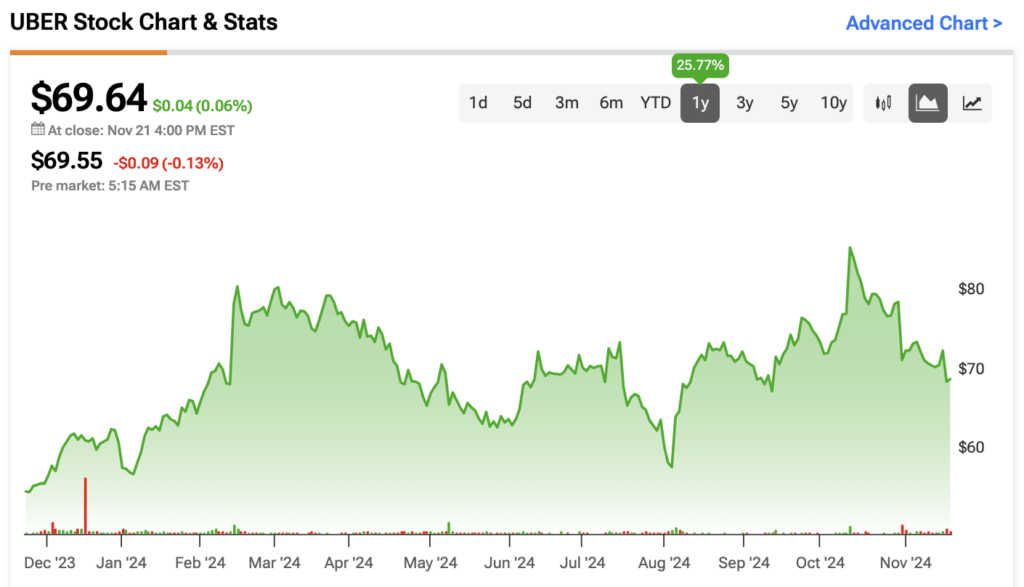

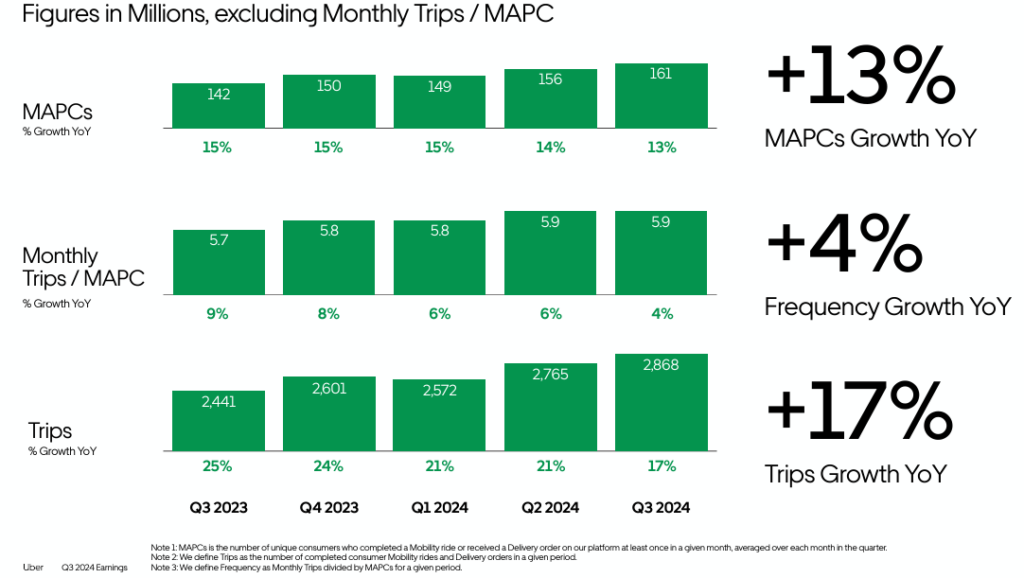

While market volatility and general uncertainty have recently pushed Uber Technologies (UBER) down 12% from its peaks, some exceptional growth metrics and strengthening financials paint a picture of a technology giant just hitting its stride. With 161 million monthly active consumers, a best-in-class interface, and rapidly improving profitability, I consider Uber’s current valuation to be a highly compelling entry point for long-term investors.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Uber’s Finances Have Never Been Stronger

I liked what I saw in the firm’s latest earnings call. The results tell a story of a company transitioning from growth-at-all-costs to sustainable profits. Revenue surged to $11.19 billion in Q3, but what I found truly impressive was the company’s bottom-line performance. Net income soared to $2.61 billion, a dramatic improvement from $221 million in the same quarter last year, demonstrating that the business model is now able to deliver profitability as well as growth.

From a look at the balance sheet, the company’s finances have never been stronger, with $9.06 billion in cash providing substantial reserves for future initiatives. While some may point to $12.66 billion in debt as a worry, an ability to generate $2.11 billion in free cash flow this quarter – more than double from recent periods – showcases the underlying strength and resilience of its business model.

Uber’s Core Segments Drive Revenue Growth

I’m seriously bullish about the trends I’m seeing across the company’s revenue streams, as well as the potential for new ones. As most would expect, mobility services remain Uber’s powerhouse, contributing 53% of revenue. The segment’s dominance in key markets has allowed for strategic pricing adjustments, even in the face of rising insurance costs and growing competition. Having this level of pricing power demonstrates the strength of the brand’s value, where many remain loyal to the platform even as cheaper alternatives emerge.

The Delivery business, accounting for a whopping 33% of revenue, continues to evolve beyond its pandemic-era takeaway boost. Rather than seeing a decline as in-person dining has returned, the segment has found new growth through retail partnerships and expanded offerings. The emerging Freight segment, while notably smaller at 14% of revenue, represents a significant opportunity in the logistics market. I see this as one of the key reasons to be excited about an investment. If the platform can use its reputation for convenience and reliability to embed itself in commercial logistics, the potential could be enormous.

Uber’s Membership Strategy Drives Customer Loyalty

Alongside strong fundamentals, I’m encouraged by the scale of innovation and improvements across the company’s products. Uber One, the company’s membership program, has emerged as a game-changer for customer retention. With over 25 million members—a 70% annual growth rate—the program has drastically transformed Uber’s relationship with its customers. Uber One now drives 35% of combined Mobility and Delivery gross bookings, creating a predictable revenue base that reduces business volatility. The market clearly values this newfound stability, especially given the nervousness investors felt during Uber’s unprofitable, cyclical-income phase.

The success of Uber One goes beyond numbers. Members demonstrate significantly higher engagement across multiple services, with average order frequency increasing by over 30% post-membership. This cross-platform usage helps shield Uber from segment-specific downturns and strengthens its competitive moat. By building an ecosystem of highly engaged users, I believe Uber has substantial potential to experiment with and introduce new services, moving closer to the ‘everything app’ concept many companies aspire to achieve.

Uber Leverages Partnerships to Drive Advertising and AV Growth

One of the most underappreciated aspects, in my view, is Uber’s rapidly growing advertising business, which achieved nearly 80% year-over-year growth. This high-margin revenue stream capitalizes on Uber’s massive user base and deep insights into consumer behavior, all without requiring significant additional investment. As a result, this business could become a valuable resource for forging future partnerships, especially as data becomes increasingly critical to understanding consumer needs.

Furthermore, management’s approach to autonomous vehicle (AV) technology reflects a similarly pragmatic strategy. Rather than burning cash on in-house development, Uber has established strategic partnerships that allow it to benefit from AV advancements while minimizing direct investment risks. This strategy enables the company to focus on network growth and customer experience while remaining at the forefront of transportation innovation.

Moreover, while competitors like Waymo have garnered attention with AV deployments in specific markets, such as San Francisco, I believe Uber’s scale and network effects provide a significant defensive edge. Its global presence and market leadership in most major cities create barriers to entry that even well-funded rivals will find challenging to overcome.

Is Uber a Buy, Sell or Hold?

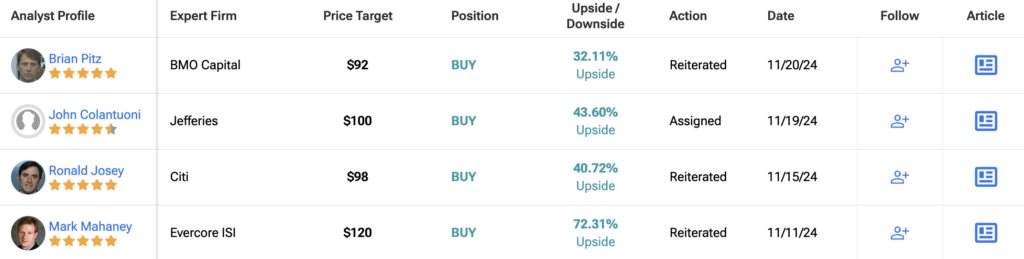

My conviction in Uber’s prospects is reflected in a remarkably consistent analyst outlook. With 34 Buy ratings and only 2 Hold ratings, the Strong Buy consensus suggests the recent stock price decline may present an opportunity. The average UBER price target of $93.26 implies nearly 34% upside, with some firms seeing even greater potential.

Recent analyst actions reinforce this optimistic stance. Jefferies maintains a $100 target, citing the current price as an attractive entry point for long-term investors. Evercore ISI’s street-high $120 target reflects confidence in Uber’s ability to expand margins while maintaining growth. Goldman Sachs’s recent target increase to $96 acknowledges improved execution and expanding market opportunities.

Uber Faces a Few Risks

While I’d say the investment case is compelling, several challenges in today’s constantly evolving technology sector still require attention. Insurance costs remain a significant factor for the business, though Uber has demonstrated the ability to manage this through pricing adjustments.

My key concern is the uncertainty brought on by the new Trump administration. With Elon Musk clearly playing a prominent role, many may suspect that companies working within the autonomous vehicle sector could be at an immediate disadvantage. With Tesla (TSLA) aggressively pushing ahead with self-driving technology and the newly launched “Robotaxi,” there could be difficulties ahead for Uber. However, I’d argue that the company’s scale, brand strength, and operational efficiency provide sufficient buffers against these headwinds.

Key Takeaway

I’m confident in Uber’s future because of its strong user growth, better profitability, and position as a leader in its market. The company’s ability to generate solid free cash flow while still growing shows that its business model is working and ready for the future. With its expanding market presence, successful membership program, and new revenue opportunities, Uber is well-positioned for long-term growth. Given everything the company has going for it, I believe the current stock price is a great entry point for investors looking to tap into its growth potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue