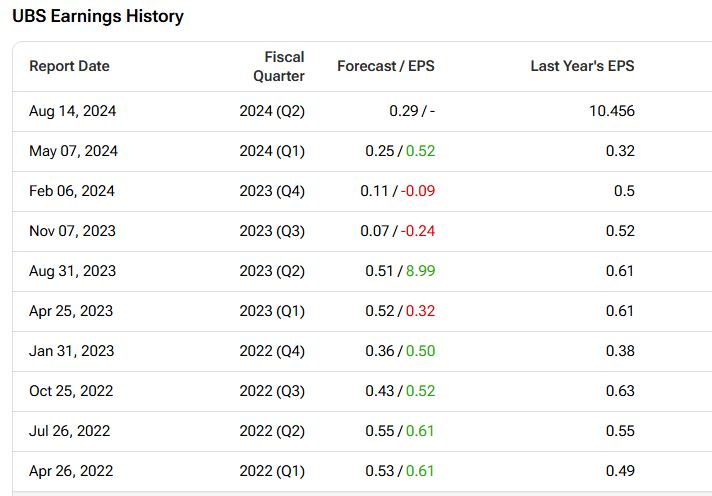

UBS Group (UBS) is set to announce its Q2 results on August 14. Wall Street analysts expect the company to report earnings of $0.29 per share for Q2 2024, down from $8.9 per share in the year-ago quarter. Meanwhile, analysts expect revenues of $11.23 billion, down 32% year-over-year, according to TipRanks’ data.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

UBS Group is a global investment bank and financial services firm.

Interestingly, UBS Group has a decent earnings surprise history. The company exceeded earnings estimates in six out of the previous nine quarters.

Key Takeaways from TipRanks’ Bulls & Bears Tool

According to TipRanks’ Bulls Say, Bears Say tool pictured below, bulls are positive on UBS because it has reduced its risk-weighted assets (RWA) by $20 billion, reflecting the company’s capital efficiency. Plus, they are positive about the company’s financial performance as the core profits are set to rise by $7 billion following the Credit Suisse acquisition.

Meanwhile, bears are cautious about UBS due to regulatory risks, ongoing political uncertainty over capital requirements, and high operational risks from significant risk-weighted Assets.

Options Traders Anticipate a 6.59% Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 6.59% move in either direction.

Is UBS a Good Stock to Buy Now?

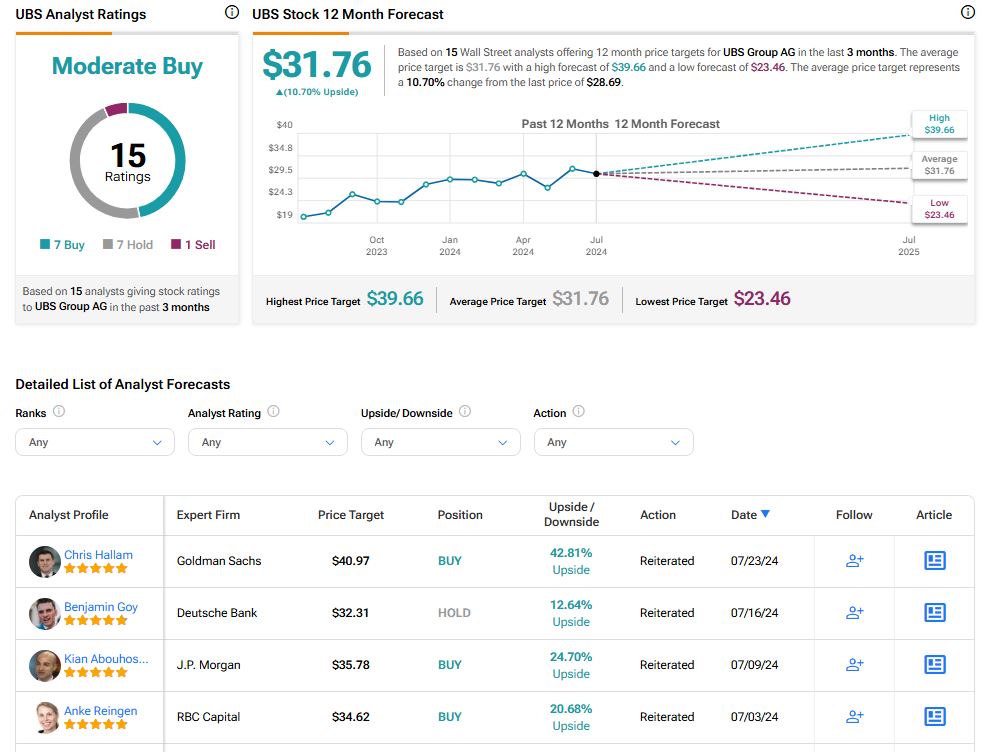

Turning to Wall Street, analysts have a Moderate Buy consensus rating on UBS stock based on seven Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 5% loss in its share price over the past year, the average UBS price target of $31.76 per share implies a 10.7% upside potential.