Shares of airline company United Airlines (UAL) fell in after-hours trading after the company reported earnings for its second quarter of Fiscal Year 2024. Earnings per share came in at $4.14, which beat analysts’ consensus estimate of $3.96 per share.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sales increased by 5.7% year-over-year, with revenue hitting $14.99 billion. This beat analysts’ expectations of $14.961 billion.

Total revenue per available seat mile (TRASM) slipped by 2.4% compared to the second quarter of 2023. In addition, the cost per available seat mile (CASM) fell by 4.8%. However, CASM-ex (which excludes the impact of fuel expense, profit sharing, special charges, and third-party expenses) increased by 2.1% year-over-year.

Investor Sentiment for UAL Stock

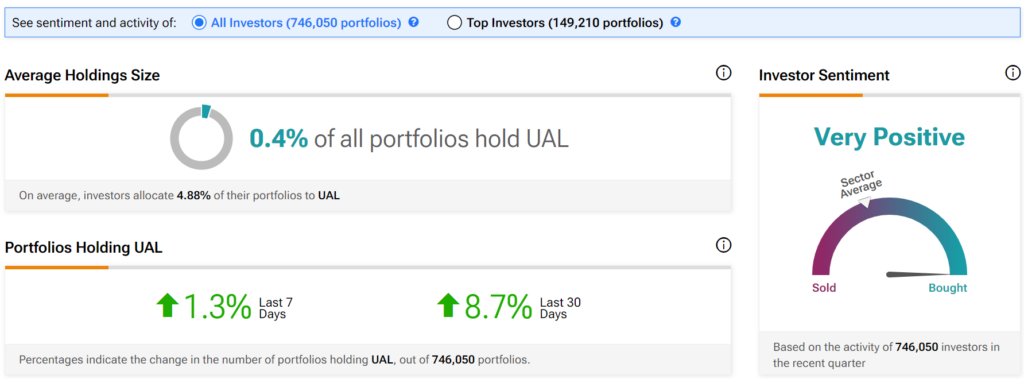

The sentiment among TipRanks investors is currently very positive. Out of the 746,050 portfolios tracked by TipRanks, 0.4% hold UAL stock. In addition, the average portfolio weighting allocated towards UAL among those who do have a position is 4.88%. This suggests that investors of the company are fairly confident about its future.

Furthermore, in the last 30 days, 8.7% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

Is United Airlines a Buy, Sell, or Hold?

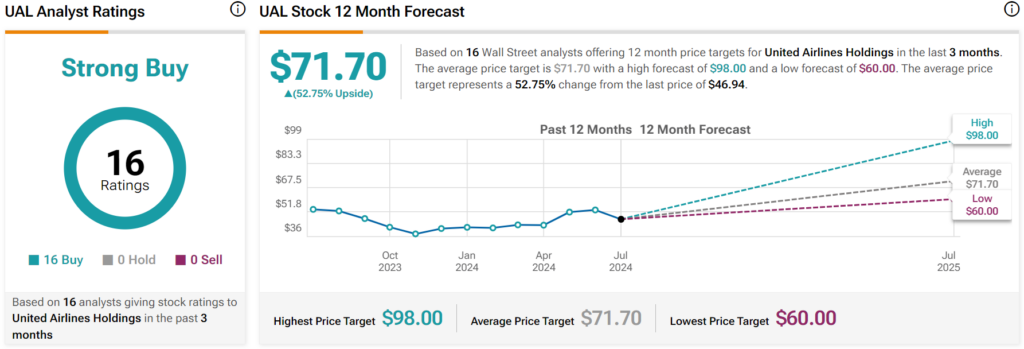

Turning to Wall Street, analysts have a Strong Buy consensus rating on UAL stock based on 16 Buys assigned in the past three months, as indicated by the graphic below. After a 14% loss in its share price over the past year, the average UAL price target of $71.70 per share implies 52.75% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.