Ride-hailing company Uber (UBER) has been holding discussions about a possible acquisition of SpotHero, a parking app that lets drivers reserve and pay for parking in advance, according to The Information. Notably, SpotHero was founded in 2011 and has raised more than $110 million from investors, with its most recent valuation pegged at about $290 million, based on PitchBook data. Talks are still ongoing and could ultimately fall apart, and no potential purchase price has been disclosed.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nevertheless, if a deal were to happen, it could create natural synergies between parking and ride-hailing. Uber could offer drivers more services when they use their own cars, such as reserving parking, and then make it easier for them to switch to ride-hailing after parking. This would fit with Uber’s push to expand beyond rides, which already includes rental cars, ski lift tickets, high-speed trains, and its growing Uber Eats delivery business. At the same time, Uber faces rising competition from autonomous vehicle players like Waymo (GOOGL) and Tesla (TSLA), thereby making added services more strategically valuable.

Interestingly, SpotHero operates in more than 11,000 locations across over 400 cities in the U.S. and Canada. The company works with parking garages and lot owners by taking a share of customers’ parking fees. More importantly, CEO and cofounder Mark Lawrence has said that SpotHero is the largest player in its space and has survived while many competitors have faded. It has also built key partnerships, including integrations with Google Maps and Google Search since 2024 and Apple (AAPL) Maps since 2023.

Is UBER Stock a Good Buy?

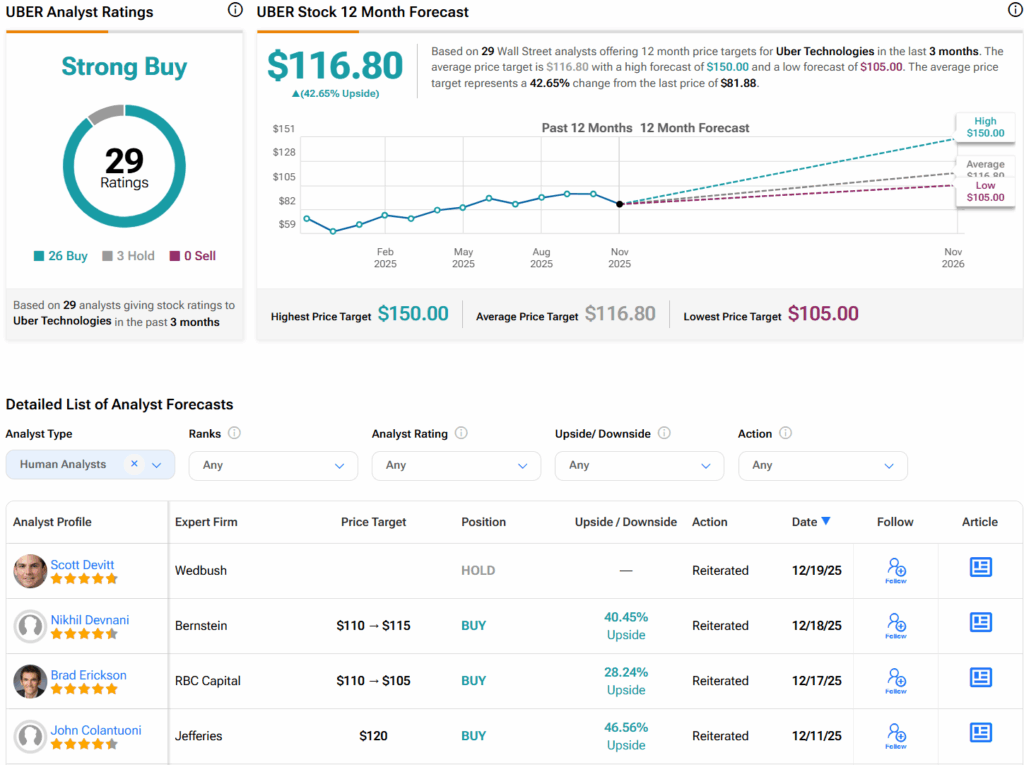

Turning to Wall Street, analysts have a Strong Buy consensus rating on UBER stock based on 26 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average UBER price target of $116.80 per share implies 42.7% upside potential.