UBS Group (UBS) has applied for a U.S. national banking license, marking a step toward expanding its reach across the country. The approval would let the Swiss lender offer checking and savings accounts, along with mortgages, to its wealthy clients nationwide. UBS submitted the application to the Office of the Comptroller of the Currency through UBS Bank USA earlier this week. The timing is notable, as UBS is set to release its Q3 earnings report tomorrow, Wednesday, Oct. 29, and may share updates on the plan.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Currently, UBS Bank USA operates under a Utah state charter and is supervised by the Federal Deposit Insurance Corporation. This structure limits where the bank can provide full-service offerings. By gaining a national license, UBS could serve clients in all states and handle more of their everyday banking needs within its own network.

In an internal note, Rob Karofsky, President of UBS Americas, and Michael Camacho, Head of UBS Global Wealth Management US, said the move will give clients more choice and convenience. They also emphasized that there will be no immediate changes to how financial advisors offer banking or lending services.

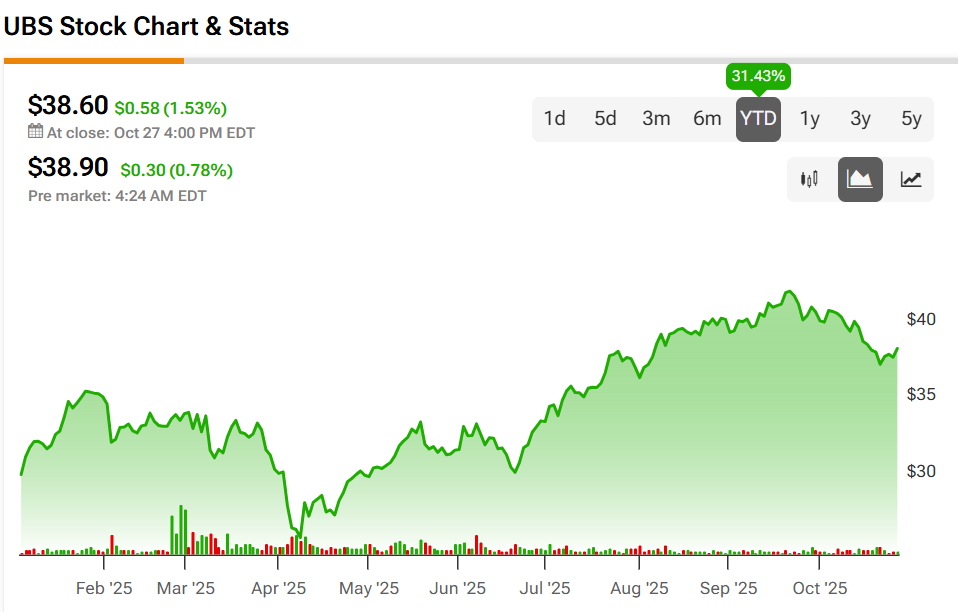

Meanwhile, UBS shares rose 1.53% on Monday, closing at $38.60.

Building for Growth

The license request is part of a larger plan inside the company called “Build the Bank.” The project is meant to update UBS’s systems, add new products, and build stronger links between its banking and wealth services.

UBS has a large U.S. business but still trails rivals like Morgan Stanley (MS) and Bank of America (BAC) in wealth management profits. By expanding its banking reach, the firm hopes to improve returns and attract more deposits from wealthy clients who now use other banks for day-to-day accounts.

If the license wins approval, UBS would be the first Swiss bank to get a national charter in the U.S. The Office of the Comptroller of the Currency usually reviews such requests in two steps before granting full approval. Overall, the plan shows how UBS aims to deepen its roots in the U.S. market and make its banking and wealth management services easier for clients nationwide to access.

Is UBS Stock a Buy?

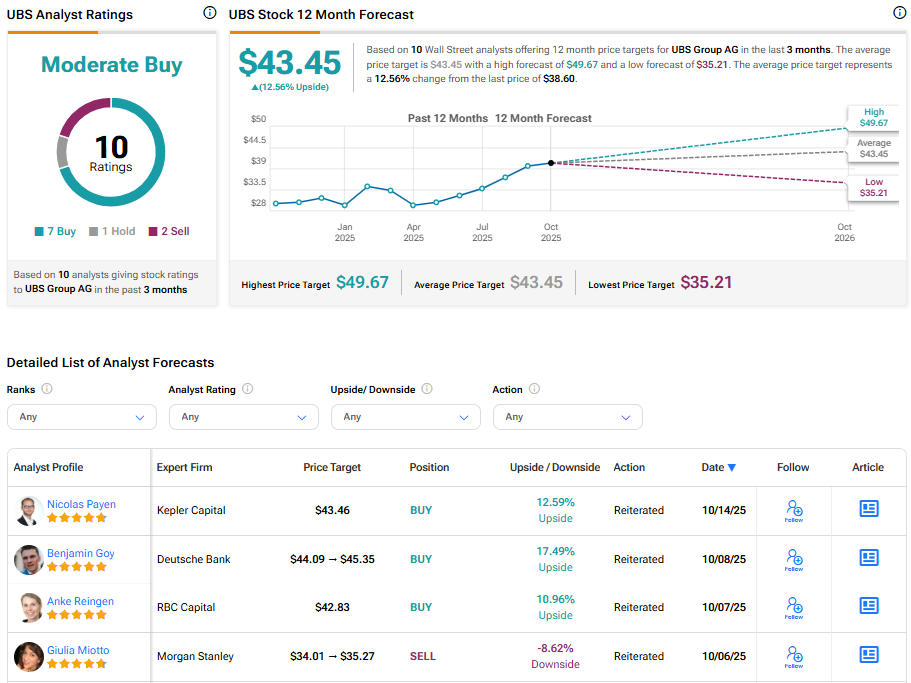

Among the Street’s analysts, UBS boasts a Moderate Buy consensus rating. The average UBS stock price target is $43.45, implying a 12.56% upside from the current price.