As the date of its second-quarter earnings approaches, ride-share giant Uber Technologies Inc. (UBER) is in a strong financial position. This is due to continued strong ride demand and the company’s rollout of multiple new offerings in the European market.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Uber’s recently launched stock buyback program, aided by a robust delivery booking, has also helped strengthen its financial bookings. This is despite challenges facing the restaurant industry and the delay in rival Tesla’s (TSLA) anticipated launch of the robotaxis.

Based on these considerations, analysts are strongly optimistic about Uber’s prospects, and I echo this sentiment. This is the case despite the fact that Uber shares have already been up 45.3% in the last year. Below, we break down in detail some of the reasons why UBER stock could continue its impressive rally.

Maintaining Ride Demand Amid European Expansion

Ubers’ latest services could attract new customers with its upcoming European service launches, which could tap into increasing tourism demand in the area. One is Uber Yacht, a boat service in Ibiza slated to accept pre-bookings starting July 26. Uber Boat will expand to Venice and parts of Greece after launching in Mykonos last year. Another new offering is Uber Bubbles, a champagne tour service in France.

These services capitalize on the rapidly growing European luxury tourism market, valued at an estimated $1.3 trillion in 2022 and forecasted to grow at a CAGR of 7.8% through 2032.

Uber’s core rideshare business is projected to post 26% year-over-year gains in gross for the second quarter of the year, driven by consistent strong demand. This performance is likely buoyed by favorable pricing trends in the quarter as well. Based on these and other factors, analysts have called for accelerating monthly average user growth, which will likely help drive further growth.

Stock Buyback and Delivery Bookings

In February, Uber announced its first-ever stock repurchase program, with plans to buy back up to $7 billion in common shares. Though the company did not provide a timeline for the program, analysts have estimated it could be completed in two years. This program has the potential to increase shareholder value.

Also key to Uber’s future plans is its food delivery segment, which is expected to post-delivery gross bookings growth of 17.5% year-over-year for the second quarter. This portion of Uber’s business faces both tailwinds and headwinds. On the one hand, Uber’s purchase of Taiwanese delivery service Food Panda for $950 million this year will likely consolidate its market share in that region. Still, weaker restaurant traffic in other parts of the world has the potential to dampen bookings as well.

Tesla Robotaxi Delay

Though Uber remains a leader in the rideshare space, competition is still fierce. Tesla’s long-awaited robotaxi service, which is expected to include a rideshare alternative provided by autonomous vehicles, could put a dent in Uber’s business.

However, in a boon for Uber, Tesla’s robotaxi unveiling, originally slated for August, has been delayed, with CEO Elon Musk saying the company needed more time to incorporate a design change, among other things. No date has been announced for the unveiling, but estimations are for an October presentation.

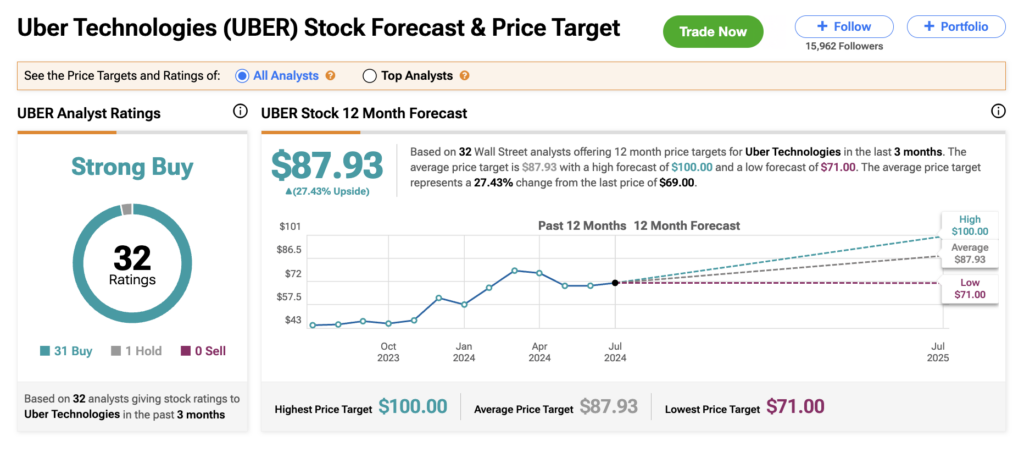

These factors illustrate why Wall Street analysts rate UBER shares as a strong buy. This rating is based on 31 Buy ratings, one Hold rating, and zero Sell Ratings. Analysts give UBER stock an average price target of $87.93, representing an upside potential of 27.6%.

Conclusion: Demand and New Offerings Could Fuel Growth

Even as an established leader in the rideshare space, Uber continues to enjoy growth opportunities. The company’s strong ride demand, the resilience of its food delivery service despite challenging conditions, and its new offerings rolling out in the luxury tourism space in Europe all demonstrate why many Wall Street analysts view it as a Buy.