Under Armour (NYSE:UAA) shares nosedived by nearly 10% today after the branded athletic performance apparel and products provider announced lackluster fourth-quarter results, and a disappointing financial outlook. Even a $500 million share buyback plan is failing to lift investor sentiment in the stock today.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Chinks in the Armour

Under Armour’s Q4 revenue declined by 5% year-over-year to $1.3 billion, lagging expectations by $30 million. Additionally, its EPS declined by nearly 39% to $0.11. During the quarter, UAA’s Wholesale revenue declined by 7% to $850 million. While its direct-to-consumer revenue remained flat, the company’s eCommerce revenue decreased by 8%.

Moreover, UAA experienced sales declines across its Apparel, Footwear, and Accessories categories. Although its gross margin benefitted from lower product and freight costs, these gains were partially offset by higher promotional activities and inventory levels.

UAA is now undertaking a restructuring plan to improve its performance. The move is anticipated to result in pre-tax restructuring and associated charges to the tune of $70-$90 million. For Fiscal year 2025, Under Armour expects a low-double-digit decline in its top line. The EPS for the year is expected to range between $0.18 and $0.21. Additionally, Under Armour has announced a $500 million share buyback program.

Is UAA Stock a Buy, Sell, or a Hold?

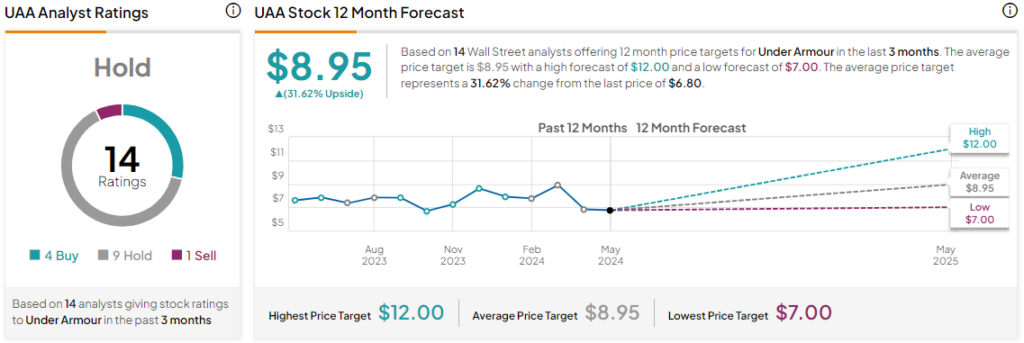

Today’s price decline further adds to the nearly 71% plunge in Under Armour’s share price over the past three years. Overall, the Street currently has a Hold consensus rating on the stock, alongside an average UAA price target of $8.95. However, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure