Shares of Swiss investment bank UBS (NYSE:UBS) tanked after it reported a net loss per share of $0.09 for the fourth quarter. The figure missed the street’s expectations by a wide margin of $0.20. However, revenue of $10.86 billion fared better than estimates by $100 million. The company also plans to reinstate share repurchases in H2 2024.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

UBS has added nearly $77 billion in net new assets since it acquired Credit Suisse. The company is now focusing on restructuring and optimizing the combined businesses. Sergio Ermotti, the CEO of UBS, expects the enhanced scale and capabilities to drive long-term growth and higher returns for the company. UBS has achieved nearly $4 billion in cost savings for the combined business and expects to reach about $13 billion in cumulative cost savings by the end of 2026.

However, its Q4 performance was marked by lower client activity and billable invested assets. Additionally, the company incurred losses to the tune of $508 million from its investment in SIX Group (The operator of Switzerland’s main stock exchange). The company’s board plans to propose a dividend of $0.70 per share at its annual meeting on April 24. If approved, the UBS dividend will be payable on May 3 to investors of record on May 2.

Looking ahead, UBS aims to reach an underlying return on CET1 (Common Equity Tier) capital of 15% and a cost/income ratio of less than 70% by 2026. The firm’s goal is to deliver a return on CET1 capital of 18% in 2028. It expects the merger with Credit Suisse to close by the end of the second quarter. Following this closure, UBS plans to repurchase shares worth up to $1 billion in 2024.

Is UBS a Good Stock to Buy?

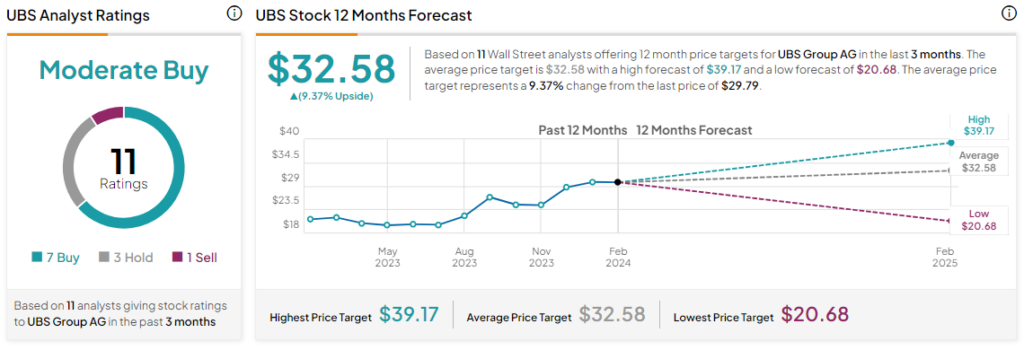

Despite these ambitions, the combination of Credit Suisse merger overhang and another quarterly loss is weighing on the company’s share price today. Overall, the Street has a Moderate Buy consensus rating on UBS Group, and the average UBS price target of $32.58 points to a modest 9.4% potential upside in the stock.

Read full Disclosure