Ride-hailing giant Uber Technologies (UBER) is considering a potential acquisition of Expedia (EXPE), a travel booking website with a market cap of nearly $20 billion. This would mark Uber’s largest deal to date. According to the Financial Times, Uber has sought advice from consultants regarding the possible bid. Following the report, UBER shares dropped around 3% in after-hours trading, while EXPE surged over 7%.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The feasibility and structure of the potential deal have been the primary topics of discussion with advisors, with particular attention given to the role of Uber CEO Dara Khosrowshahi. It is worth highlighting that Khosrowshahi is the former CEO of Expedia and currently serves as a non-executive director at EXPE. To ensure transparency and prevent any conflict of interest, Khosrowshahi would likely step back from any deal negotiations.

It’s also important to note that these discussions are still in the early stages, and Uber has not yet made a formal offer to Expedia.

Expedia Deal Could Bolster Uber’s Diversification Plans

Expedia’s acquisition would be a strategic move for Uber, advancing its efforts to expand into travel booking services. Expedia’s technology, large customer base, and strong foothold in the online travel market could support Uber’s goal of becoming a one-stop platform offering a variety of services beyond ride-hailing.

In recent years, Uber has broadened its scope, venturing into areas like train and flight booking, food delivery, corporate logistics, and advertising.

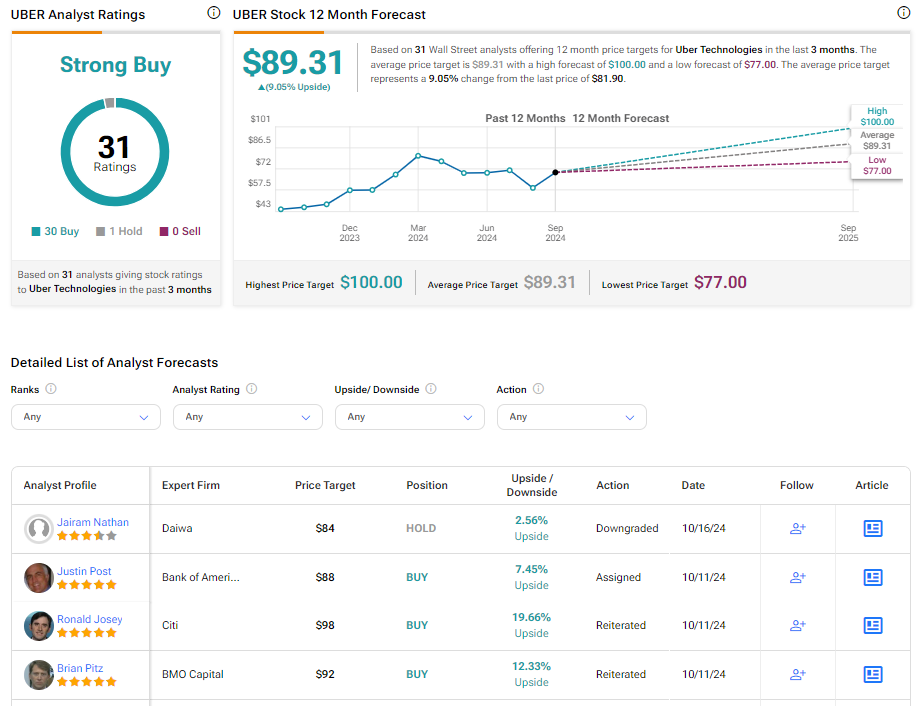

Is Uber a Buy or Sell Right Now?

Turning to Wall Street, UBER has a Strong Buy consensus rating based on 30 Buys and one Hold assigned in the last three months. At $89.31, the average Uber price target implies 9.05% upside potential. Shares of the company have gained about 33% year-to-date.

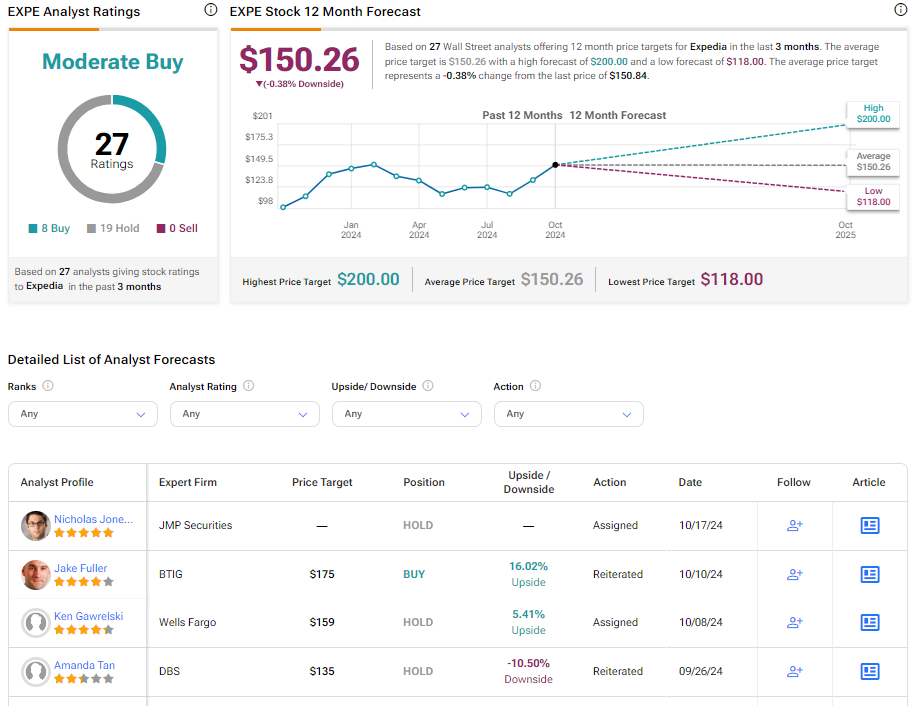

Is EXPE Stock a Good Buy?

Overall, EXPE has a Moderate Buy consensus rating based on eight Buys and 19 Holds assigned in the last three months. At $150.26, the average Expedia price target implies 0.38% downside potential. Shares of the company have declined about 1% year-to-date.