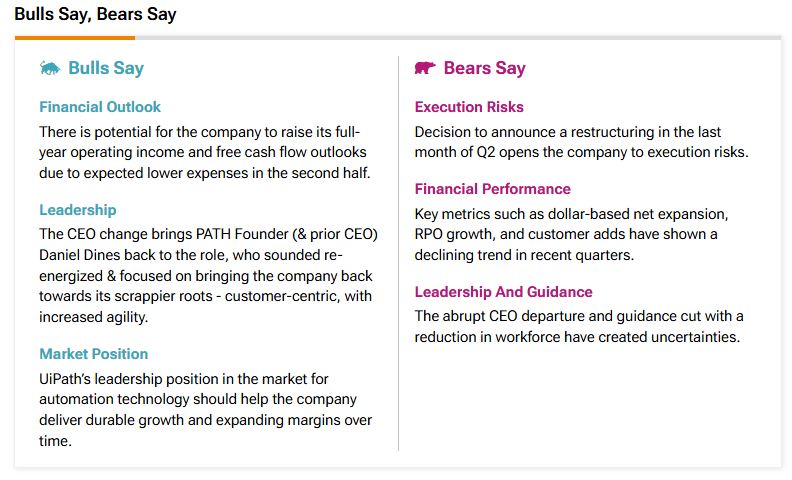

In light of this, according to TipRanks’ Bulls Say, Bears Say tool, analysts expect UiPath to raise its full-year forecasts due to lower anticipated expenses in the second half of the year. The return of founder Daniel Dines is expected to realign the company’s strategy and operations to be more customer-centric. Also, analysts believe that UiPath’s strong position in automation technology should drive continued growth and expanding margins.

Meanwhile, bears are concerned about potential execution risks following the recent restructuring announcement and declining key financial metrics, such as dollar-based net expansion and customer additions. Additionally, the abrupt CEO departure, coupled with a guidance cut, has raised uncertainties about the company’s future.

Options Traders Anticipate a Large Move

Using TipRanks’ Options tool, we can see what options traders are anticipating from the stock immediately after its earnings report. Indeed, the at-the-money straddle suggests that options traders expect a 15.09% price move in either direction. This estimate is derived from the $10 strike price, with call options priced at $3 and put options at $0.10.

Is PATH a Good Stock to Buy?

Turning to Wall Street, analysts have a Hold consensus rating on PATH stock based on eight Holds assigned in the past three months, as indicated by the graphic below. After a 49% year-to-date decline, the average UiPath price target of $14.33 per share implies 13.82% upside potential.