Ride-hailing service provider Uber Technologies, Inc. (NYSE: UBER) has reportedly altered the algorithm for calculating driver’s pay, according to Reuters. The step is aimed at attracting more drivers to its platform and encouraging them to accept short rides by increasing their earnings.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

At `the time of writing, UBER stock was trading down more than 4% during the pre-market trading.

Altered Algorithm for Driver Pay

Uber has launched the pilot program in 24 cities across Texas, Florida, and the Midwest. The test allows drivers to see the pay and destinations of a ride before accepting it, and increases incentives for drivers who take shorter rides. However, the changes do not affect fares paid by consumers.

The current test run is one of the widest-ranging updates to Uber’s driver pay algorithm in years. The company lost many drivers after the pandemic started in 2020, and it hopes to win back the drivers it lost by rolling out these attractive incentives.

Earlier, drivers had asked Uber to enable them to see the fare and destination of a trip before accepting it, which was denied by Uber. The company was scared of giving drivers the autonomy to select a route that would avoid disadvantaged neighborhoods.

In a 2020 state battle against gig workers’ rights to prove that they are independent contractors, Uber had started a similar program. Since the launch, Uber claims that it has not seen any discrimination by drivers for choosing the rides. Thus, it made sense to roll out a similar program in other cities. The latest pilot program is not related to any gig worker regulation.

The company also said that it had the authority to deactivate drivers who repeatedly avoided trips based on “race or low-income areas”.

So far, the program seems successful, with the company claiming that few cities from upfront pay have witnessed a 22% average rise in drivers’ earnings. These trips typically had a pick-up location that was longer than the trip itself.

Official Comments

Commenting on the launch, Dennis Cinelli, Uber’s head of mobility in the U.S and Canada, said, “Gig work is very competitive, not just with Lyft (LYFT) but other platforms, and we think this feature really enhances our platform’s competitiveness versus others.”

Uber is refraining from commenting on the financial impact of the altered algorithm, which means that the company would have to spend more for shorter rides.

Furthermore, Cinelli said that the expansion of the program depended on the results. “If we’re not seeing it attract and retain drivers, we wouldn’t roll it out further,” he added.

Some of the drivers in the cities where the program was launched have given mixed reactions stating that the new algorithm gave arbitrary earnings and was unable to calculate pay on a per-mile basis as before.

Unhappy with the changes, a Houston driver, Kevin Hernandez, said, “My earnings are already destroyed by the high prices for gas and now Uber is taking even more money away from me on long trips.”

Wall Streets’ Take

The Wall Street community has awarded the UBER stock a Strong Buy consensus rating based on 23 Buys and 1 Sell. The average Uber price target of $62.58 implies 78.9% upside potential to current levels. Its shares have lost 20.4% year-to-date.

Stock Investors

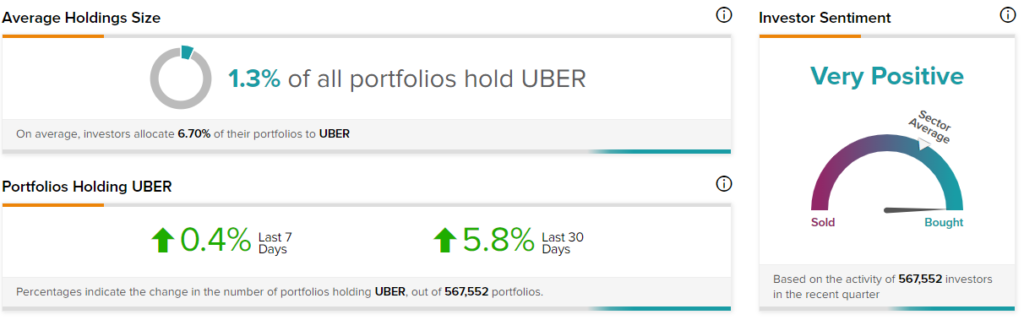

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Uber, with 5.8% of portfolios tracked by TipRanks increasing their exposure to UBER stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Moderna Soars 15% on Stellar Q4 Results

Block Surges 18% After-Hours on Robust Q4 Beat

Zscaler Plunges 15% Despite Q2 Beat