UBS raised its price target on Tesla (TSLA) from $190 to $235 after the company launched its first robotaxi pilot in Austin, Texas. The bank maintained its Sell rating, saying the stock’s current valuation already reflects high investor expectations for autonomy and future technologies. UBS views the robotaxi market as a significant long-term opportunity if Tesla can deliver on its technology, secure regulatory approvals, and scale production.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Cautious Approach Despite a Huge Market

UBS estimates a potential fleet of 2.3 million robotaxis by 2040, generating about $200 billion in annual revenue. It values the robotaxi business alone at $99 per share. That number is now baked into its new model for Tesla. Still, the bank is cautious. It believes the stock remains fully valued even after factoring in the upside from robotaxis and humanoid robots.

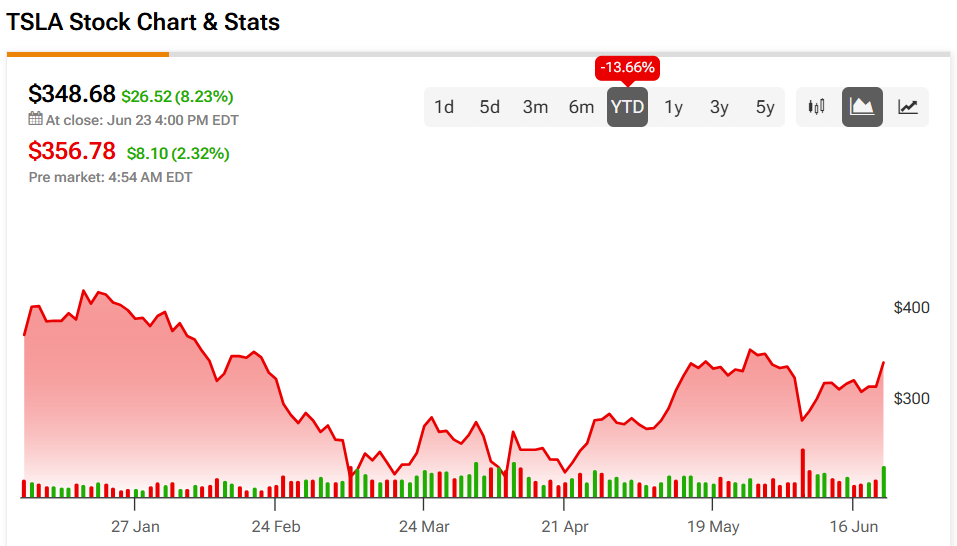

Elon Musk has described autonomy and robotics as key drivers of Tesla’s future. UBS agrees, but highlights significant execution risks. It also notes that Tesla’s valuation already prices in much of this growth. At a $1.14 trillion market cap and a P/E ratio of 181, the stock leaves little room for error.

While investor sentiment has turned bullish on Tesla’s AI and autonomous bets, UBS is taking a more reserved view. They are examining the fundamentals, regulatory hurdles, and the time required to realize the potential of these ventures fully.

In short, UBS sees long-term promise but is not convinced it justifies the current stock price. The firm is urging investors to remain grounded, even as Tesla makes headlines with key moves in autonomy.

Is Tesla Stock a Buy, Sell, or Hold?

On the Street, Tesla boasts a Hold position, based on 35 analysts’ ratings. The average TSLA stock price target is $287, implying a 17.69% downside.