Shares of airline company United Airlines (UAL) were little changed in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2024. Earnings per share came in at $3.33, which beat analysts’ consensus estimate of $3.05 per share. In addition, sales increased by 2.5% year-over-year, with revenue hitting $14.8 billion. This also beat analysts’ expectations of $14.73 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Total revenue per available seat mile (TRASM) slipped by 1.6% compared to the third quarter of 2023. However, the cost per available seat mile (CASM) increased by 0.1%. In addition, CASM-ex (which excludes the impact of fuel expense, profit sharing, special charges, and third-party expenses) increased by 6.5% year-over-year.

United Airlines did not provide guidance for the following quarter in today’s press release but will discuss its financial and operational outlook during a conference call on Wednesday, October 16, at 10:30 a.m. EDT.

Investor Sentiment for UAL Stock

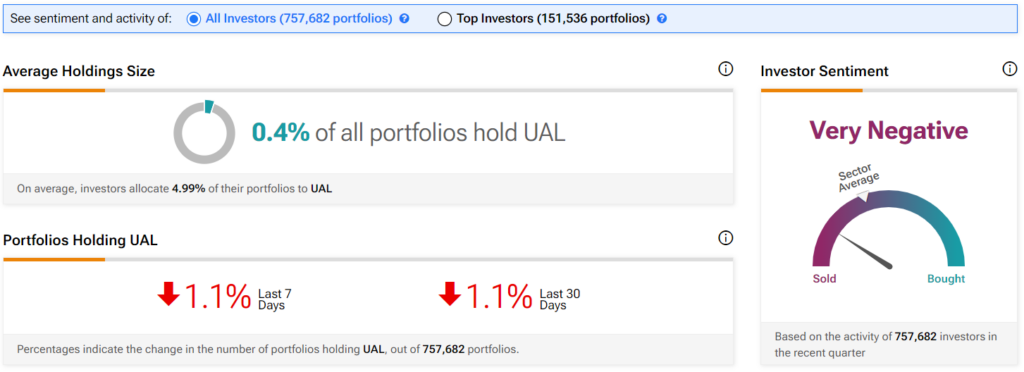

When taking a look at investor sentiment for UAL stock, some interesting data points emerge when compared to the previous earnings report. For starters, sentiment among TipRanks investors is currently very negative, whereas it was very positive last time. This is despite the fact that shares have rallied significantly since then.

It appears that investors have taken the opportunity to take some profits off the table as the stock hovers around 52-week highs. Indeed, 1.1% of investors trimmed their holdings during the past 30 days. However, given that investors still have an average portfolio weighting of almost 5% in UAL, which is actually higher than the 4.88% in the previous quarter, investor sentiment may not be as negative as it seems.

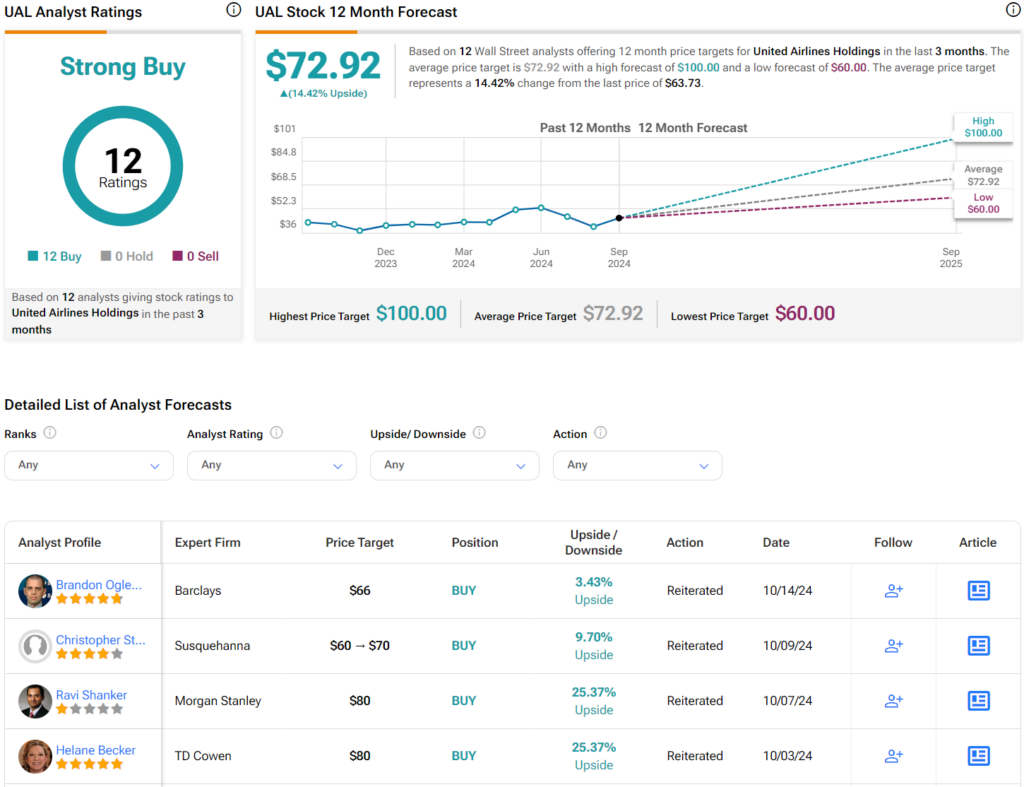

Is United Airlines a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Strong Buy consensus rating on UAL stock based on 12 Buys assigned in the past three months, as indicated by the graphic below. After a 61% rally in its share price over the past year, the average UAL price target of $72.92 per share implies 14.42% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.