U.S. ride-hailing company Uber (UBER) has announced a major expansion of its partnership with Chinese autonomous vehicle tech provider, WeRide (WRD). Over the next five years, the companies will roll out WeRide’s Robotaxi services in 15 new cities across Europe and other regions outside of China and the U.S. Importantly, the news comes ahead of UBER’s Q1 earnings report, due on May 7.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This expansion builds on Uber and WeRide’s existing partnership under which they launched robotaxi services in Abu Dhabi, with Dubai next in line. As part of the deal, WeRide will provide the self-driving technology, while Uber will integrate the service into its app and manage fleet operations.

Interestingly, this expanded partnership with WeRide strengthens Uber’s global autonomous strategy, given WeRide’s presence in 30 cities across 10 countries. Since WeRide holds test licenses in China, UAE, Singapore, France, and the U.S., Uber gains a regulatory advantage, making it easier to enter key markets.

Uber’s Autonomous Push

Uber has been actively expanding its presence in the autonomous vehicle space by teaming up with over 15 autonomous vehicle firms in the last two years. Some of its latest partners include May Mobility, Volkswagen (DE:VOW), and Momenta.

It is worth noting that Uber’s most prominent operational autonomous ride-hailing partnership in the U.S. is with Alphabet’s (GOOGL) Waymo. The companies currently offer a “Waymo on Uber” service in Austin, with plans to launch soon in Atlanta.

Analysts’ View Ahead of UBER’s Q1 Earnings

Ahead of Q1 results, analysts expect Uber to report earnings per share (EPS) of $0.51, against a loss of $0.32 in the prior-year quarter. Also, the company’s revenue is expected to increase 14.8% to $11.63 billion in the first quarter.

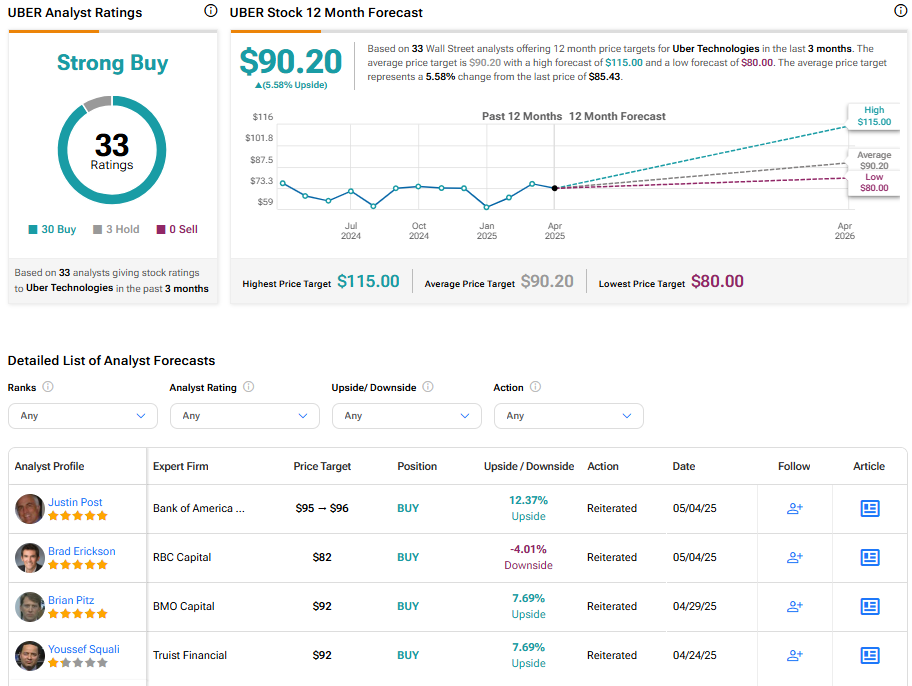

Also, two Top Wall Street analysts have reiterated a Buy rating on Uber stock ahead of the earnings. Among them, Bank of America Securities analyst Justin Post remains bullish due to Uber’s strong financial performance and favorable market conditions.

Despite Uber’s year-to-date stock surge, Post believes its valuation remains attractive compared to peers. Further, the five-star analyst said that Uber’s role in autonomous vehicles and its long-term growth potential make its future look promising.

Is UBER a Good Stock to Buy?

On TipRanks, UBER stock has a Strong Buy consensus rating based on 30 Buys and three Holds assigned in the last three months. The average Uber stock price target of $90.20 suggests an upside potential of 5.58% from its current price. Year-to-date, shares of the company have gained about 42%.