Shares of United Airlines (UAL) are down 2% after the U.S. carrier reported mixed financial results for this year’s third quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Chicago-based airline announced earnings per share (EPS) of $2.78, beating analysts’ consensus forecast of $2.65 a share. However, revenue in the period of $15.23 billion missed expectations for $15.33 billion. Sales were 2.6% higher than a year earlier.

In terms of guidance, United Airlines said that for the current fourth quarter, it expects earnings per share of $3 to $3.50. That’s ahead of Wall Street forecasts calling for a profit of $2.87 per share. United has been expanding its flying capacity in recent months even as many of its rivals have scaled back their growth plans due to macroeconomic uncertainty.

Capacity

For the just completed third quarter, United Airlines said that it increased its overall capacity 7% from a year ago. Unit passenger revenue for the three months ended Sept. 30 fell 3.3% for domestic travel and 7.1% for international destinations. Sales from its lucrative loyalty program rose 9% year-over-year.

Management at United Airlines said they remain focused on winning more affluent travelers who shell out big bucks for premium and first-class seats. To that end, the carrier has expanded its global network with far-flung destinations like Greenland and Mongolia. United said that in the third quarter, its premium-cabin revenue, which includes first class, rose 6%.

Is UAL Stock a Buy?

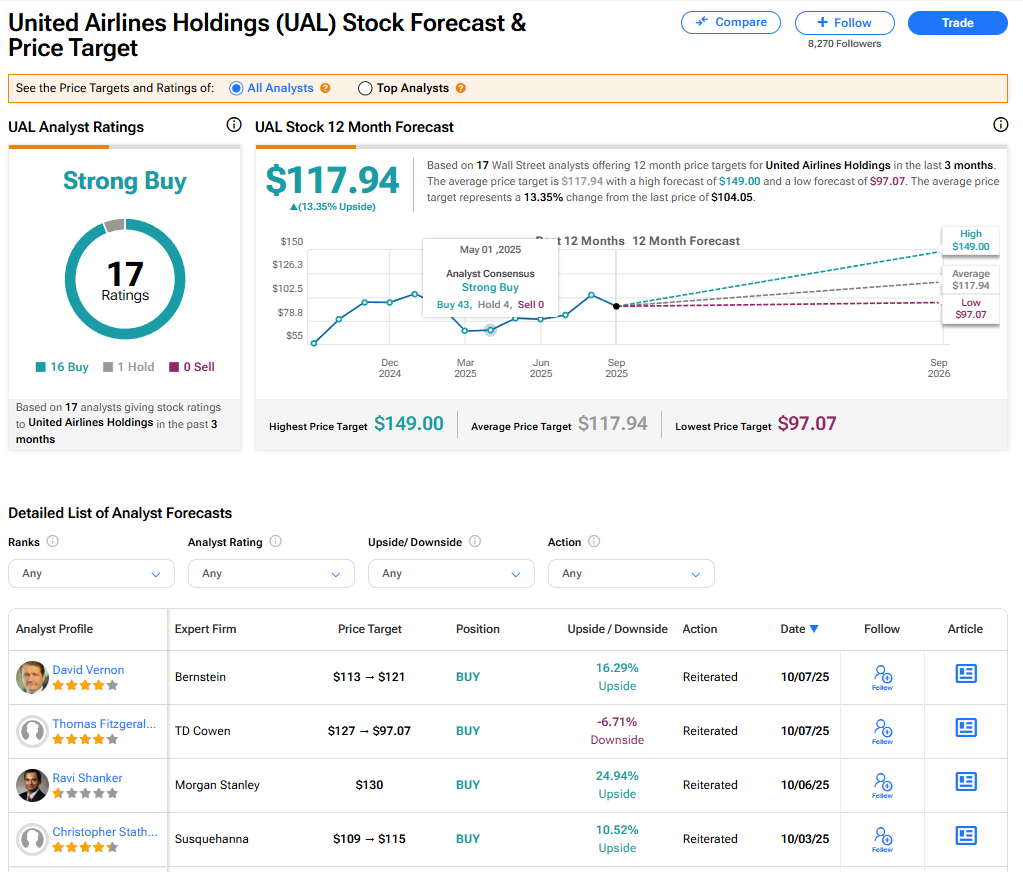

The stock of United Airlines has a consensus Strong Buy rating among 17 Wall Street analysts. That rating is based on 16 Buy and one Hold recommendations issued in the last three months. The average UAL price target of $117.94 implies 13.35% upside from current levels. These ratings are likely to change after the company’s financial results.